- United States

- /

- Life Sciences

- /

- NasdaqCM:CYRX

Improved Revenues Required Before Cryoport, Inc. (NASDAQ:CYRX) Shares Find Their Feet

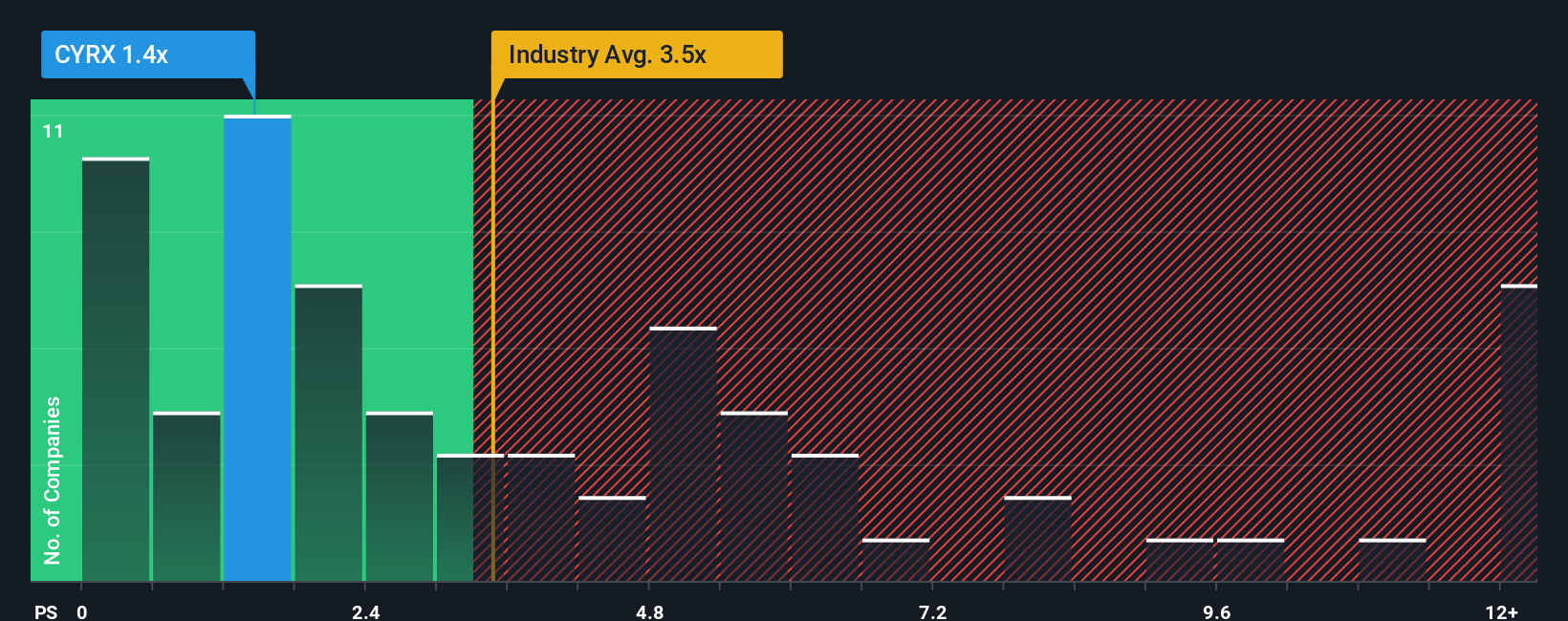

With a price-to-sales (or "P/S") ratio of 1.4x Cryoport, Inc. (NASDAQ:CYRX) may be sending very bullish signals at the moment, given that almost half of all the Life Sciences companies in the United States have P/S ratios greater than 3.5x and even P/S higher than 6x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cryoport

What Does Cryoport's Recent Performance Look Like?

Cryoport certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Cryoport's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cryoport's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Cryoport's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 4.3% per annum as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 7.2% per annum, which paints a poor picture.

In light of this, it's understandable that Cryoport's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Cryoport's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Cryoport.

If these risks are making you reconsider your opinion on Cryoport, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CYRX

Cryoport

Provides temperature-controlled supply chain solutions in biopharma/pharma, animal health, and reproductive medicine markets worldwide.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives