- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

Could CytomX Therapeutics (CTMX) Leverage New Leadership to Expand Strategic Partnerships?

Reviewed by Sasha Jovanovic

- Earlier this week, CytomX Therapeutics appointed Rachael Lester as Senior Vice President and Chief Business Officer to oversee strategy and business development initiatives, bringing more than 20 years of biopharmaceutical industry experience spanning corporate strategy and partnerships.

- Lester's history of securing key funding and transformative collaborations at previous organizations may position CytomX to broaden its partnerships and industry engagement in support of its clinical programs.

- We'll explore how Lester's expertise in forging industry alliances could influence CytomX’s investment narrative and future partnership prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CytomX Therapeutics Investment Narrative Recap

Owning CytomX Therapeutics stock means believing in its potential to deliver meaningful clinical data from CX-2051 and CX-801, attract new partnerships, and manage revenue gaps as older collaborations wind down. The appointment of Rachael Lester as Chief Business Officer enhances the company's business development capabilities, but does not materially alter the importance of near-term clinical results or the exposure to setbacks in early-stage trials, which remain the most important catalyst and risk. Investors should continue to focus on regulatory and clinical progress, as these directly impact CytomX’s outlook and valuation.

One of the most recent and relevant company updates was the positive interim data on CX-2051 in advanced colorectal cancer, showing a 28% response and 94% disease control rate. This milestone puts the spotlight on how much future value depends on successful trial outcomes and subsequent regulatory decisions. The ability to convert promising data into later-stage development and eventual approvals is central to advancing the investment case, as partnership discussions and non-dilutive funding are often contingent on validated clinical progress.

However, given the heavy reliance on new deals for near-term cash flow and current clinical trials for long-term value, investors should be aware if...

Read the full narrative on CytomX Therapeutics (it's free!)

CytomX Therapeutics' narrative projects $45.0 million in revenue and $6.4 million in earnings by 2028. This requires a 31.7% yearly revenue decline and a $41.6 million decrease in earnings from $48.0 million today.

Uncover how CytomX Therapeutics' forecasts yield a $6.14 fair value, a 70% upside to its current price.

Exploring Other Perspectives

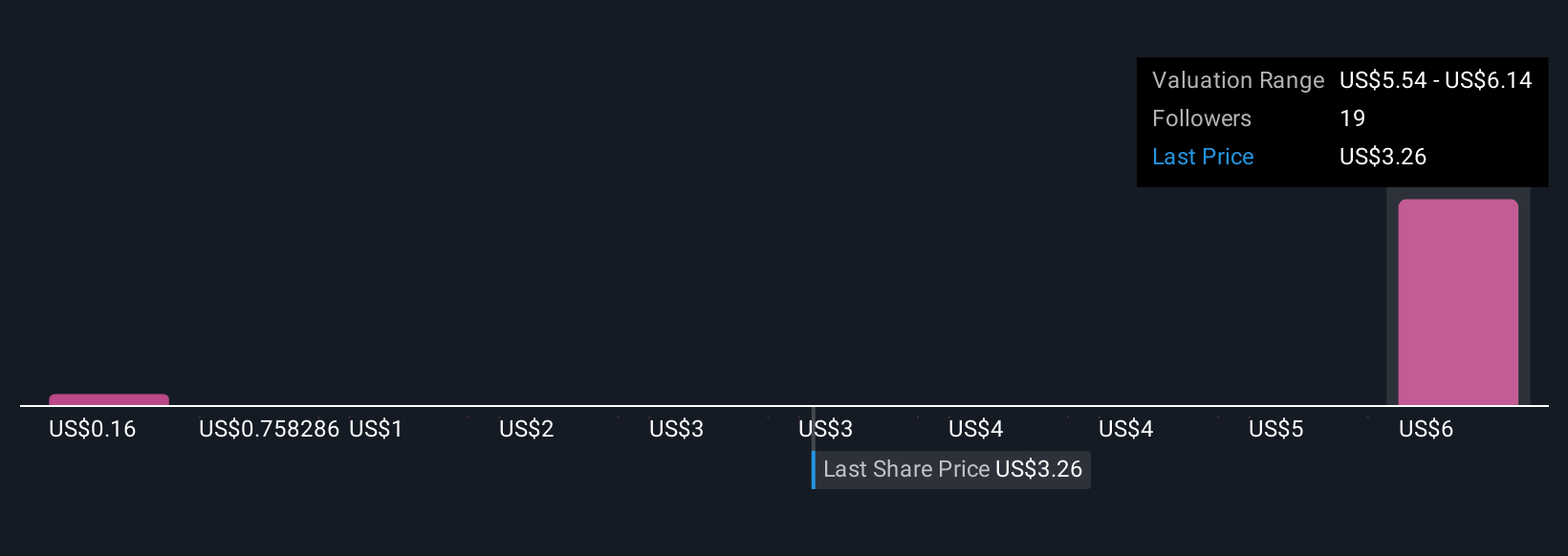

Fair value estimates from the Simply Wall St Community range from US$0.16 to US$6.14, with five distinct perspectives captured. While clinical success could accelerate partnerships and non-dilutive funding, opinions across market participants remain highly varied, so consider several viewpoints as you assess CytomX’s outlook.

Explore 5 other fair value estimates on CytomX Therapeutics - why the stock might be worth as much as 70% more than the current price!

Build Your Own CytomX Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CytomX Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CytomX Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CytomX Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives