- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Should You Reconsider CRISPR Therapeutics After Its Recent 20% One Week Surge?

Reviewed by Bailey Pemberton

Trying to figure out what to do with CRISPR Therapeutics stock right now? You are not alone. After all, when a stock jumps over 20.7% in just one week and racks up a 75.8% return since January, even the most seasoned investor pauses to ask what is driving this surge and, more importantly, is it sustainable?

Much of the momentum around CRISPR Therapeutics comes from renewed optimism about gene editing technologies and the wider acceptance of gene therapies in key markets. Investors have also taken note of regulatory milestones that signal growing trust in CRISPR’s innovations. While the five-year performance is still in the red at -23.7%, the recent 38.3% rally over the last month and a 62.2% return over the past year tell a story of shifting sentiment and expanding growth potential for the company.

But as with any stock on a hot streak, the big question is whether the rapid gains are justified. Valuation is a crucial piece of the puzzle, and that is where things get really interesting: based on our checklist, CRISPR Therapeutics scores a 3 out of 6 for undervaluation. That means it meets the mark for three key value measures, which is indicative of some lingering upside but not a clear-cut bargain.

So, is now the right time to buy, hold, or sell CRISPR Therapeutics? In the next sections, we will break down the main valuation approaches and see how this stock stacks up. Then, we will wrap up with a smarter, more holistic way to size up valuation that most investors overlook.

Approach 1: CRISPR Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and discounting them back to today’s dollars. This approach focuses on how much cash CRISPR Therapeutics is expected to generate over the coming years and how those cash flows stack up in present-day terms.

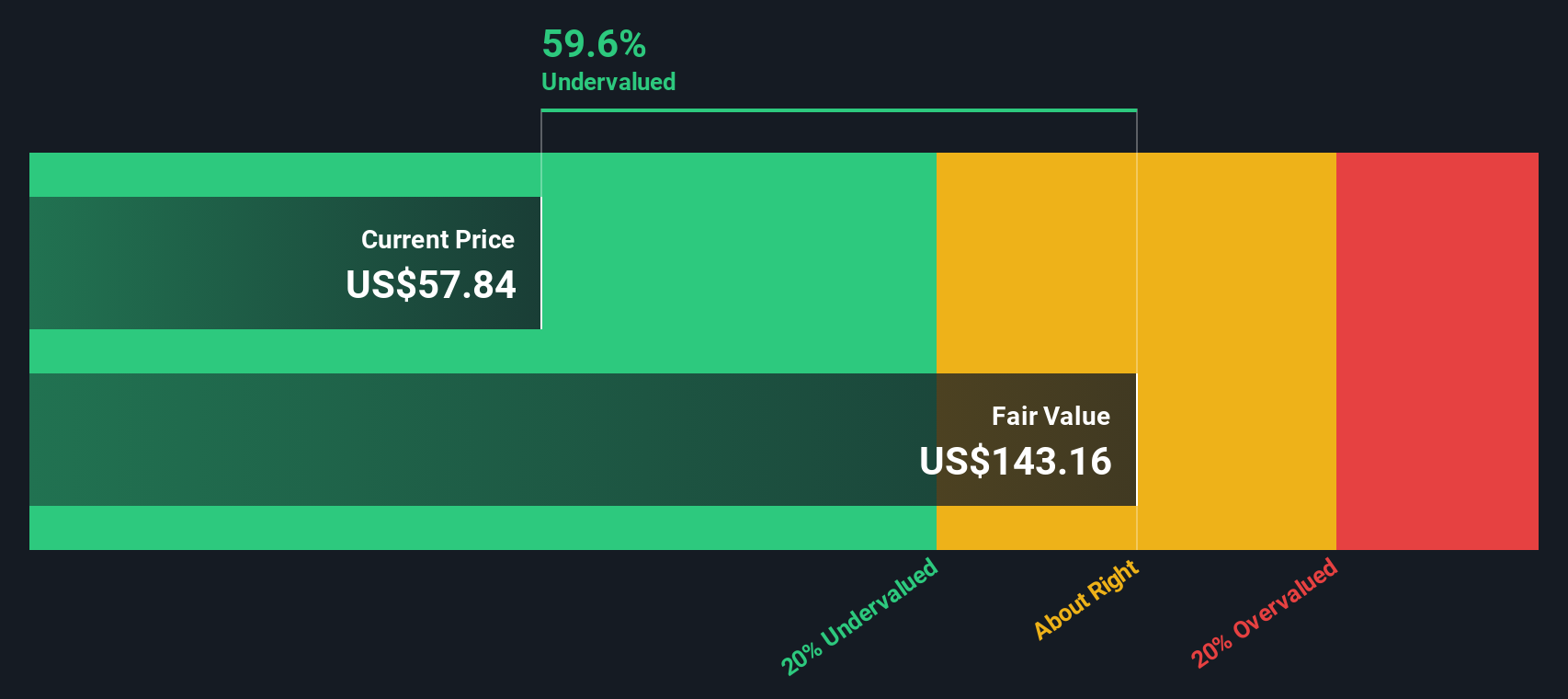

CRISPR Therapeutics currently reports a Free Cash Flow (FCF) of approximately -$329.5 million, highlighting the company’s continued investment phase. Analyst estimates predict steady improvement, with FCF turning positive by 2029 and reaching about $136.5 million. Projections become less certain beyond this point, but extrapolated figures suggest FCF could climb steadily over the next decade. By 2035, annual FCF is forecast to approach $679.8 million, all expressed in USD.

According to this DCF model, the intrinsic value for CRISPR Therapeutics stock comes out to $134.16 per share. This is 45.7% above the current market price, indicating that, based on long-term cash flow prospects, the stock appears to be significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CRISPR Therapeutics is undervalued by 45.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CRISPR Therapeutics Price vs Book

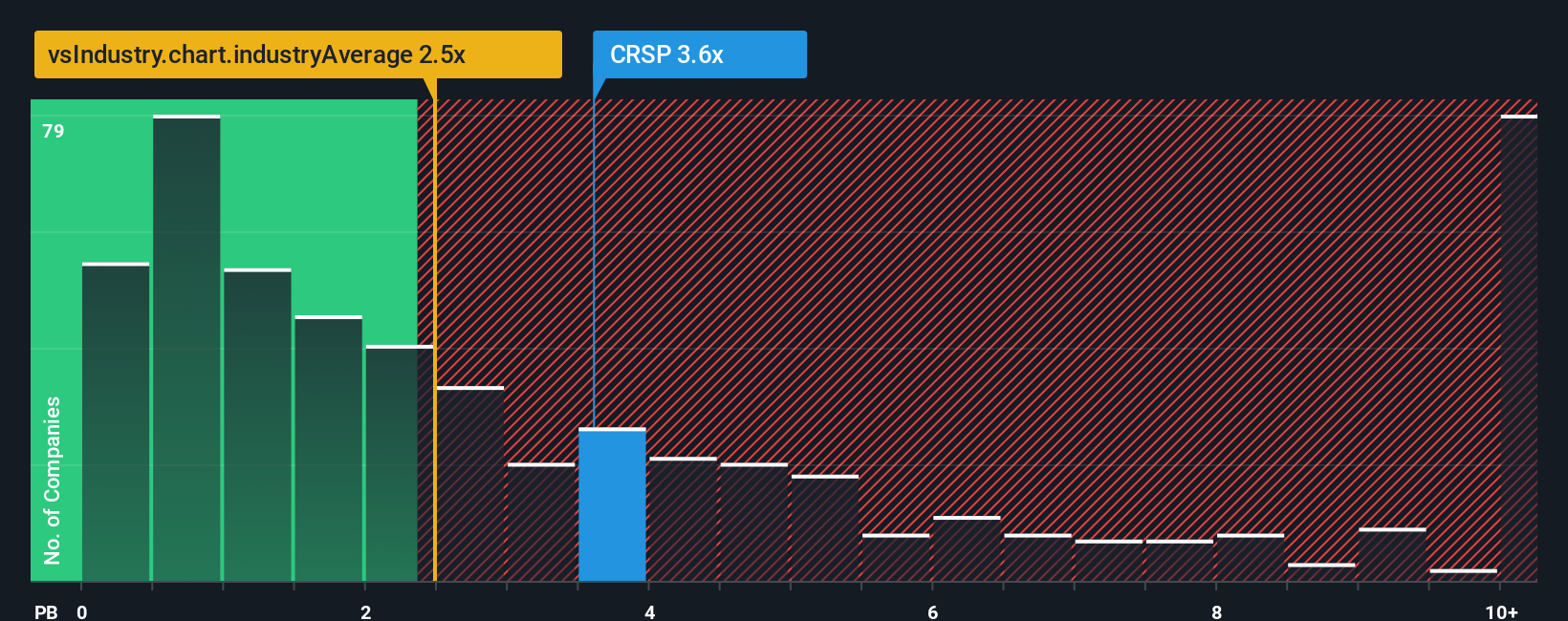

The price-to-book (P/B) ratio is frequently used to value biotech companies like CRISPR Therapeutics, especially when profitability is still around the corner or earnings are volatile. This metric allows investors to compare what the market is willing to pay for the company’s net assets, a useful perspective for businesses still in their growth or development phases.

Growth expectations and risk profile play a key role in what is considered a “normal” or “fair” P/B ratio for a biotech. High-growth or lower-risk companies tend to warrant a higher multiple, while those with more uncertainty or slower growth generally trade at a lower P/B. CRISPR Therapeutics currently trades at a P/B ratio of 3.87x. For context, the biotech industry average is 2.45x and peers average 7.44x. This positions CRSP above the broader sector average but below direct competitors, reflecting cautious optimism from the market.

Simply Wall St’s “Fair Ratio” is designed to take the next step by incorporating factors like growth prospects, risks, profit margins, size, and industry nuances. Unlike a simple peer or industry comparison, it aims to estimate what the ratio should be for CRISPR Therapeutics specifically, given all relevant fundamentals. By comparing the company’s P/B to this calculated Fair Ratio, we see that the current multiple is reasonably aligned with intrinsic expectations. In other words, it is neither expensive nor cheap for its profile.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CRISPR Therapeutics Narrative

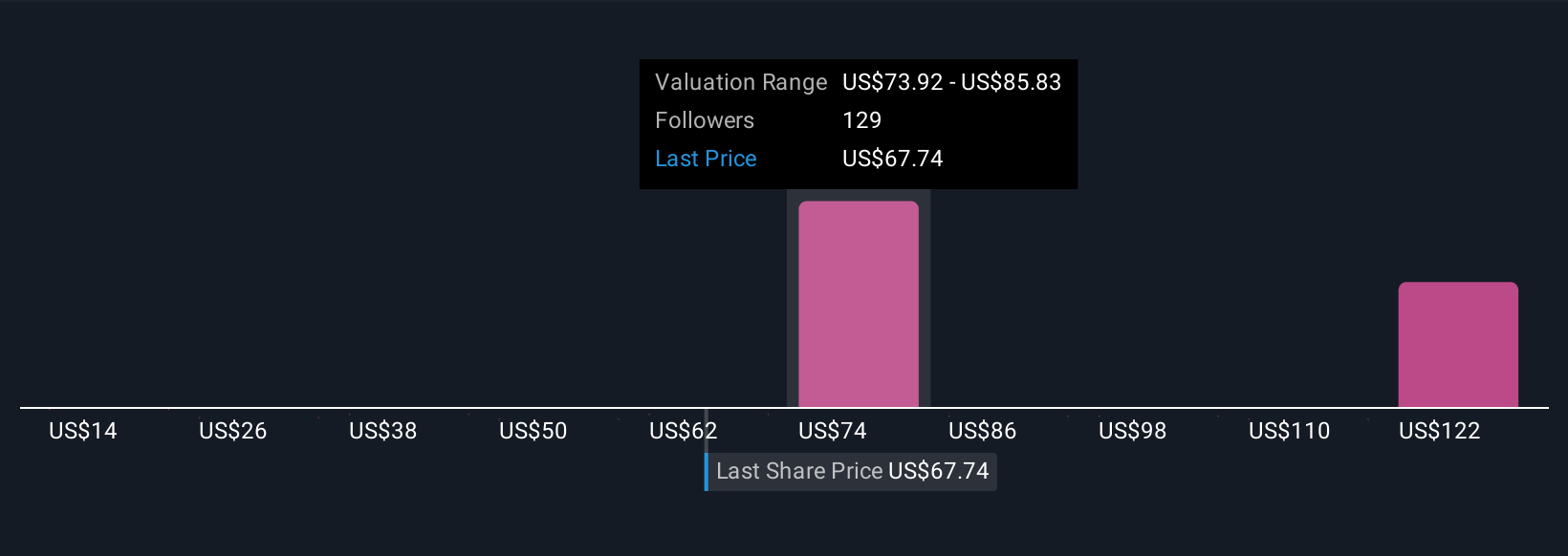

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. Put simply, a Narrative is your story or perspective about a company’s future, where you outline your assumptions for fair value, revenue growth, earnings, and margins. By connecting a company’s unique story with a financial forecast and resulting fair value, Narratives empower investors to make more informed decisions rather than relying solely on traditional ratios or models.

Narratives are easy to create and view within Simply Wall St’s Community page, allowing millions of users to explore, compare, and discuss different perspectives. This tool helps you decide whether to buy, hold, or sell by showing how your Fair Value stacks up against the current Price and is always up to date as new information, news, and earnings come in.

For example, one CRISPR Therapeutics Narrative could be optimistic, expecting rapid regulatory approval and pricing in a Fair Value over $175 per share. Another might be more cautious about clinical risks, assigning a Fair Value closer to $72. Narratives offer a dynamic, user-friendly way to invest that is built for both beginners and experts looking for a smarter edge.

Do you think there's more to the story for CRISPR Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives