- United States

- /

- Healthtech

- /

- NasdaqGS:DH

Spotlight On Top Penny Stocks For May 2025

Reviewed by Simply Wall St

The market has been flat in the last week, but it is up 8.0% over the past year, with earnings forecasted to grow by 14% annually. Penny stocks may be a throwback term, but they still offer intriguing opportunities for investors seeking growth at lower price points. By focusing on companies with strong financials and solid fundamentals, these stocks can present valuable prospects for those willing to explore beyond traditional investment avenues.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.42 | $358.57M | ✅ 4 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.698616 | $2.83M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.32 | $1.39B | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.12 | $188.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.45 | $56.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.74 | $94.3M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.83935 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dingdong (Cayman) (NYSE:DDL) | $2.42 | $518.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.23 | $72.4M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.94M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 757 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Corvus Pharmaceuticals (NasdaqGM:CRVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corvus Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing product candidates targeting proteins essential for immune cell maturation and function in the United States, with a market cap of $301.84 million.

Operations: Corvus Pharmaceuticals, Inc. does not report any revenue segments as it is focused on developing product candidates in the clinical stage.

Market Cap: $301.84M

Corvus Pharmaceuticals, with a market cap of US$301.84 million, is pre-revenue and currently focused on clinical-stage product development. The company recently reported a net income of US$15.19 million for Q1 2025, marking an improvement from the previous year's loss. Corvus's cash runway extends over a year, supported by its debt-free status and sufficient short-term assets covering liabilities. Despite high volatility in share price and ongoing unprofitability, recent positive interim data from its Phase 1 trial for soquelitinib in atopic dermatitis shows potential efficacy and safety benefits, offering promise amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Corvus Pharmaceuticals.

- Learn about Corvus Pharmaceuticals' future growth trajectory here.

Definitive Healthcare (NasdaqGS:DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp. offers a SaaS healthcare commercial intelligence platform both in the United States and internationally, with a market cap of approximately $539.99 million.

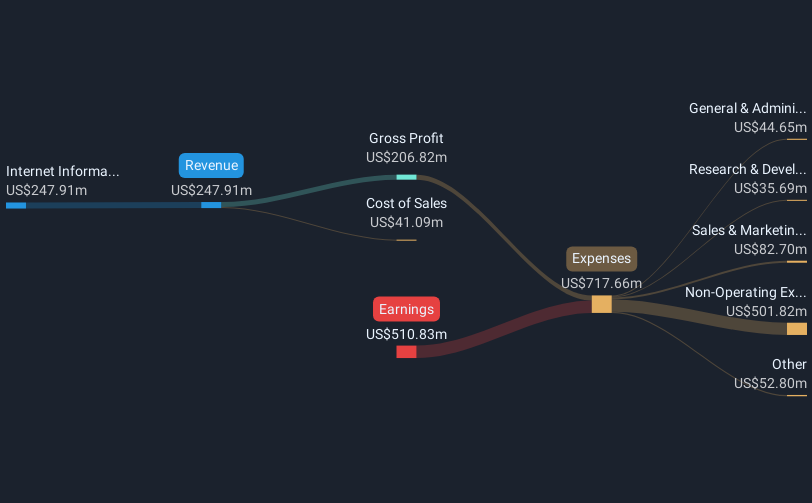

Operations: The company generates revenue of $247.91 million from its Internet Information Providers segment.

Market Cap: $539.99M

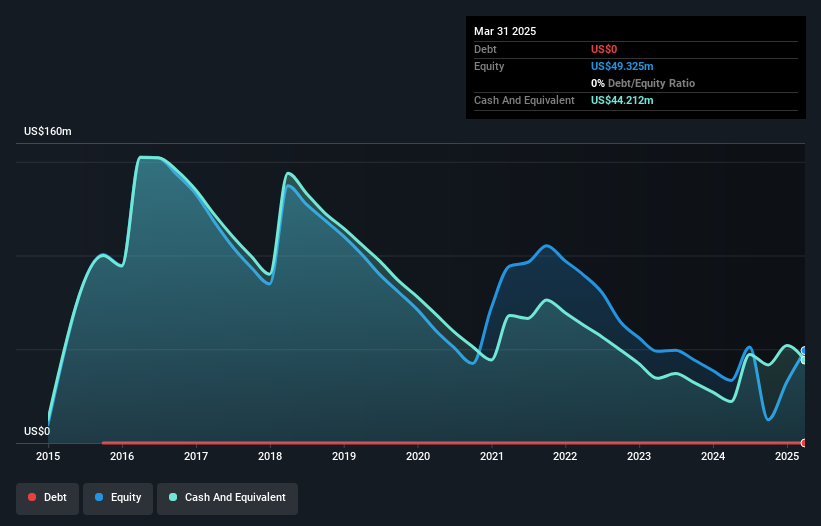

Definitive Healthcare, with a market cap of US$539.99 million, is navigating financial challenges as it remains unprofitable with increasing losses over the past five years. Recent earnings reports show a net loss of US$107.23 million for Q1 2025, while revenue guidance for the year has been slightly raised to US$234-240 million. Despite high volatility and goodwill impairments impacting its financials, the company maintains sufficient cash runway exceeding three years due to positive free cash flow. The management team is relatively new but experienced board members provide stability amid ongoing strategic adjustments in its SaaS healthcare platform operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Definitive Healthcare.

- Review our growth performance report to gain insights into Definitive Healthcare's future.

FIGS (NYSE:FIGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FIGS, Inc., along with its subsidiary FIGS Canada, Inc., is a direct-to-consumer healthcare apparel and lifestyle company operating in the United States and internationally, with a market cap of approximately $799.75 million.

Operations: The company's revenue primarily comes from its online retail segment, which generated $561.17 million.

Market Cap: $799.75M

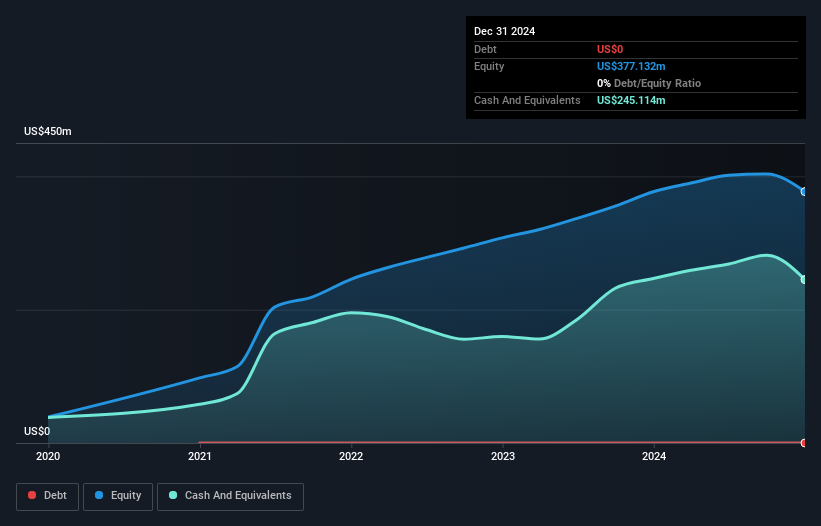

FIGS, Inc., with a market cap of approximately US$799.75 million, recently reported Q1 2025 sales of US$124.9 million but faced a net loss of US$0.102 million, reflecting challenges in maintaining profitability amidst revenue growth pressures. The company has no debt and its short-term assets significantly exceed liabilities, indicating strong liquidity management. However, profit margins have declined from the previous year and insider selling has been significant recently. Despite these issues, FIGS's earnings are forecast to grow by 40.22% annually, suggesting potential for recovery if strategic adjustments are effectively implemented under its experienced board leadership.

- Take a closer look at FIGS' potential here in our financial health report.

- Understand FIGS' earnings outlook by examining our growth report.

Taking Advantage

- Dive into all 757 of the US Penny Stocks we have identified here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Terbium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DH

Definitive Healthcare

Provides software as a service (SaaS) healthcare commercial intelligence platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives