- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics AG's (NASDAQ:CRSP) Business Is Yet to Catch Up With Its Share Price

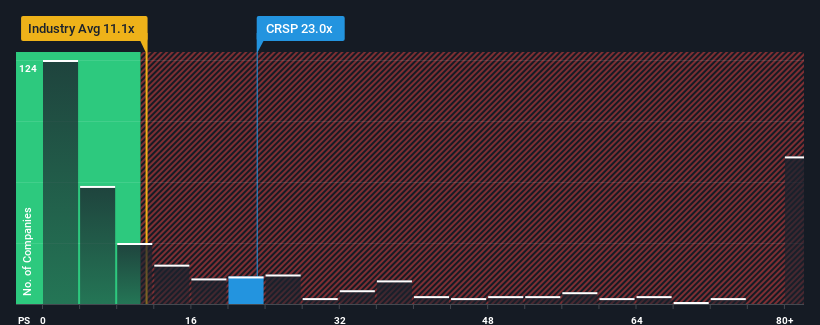

With a price-to-sales (or "P/S") ratio of 23x CRISPR Therapeutics AG (NASDAQ:CRSP) may be sending very bearish signals at the moment, given that almost half of all the Biotechs companies in the United States have P/S ratios under 11.1x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for CRISPR Therapeutics

How CRISPR Therapeutics Has Been Performing

With revenue growth that's superior to most other companies of late, CRISPR Therapeutics has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think CRISPR Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For CRISPR Therapeutics?

In order to justify its P/S ratio, CRISPR Therapeutics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 72% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 122% per year growth forecast for the broader industry.

With this information, we find it concerning that CRISPR Therapeutics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that CRISPR Therapeutics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for CRISPR Therapeutics that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives