- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (CRSP): Reassessing Valuation After Casgevy Approvals and Growing 2025 Revenue Expectations

Reviewed by Simply Wall St

CRISPR Therapeutics (CRSP) is back in the spotlight after Casgevy secured both FDA and EMA approvals, shifting the story from distant promise to real commercial execution and near term revenue momentum.

See our latest analysis for CRISPR Therapeutics.

Those regulatory wins have helped support a 37.29 percent year to date share price return. However, the 1 year total shareholder return of 14.13 percent and 5 year total shareholder return of negative 62.10 percent show sentiment is still in the early stages of rebuilding around the $56.88 stock.

If Casgevy has you rethinking your exposure to innovative healthcare, this might be a good time to explore other potential leaders using our healthcare stocks.

With shares still down sharply over five years yet trading at a roughly 43 percent discount to consensus targets, the debate now is simple: is CRISPR Therapeutics quietly undervalued, or is the market already pricing in Casgevy and pipeline upside?

Price to Book of 2.8x: Is it justified?

On a price to book basis, CRISPR Therapeutics trades at 2.8 times. This level screens as marginally expensive against the broader US Biotech sector, but far cheaper than its closest high growth peers.

The price to book ratio compares a company’s market value to its net assets on the balance sheet. It is a useful lens for pre profit, R&D heavy biotech names where earnings are not yet a reliable anchor. For CRISPR Therapeutics, a 2.8 times multiple suggests investors are paying a premium over the industry average for its asset base, but nowhere near the valuations often attached to cutting edge gene editing platforms with similar growth expectations.

Relative to the US Biotechs industry average of 2.7 times, CRSP’s 2.8 times price to book looks only slightly elevated. This implies the market is ascribing a modest premium for its pipeline and Casgevy optionality. However, when set against a peer group that trades closer to 20.8 times book, that same 2.8 times multiple can appear conservative, which may indicate that the company’s technology platform and forecast revenue growth are not yet fully reflected in the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 2.8x (ABOUT RIGHT)

However, risks remain, including potential safety or uptake issues with Casgevy and setbacks in the broader pipeline that could undermine long term growth assumptions.

Find out about the key risks to this CRISPR Therapeutics narrative.

Another View, Our DCF Fair Value

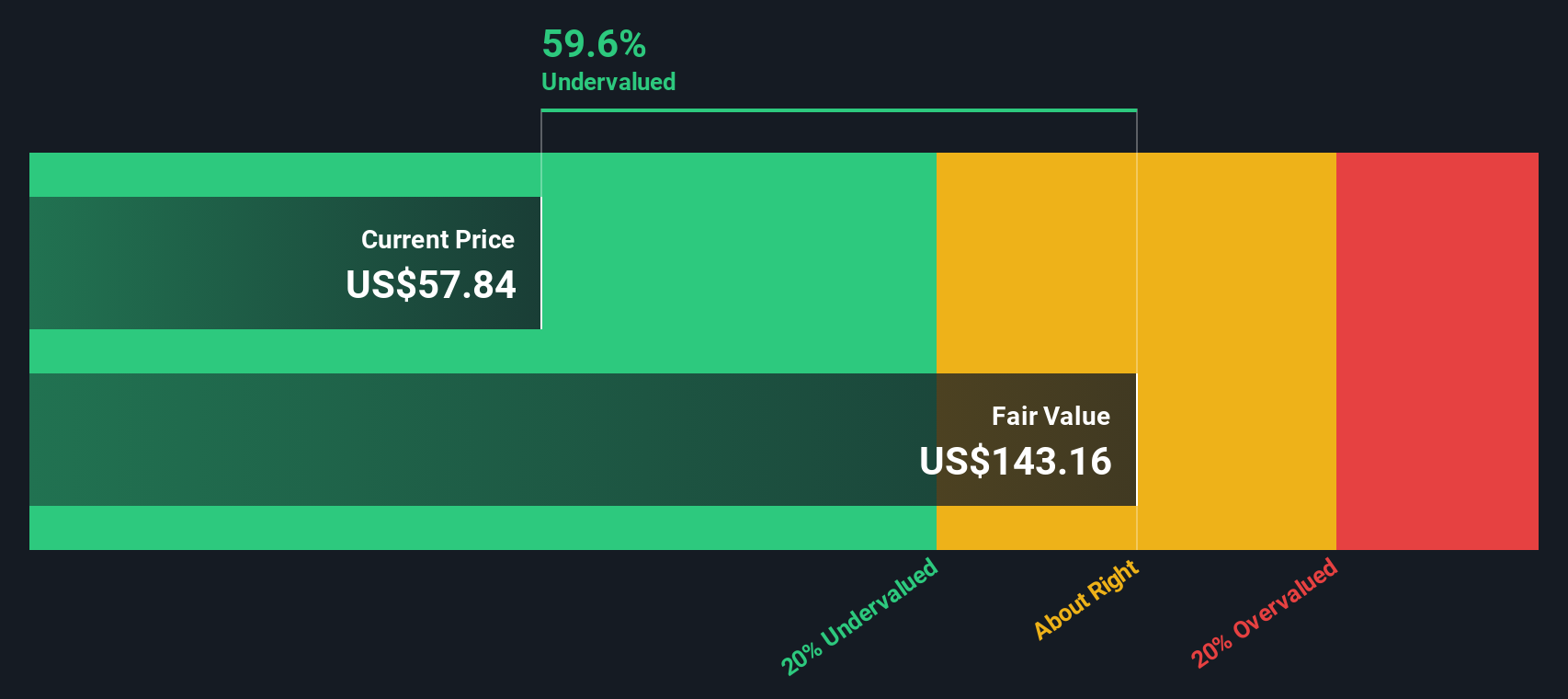

While 2.8 times book suggests CRISPR Therapeutics is roughly fairly priced versus assets, our DCF model indicates a higher fair value of $126.66. This is around 55 percent above today’s $56.88 share price. Is the market underestimating potential long term cash flows from Casgevy and the wider pipeline?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

If you see the numbers differently or want to test your own assumptions, you can build a personalised view in minutes: Do it your way.

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

CRISPR Therapeutics might be compelling, but you will miss out on other powerful opportunities if you do not scan the market with focused, data backed stock screens.

- Capture early stage potential by reviewing these 3577 penny stocks with strong financials that pair tiny share prices with surprisingly solid balance sheets and improving fundamentals.

- Position yourself at the forefront of innovation with these 26 AI penny stocks targeting companies using artificial intelligence to reshape industries and earnings power.

- Lock in income plus quality by analysing these 15 dividend stocks with yields > 3% that combine attractive yields above 3 percent with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026