- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Shares Leap 225% Yet They're Still Not Telling The Full Story

CytomX Therapeutics, Inc. (NASDAQ:CTMX) shareholders would be excited to see that the share price has had a great month, posting a 225% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

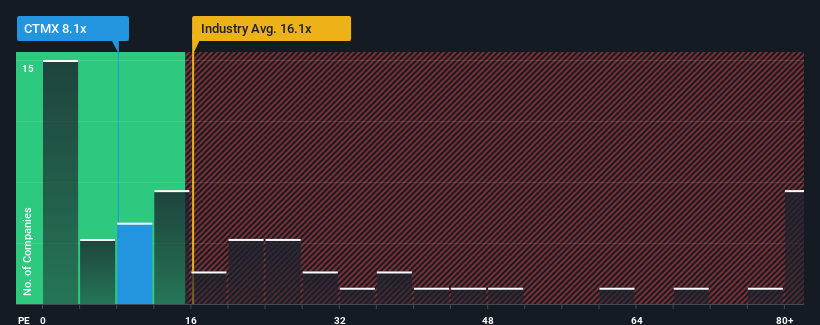

Although its price has surged higher, CytomX Therapeutics may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.1x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

We've discovered 3 warning signs about CytomX Therapeutics. View them for free.Recent times have been advantageous for CytomX Therapeutics as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for CytomX Therapeutics

How Is CytomX Therapeutics' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as CytomX Therapeutics' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 128%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

The Final Word

CytomX Therapeutics' recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for CytomX Therapeutics that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives