- United States

- /

- Biotech

- /

- NasdaqGM:CVAC

Does CureVac’s 108% Rally Signal a Smarter Opportunity After mRNA Breakthrough News?

Reviewed by Bailey Pemberton

- Ever wondered whether CureVac's stock is a hidden gem or a value trap? You're not alone as many investors are taking a closer look after a wild ride.

- Despite a turbulent three-year stretch, CureVac shares are up an eye-popping 107.9% in the past year, with a year-to-date gain of 53% sparking new optimism and debate about its outlook.

- Recent attention around CureVac has centered on developments in its mRNA vaccine research as well as fresh updates on ongoing clinical trials. These announcements have fueled market speculation and likely contributed to the big swings in share price, drawing both risk-takers and long-term followers.

- On our six-point valuation check, CureVac notches a strong 5 out of 6, positioning it as potentially undervalued by conventional metrics. As we explore different valuation approaches, we'll also touch on an even smarter way to gauge its true worth by the end of this article.

Approach 1: CureVac Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This method looks beyond short-term fluctuations and instead focuses on what the business could earn over time.

CureVac's latest Free Cash Flow stands at approximately €100.8 million. Analysts forecast a mixed path in coming years, with projections becoming more optimistic further out. By 2029, Free Cash Flow is estimated to reach €99 million, with longer-term projections as high as €315.97 million. This latter part relies on extrapolations beyond the five-year analyst consensus.

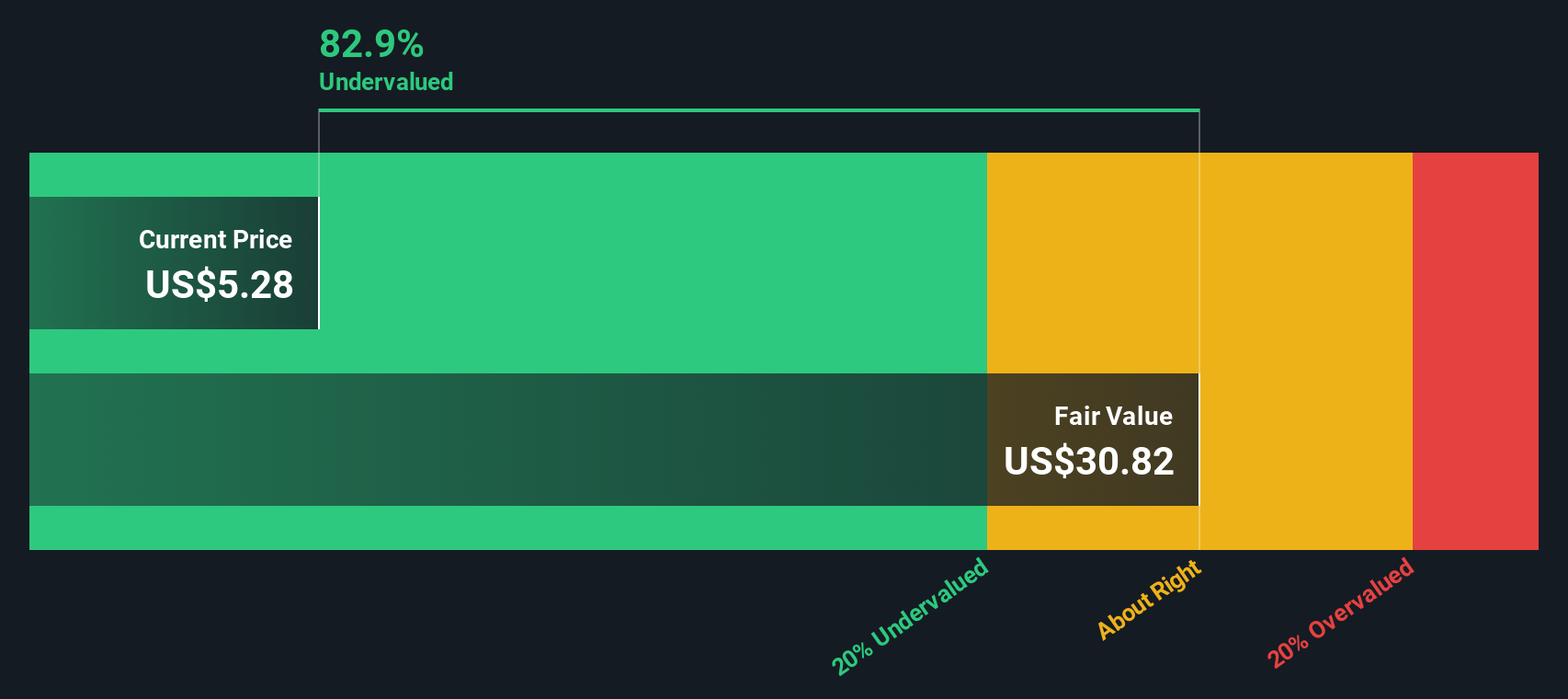

Based on these cash flow projections and CureVac’s risk profile, the DCF model places the stock’s fair value at €31.00 per share. With today’s actual share price representing an 83.0% discount to this intrinsic value, CureVac currently appears to be trading well below what the model suggests is fair.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CureVac is undervalued by 83.0%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: CureVac Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation method for profitable biotech companies like CureVac, as it directly reflects how much investors are willing to pay for each euro of current earnings. For established firms with positive income, the PE ratio provides a straightforward lens to compare profitability and market sentiment.

The definition of a “fair” PE ratio, however, is more nuanced. High-growth companies often trade at higher multiples due to future profit expectations, while firms facing uncertainty or risk may warrant lower PE ratios. Industry context, risk profiles, and overall growth prospects all play a part in determining what counts as a reasonable benchmark.

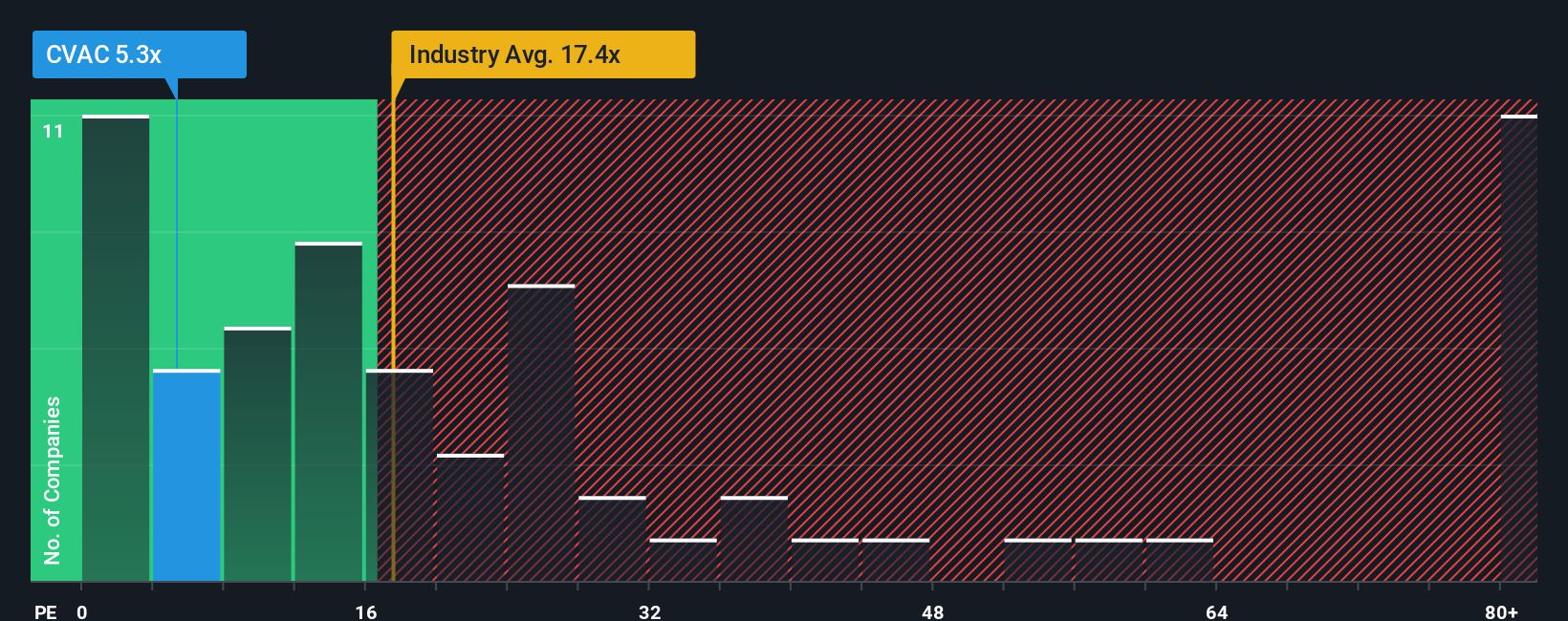

CureVac currently trades at a PE ratio of 5.28x, which is significantly below the biotech industry average of 17.44x and also much lower than the peer average of 43.09x. At first glance, this would suggest the stock is undervalued relative to competitors. However, Simply Wall St’s proprietary Fair Ratio algorithm, which factors in CureVac’s specific growth prospects, risk profile, margins, and size, estimates that a PE of 12.93x would better reflect its true value.

Unlike basic peer or industry comparisons, the Fair Ratio gives a more tailored view for investors by adjusting for variables like future growth, risk, and company scale. This makes it a more insightful reference point when evaluating whether a stock is truly undervalued or simply trading at a discount for good reason.

Since CureVac’s actual PE is well below the Fair Ratio, the stock appears to be attractively priced based on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CureVac Narrative

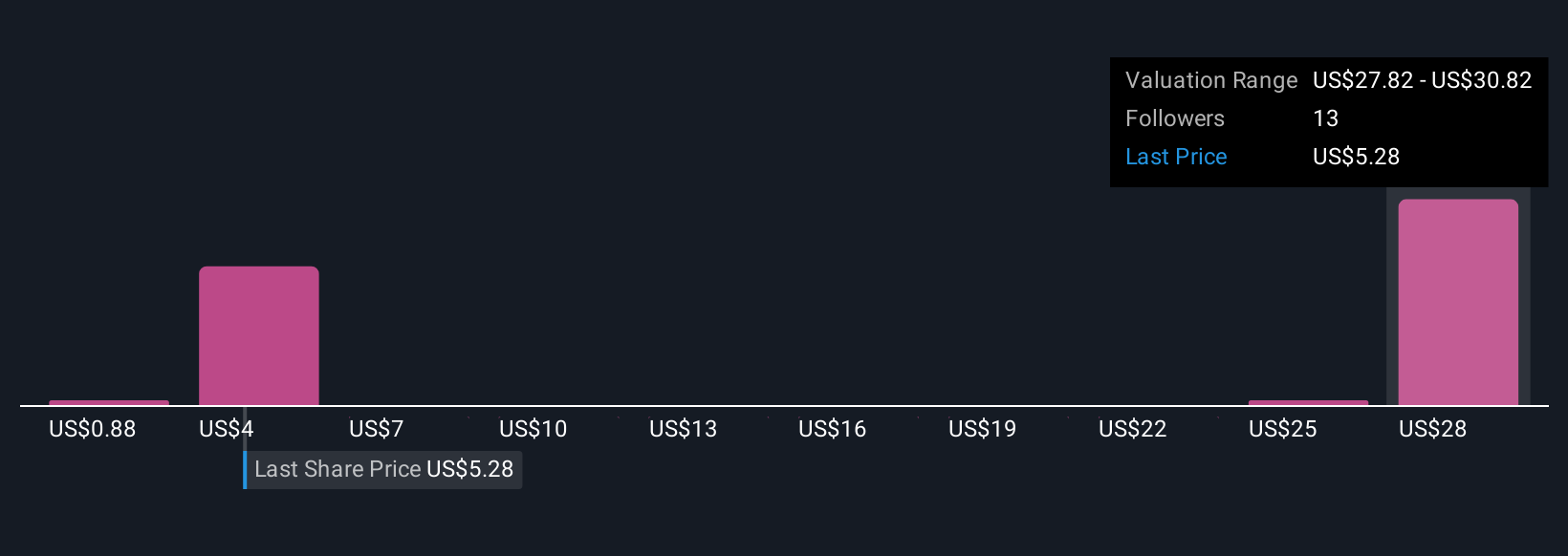

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, connecting your view of its future potential to realistic forecasts for key numbers like revenue, earnings, and margins. This approach then leads to your own fair value estimate. Narratives make investing more approachable by linking a company's journey, such as research breakthroughs, partnerships, or risks, to numbers that can guide real decisions.

Simply Wall St's platform, used by millions, offers an easy way to create and share Narratives right from the Community page. With Narratives, you can directly compare your estimated Fair Value with the current market Price, helping you decide when to buy or sell based on your beliefs and new data. As fresh news or earnings emerge, Narratives update dynamically, so your investment case is always current.

For example, the most optimistic CureVac Narrative might expect a $12.11 price target based on success in oncology and licensing deals. In contrast, the most cautious Narrative could value the stock as low as $2.03 due to legal and revenue risks. This showcases how different investor stories can lead to very different conclusions, depending on assumptions and forecasts.

Do you think there's more to the story for CureVac? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CVAC

CureVac

A biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives