- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Is CRISPR Therapeutics' US$600 Million Stock Sale and CTX460 Results Shaping Its Path as a Gene Editing Leader (CRSP)?

Reviewed by Sasha Jovanovic

- In October 2025, CRISPR Therapeutics announced new preclinical results for its SyNTase™ gene editing platform targeting Alpha-1 Antitrypsin Deficiency, alongside a plan to raise up to US$600 million through a common stock sale to fund its research and development pipeline.

- The CTX460 investigational candidate delivered over 90% gene correction in animal models with a single dose, highlighting meaningful progress in therapies aimed at treating the root cause of genetic diseases.

- We'll explore how the combined financing move and CTX460 progress affect CRISPR Therapeutics' trajectory as a gene editing innovator.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is CRISPR Therapeutics' Investment Narrative?

Owning a piece of CRISPR Therapeutics is ultimately a bet on gene editing’s ability to reshape medicine, and this means believing the company can convert its current pipeline into impactful therapies and, eventually, sustainable revenue. The recent SyNTase/CTX460 breakthrough and US$600 million financing plan mark important milestones, but don’t shift the biggest short-term catalysts: pipeline progress on approved therapies like Casgevy and continued clinical momentum for existing candidates. While preclinical updates are promising and help build credibility around CRISPR’s innovation, they don’t immediately change near-term risks, especially the company’s growing net losses and the challenge of funding long development timelines. The share sale could weigh on the stock in the short run through dilution, but also strengthens the balance sheet to support R&D. For now, the company’s overall risk profile as an early-stage innovator with high spending and no profits remains in place.

However, investors should be aware of the risk of continued losses and reliance on future funding decisions.

Exploring Other Perspectives

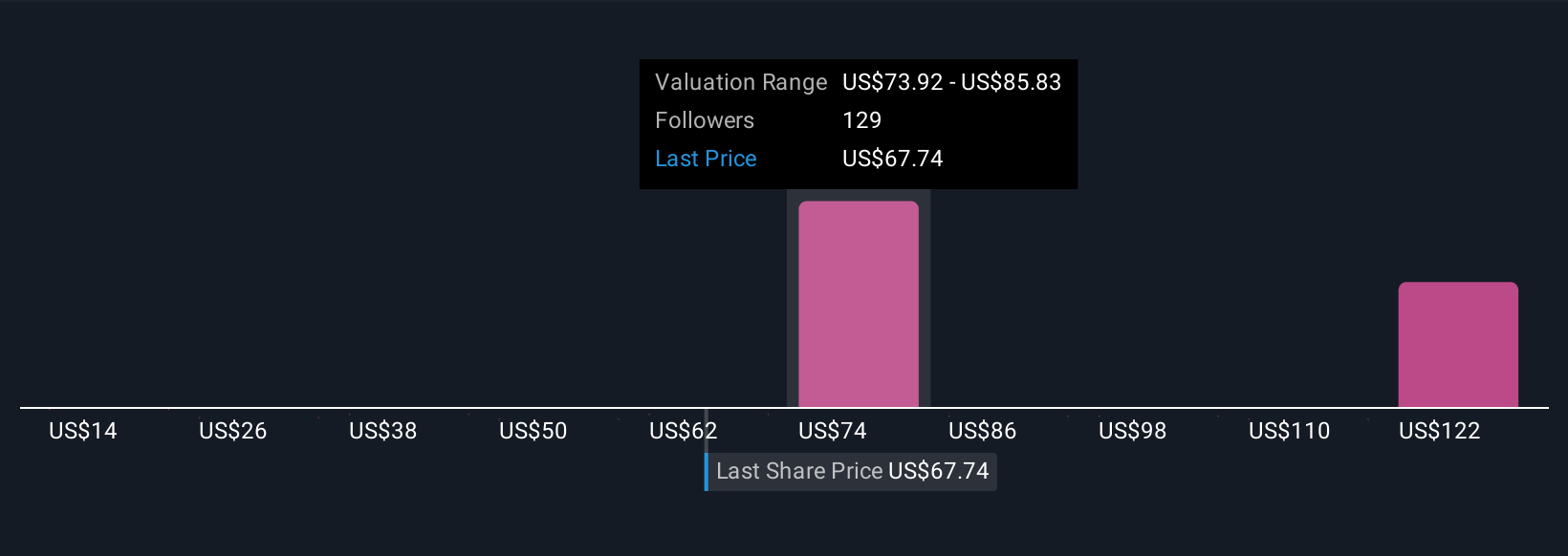

Explore 18 other fair value estimates on CRISPR Therapeutics - why the stock might be worth less than half the current price!

Build Your Own CRISPR Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CRISPR Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRISPR Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives