- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

The Market Doesn't Like What It Sees From CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Revenues Yet As Shares Tumble 30%

The CytomX Therapeutics, Inc. (NASDAQ:CTMX) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 11% share price drop.

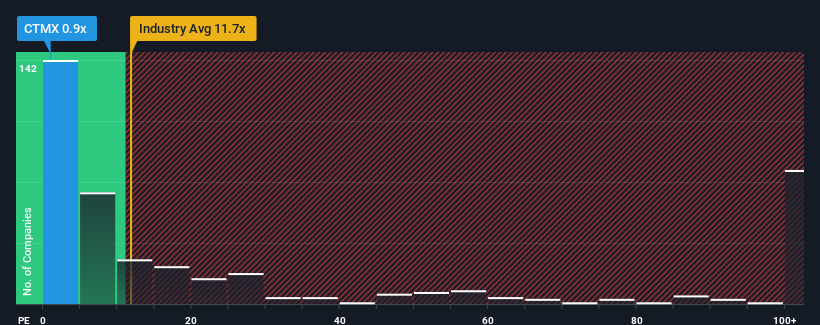

Following the heavy fall in price, CytomX Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.7x and even P/S higher than 66x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for CytomX Therapeutics

What Does CytomX Therapeutics' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, CytomX Therapeutics has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think CytomX Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For CytomX Therapeutics?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like CytomX Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 28% each year during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to expand by 208% each year, which paints a poor picture.

In light of this, it's understandable that CytomX Therapeutics' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does CytomX Therapeutics' P/S Mean For Investors?

Shares in CytomX Therapeutics have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that CytomX Therapeutics' P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for CytomX Therapeutics (3 shouldn't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Undervalued moderate.

Market Insights

Community Narratives