- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (CRSP): Evaluating Its Valuation as Shares Attract Fresh Attention

Reviewed by Simply Wall St

Price-to-Book of 3x: Is it justified?

CRISPR Therapeutics is currently trading at a price-to-book (P/B) ratio of 3, which is above the US Biotechs industry average of 2.2 but below the peer average of 5.4. This suggests the stock is valued higher than many industry peers on a book value basis, yet offers relative value compared to other top names in the field.

The price-to-book ratio compares a company's market value to its book value, indicating how much investors are willing to pay for each dollar of net asset value. For biotech firms like CRISPR Therapeutics, which typically invest heavily in research while remaining unprofitable, the P/B ratio can signal the market’s expectations for future breakthroughs and long-term growth potential.

While the company appears expensive next to the industry average, its valuation is more favorable when compared to similar innovative firms. This pricing may reflect the anticipation of strong revenue growth and pipeline progress, even as current earnings remain negative.

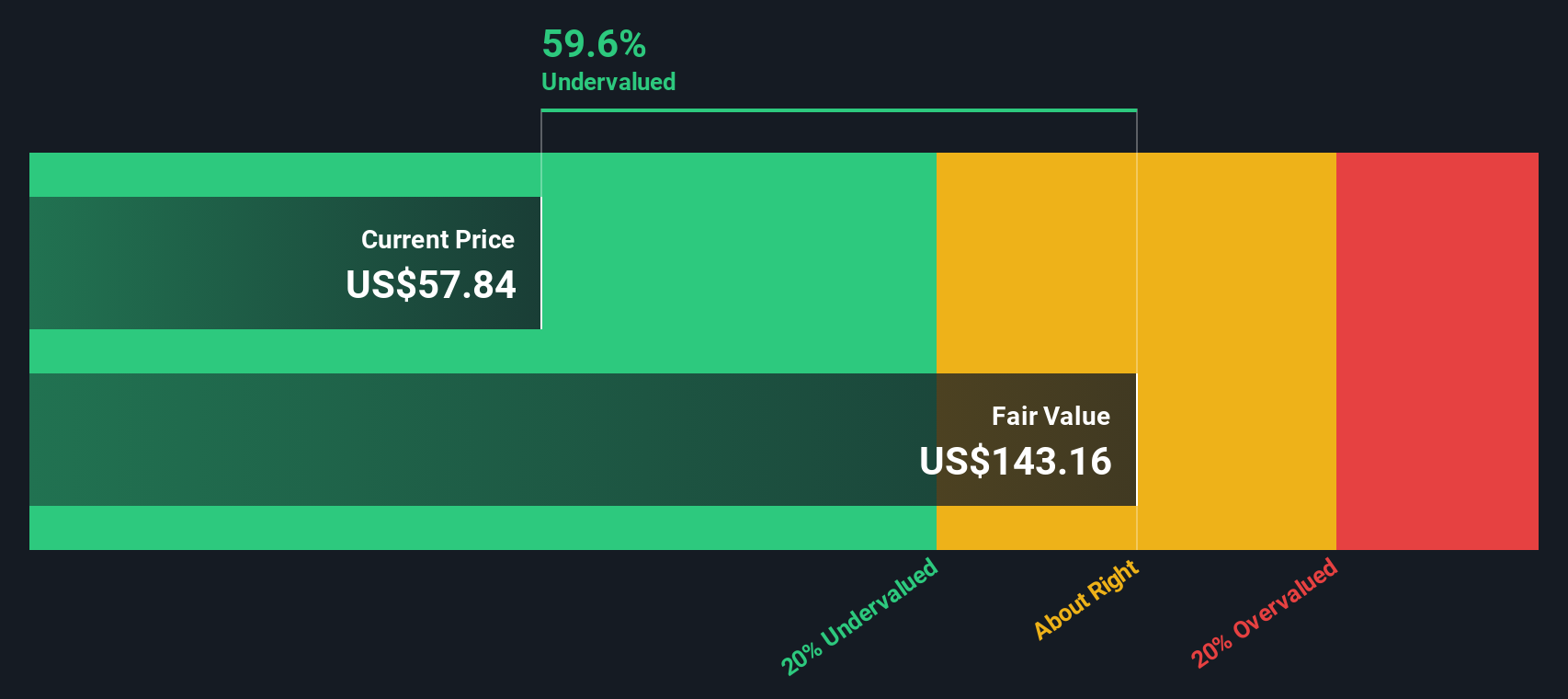

Result: Fair Value of $143.16 (UNDERVALUED)

See our latest analysis for CRISPR Therapeutics.However, risks such as volatile revenue growth and persistent net losses could quickly shift perceptions. This may make future gains less certain for CRISPR Therapeutics.

Find out about the key risks to this CRISPR Therapeutics narrative.Another View: SWS DCF Model

Looking from the perspective of our DCF model, the outlook shifts. This approach suggests the stock may actually be undervalued. This adds another layer to the debate. Which valuation do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CRISPR Therapeutics Narrative

If you see the numbers differently or want to follow your own path, you can start building your own view in just a few minutes. Do it your way

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let the next opportunity pass you by. With so many innovative companies out there, smart investors always look one step ahead for the next winner. Use these expert-curated tools to track new prospects, hidden value, and the fastest-growing sectors before they grab the spotlight.

- Uncover value plays with upside potential by jumping into undervalued stocks based on cash flows, which highlights companies trading below their fair value based on cash flow strength.

- Spot high-yield opportunities for growing your portfolio faster by using dividend stocks with yields > 3%, featuring stocks with strong dividends above 3%.

- Get ahead of the healthcare-tech curve by tapping into healthcare AI stocks, which tracks firms pioneering AI breakthroughs in medicine and biotech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives