- United States

- /

- Life Sciences

- /

- NasdaqCM:CYRX

Could Cryoport's (CYRX) New Monitoring Tech Reveal Its Strategy for Digital Cold Chain Leadership?

Reviewed by Sasha Jovanovic

- Cryoport, Inc. recently unveiled new integrated condition monitoring solutions for its MVE Biological Solutions dewars, incorporating the SmartTag and CryoBeacon devices powered by Tec4Med, with data centralized in the FDA-compliant MVECloud platform for enhanced monitoring of cryogenic storage.

- This innovation offers life sciences companies real-time visibility and improved safety for temperature-sensitive commodities, reflecting an ongoing push toward advanced digital and compliance solutions in cold chain logistics.

- We'll consider how the launch of cloud-powered condition monitoring could reshape the outlook for Cryoport's technology-driven growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cryoport Investment Narrative Recap

Being a Cryoport shareholder means trusting in the ongoing expansion of the cell and gene therapy industry, and believing that the company’s investments in specialized logistics and digital solutions will capture and retain major biopharma clients. The launch of advanced condition monitoring for MVE dewars is a technical step forward, but for now, the most significant short-term catalyst, clinician demand and regulatory progress for cell and gene therapies, remains unchanged, while the biggest risk continues to be reliance on successful commercialization by a limited number of major clients.

Among Cryoport’s recent product developments, the July 2025 unveiling of the next-generation vapor shippers stands out for its direct relevance. These upgraded shippers, now integrated with condition monitoring, further enhance safety and traceability for biopharma shipments, supporting the company’s emphasis on technological differentiation, which underpins its broader efforts to reduce client concentration risk and strengthen recurring revenues.

By contrast, investors should also pay close attention to how tighter clinical trial regulations could...

Read the full narrative on Cryoport (it's free!)

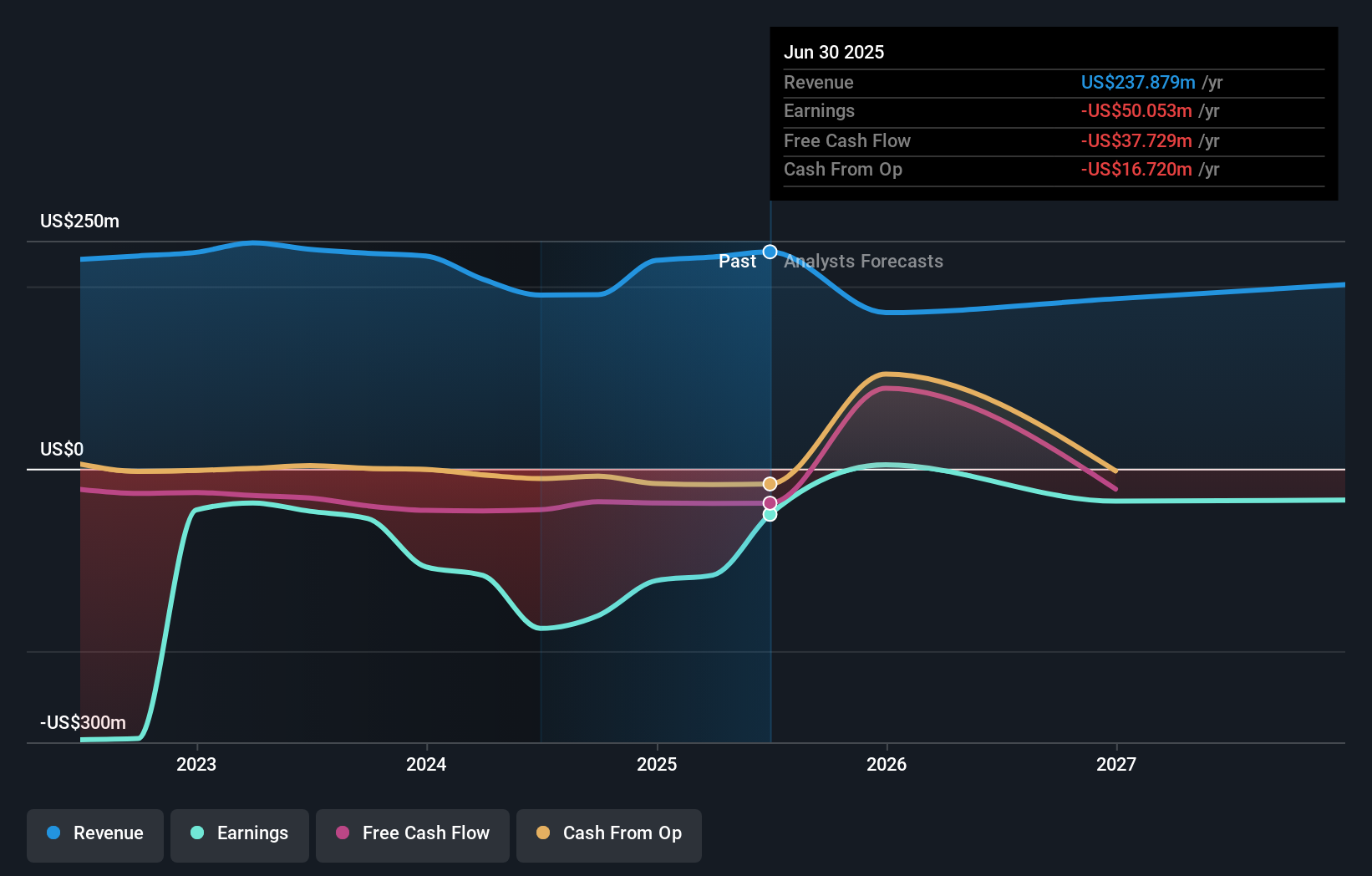

Cryoport's narrative projects $206.0 million revenue and $29.3 million earnings by 2028. This requires a 4.7% yearly revenue decline and a $79.4 million increase in earnings from -$50.1 million.

Uncover how Cryoport's forecasts yield a $12.11 fair value, a 20% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate for Cryoport lands at US$12.11, highlighting limited divergence in private investor views. At the same time, the company’s ongoing exposure to major therapy approvals remains a key focus for those considering longer-term performance beyond headline innovation.

Explore another fair value estimate on Cryoport - why the stock might be worth as much as 20% more than the current price!

Build Your Own Cryoport Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cryoport research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Cryoport research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cryoport's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CYRX

Cryoport

Provides temperature-controlled supply chain solutions in biopharma/pharma, animal health, and reproductive medicine markets worldwide.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives