- United States

- /

- Life Sciences

- /

- NasdaqCM:CYRX

Market Cool On Cryoport, Inc.'s (NASDAQ:CYRX) Revenues Pushing Shares 25% Lower

Cryoport, Inc. (NASDAQ:CYRX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

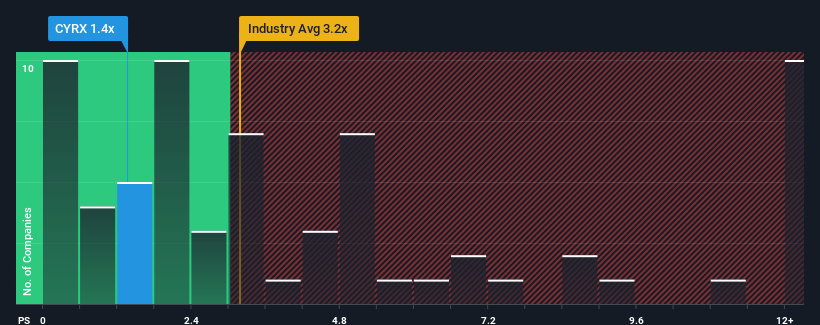

Since its price has dipped substantially, Cryoport may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 6x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cryoport

How Has Cryoport Performed Recently?

Cryoport could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Cryoport's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cryoport's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Cryoport's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.4% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 7.0% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 6.6% per annum growth forecast for the broader industry.

With this information, we find it odd that Cryoport is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Cryoport's recently weak share price has pulled its P/S back below other Life Sciences companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Cryoport's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Cryoport that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CYRX

Cryoport

Provides temperature-controlled supply chain solutions in biopharma/pharma, animal health, and reproductive medicine markets worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives