- United States

- /

- Biotech

- /

- NasdaqCM:CYCN

Can You Imagine How Cyclerion Therapeutics' (NASDAQ:CYCN) Shareholders Feel About The 40% Share Price Increase?

The last three months have been tough on Cyclerion Therapeutics, Inc. (NASDAQ:CYCN) shareholders, who have seen the share price decline a rather worrying 62%. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. After all, the share price is up a market-beating 40% in that time.

See our latest analysis for Cyclerion Therapeutics

Cyclerion Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

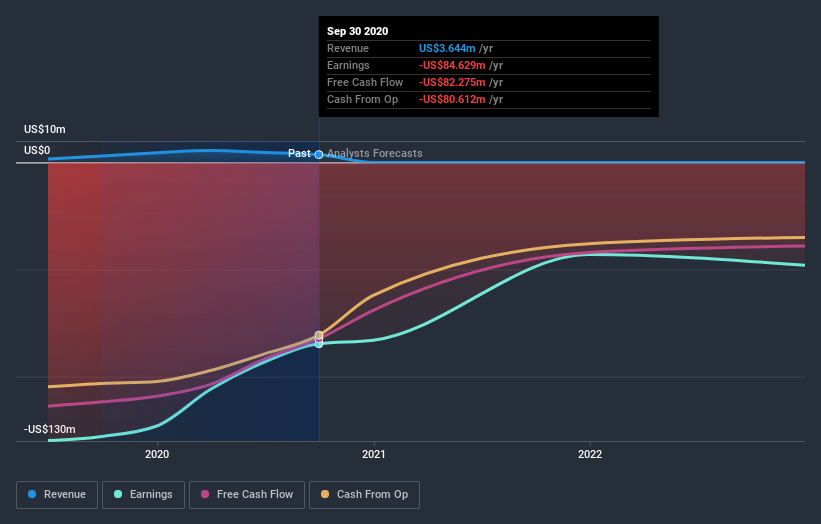

Cyclerion Therapeutics grew its revenue by 20% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 40% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Cyclerion Therapeutics

A Different Perspective

Cyclerion Therapeutics boasts a total shareholder return of 40% for the last year. Unfortunately the share price is down 62% over the last quarter. Shorter term share price moves often don't signify much about the business itself. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Cyclerion Therapeutics has 5 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Cyclerion Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:CYCN

Cyclerion Therapeutics

A biopharmaceutical company, develops treatments for serious diseases serious diseases with novel sGC stimulators in both the central nervous system (CNS) and the periphery.

Flawless balance sheet low.

Market Insights

Community Narratives