- United States

- /

- Life Sciences

- /

- NasdaqCM:CSBR

We Think Some Shareholders May Hesitate To Increase Champions Oncology, Inc.'s (NASDAQ:CSBR) CEO Compensation

The underwhelming share price performance of Champions Oncology, Inc. (NASDAQ:CSBR) in the past three years would have disappointed many shareholders. Per share earnings growth is also lacking, despite revenue growth. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 20 October 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Champions Oncology

How Does Total Compensation For Ronnie Morris Compare With Other Companies In The Industry?

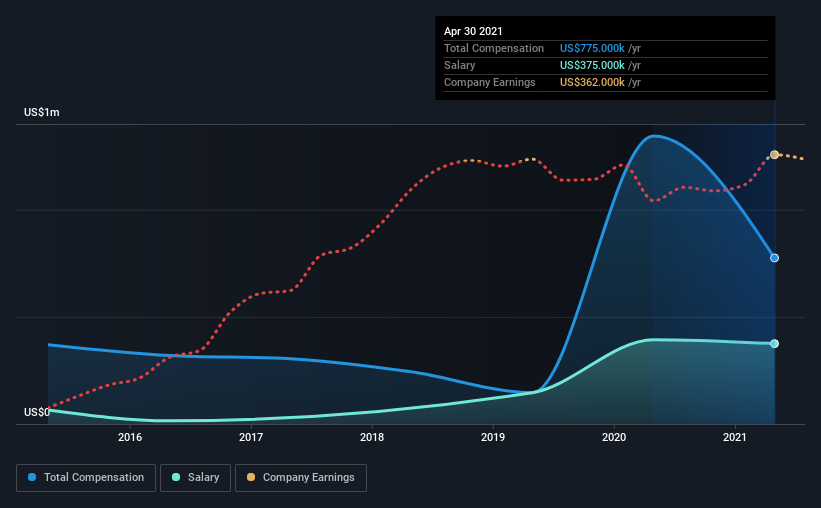

According to our data, Champions Oncology, Inc. has a market capitalization of US$136m, and paid its CEO total annual compensation worth US$775k over the year to April 2021. That's a notable decrease of 42% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$375k.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$391k. This suggests that Ronnie Morris is paid more than the median for the industry. What's more, Ronnie Morris holds US$8.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$375k | US$394k | 48% |

| Other | US$400k | US$950k | 52% |

| Total Compensation | US$775k | US$1.3m | 100% |

Talking in terms of the industry, salary represented approximately 21% of total compensation out of all the companies we analyzed, while other remuneration made up 79% of the pie. It's interesting to note that Champions Oncology pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Champions Oncology, Inc.'s Growth

Champions Oncology, Inc. has reduced its earnings per share by 18% a year over the last three years. Its revenue is up 22% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Champions Oncology, Inc. Been A Good Investment?

With a three year total loss of 18% for the shareholders, Champions Oncology, Inc. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Champions Oncology that investors should think about before committing capital to this stock.

Important note: Champions Oncology is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CSBR

Champions Oncology

A technology-enabled research company, provides technology solutions for drug discovery and development in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives