- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

A Look at CRISPR Therapeutics (CRSP) Valuation Following Promising CTX460 Preclinical Results

Reviewed by Kshitija Bhandaru

CRISPR Therapeutics (CRSP) just shared promising preclinical data for its SyNTase-based candidate, CTX460, which showed strong gene correction in animal models of Alpha-1 Antitrypsin Deficiency. This brings some fresh attention to the company’s developing pipeline.

See our latest analysis for CRISPR Therapeutics.

CRISPR Therapeutics’ recent breakthrough with CTX460 has added to the positive momentum reflected in the company’s 66.9% year-to-date share price return. Investor excitement has grown around both commercial progress and new pipeline advances. Despite the occasional short-term volatility, the stock’s 1-year total shareholder return of 41.4% underscores how confidence in its gene-editing leadership continues to build over the longer run.

If you’re interested in what other healthcare innovators are achieving, you’ll want to browse the leaders in the sector with our See the full list for free.

With shares already surging on breakthrough news and pipeline buzz, investors are now left to weigh whether CRISPR Therapeutics is trading at a bargain based on future potential, or if the market has already factored in all the upside ahead.

Price-to-Book Ratio of 3.7x: Is it justified?

CRISPR Therapeutics is currently trading at a price-to-book (P/B) ratio of 3.7x, which places the company above the sector’s average and suggests the market is paying a premium for its assets compared to most rivals.

The price-to-book ratio reflects how much investors are willing to pay per dollar of a company’s net assets. For biotechs like CRISPR Therapeutics, this multiple often captures both the value of intellectual property and expectations for future breakthroughs.

At 3.7x, the P/B multiple is higher than the US Biotechs industry average of 2.5x. However, it is noticeably cheaper than the peer group average of 9.9x. This positions CRSP as more expensive than most industry players, but a relative bargain compared to certain peers. There is currently insufficient data to assess its fair ratio, which could provide further clarity on whether the current valuation is sustainable.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3.7x (ABOUT RIGHT)

However, lower profitability and negative net income remain risks. These factors could challenge sustained investor confidence if growth expectations are not met in future quarters.

Find out about the key risks to this CRISPR Therapeutics narrative.

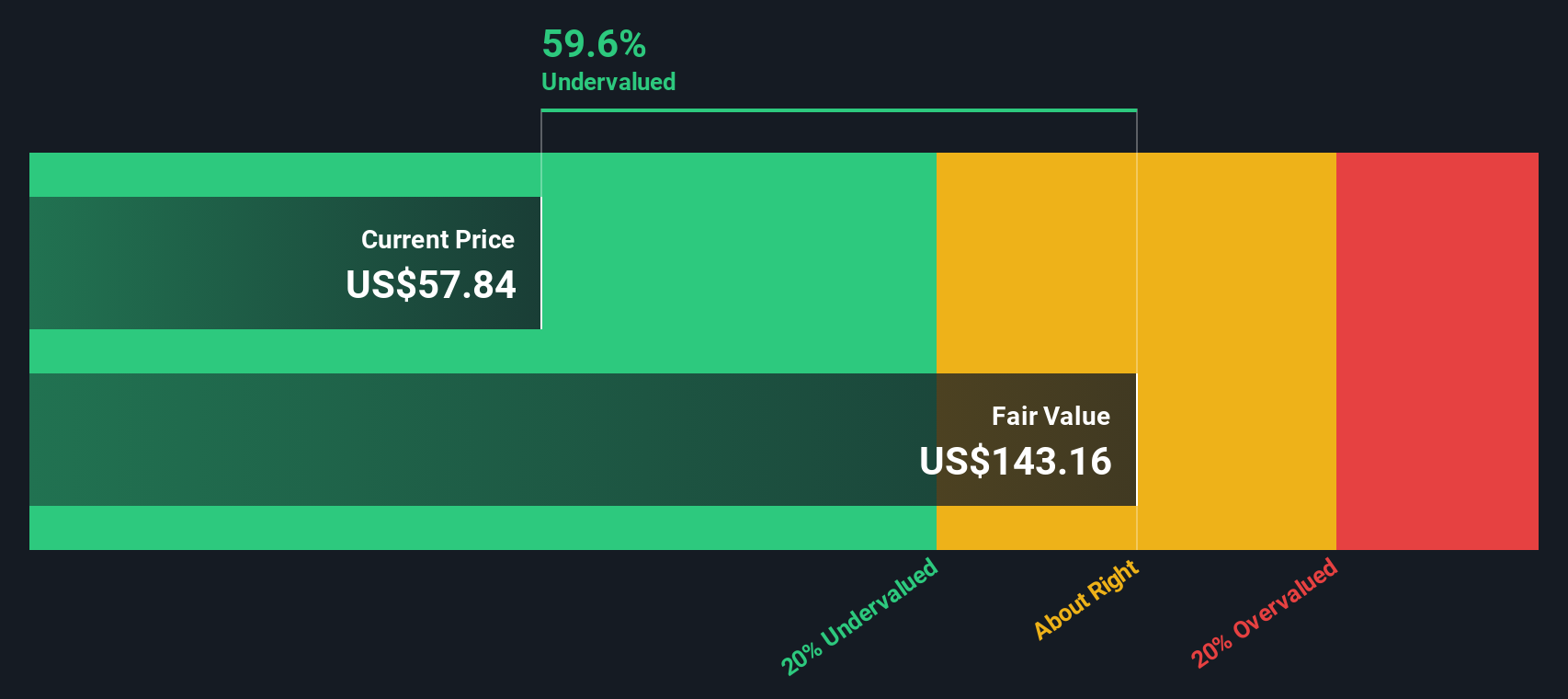

Another View: Discounted Cash Flow Model Signals Opportunity

Taking a different approach, our SWS DCF model suggests CRISPR Therapeutics is trading at a hefty discount. Shares are currently 47.3% below our estimate of fair value. While the P/B multiple paints a picture of moderate pricing, the market could be seriously underestimating the long-term potential here.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

Of course, if you see things differently or prefer to dig deeper into the numbers yourself, you can craft your own narrative quickly and easily, often in under three minutes. Do it your way

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next smart move pass you by. Supercharge your investing journey by checking out even more promising stocks handpicked to fit your goals.

- Fuel your portfolio with income by tapping into these 18 dividend stocks with yields > 3%, which spotlights companies offering strong yields above 3%.

- Jump ahead of market trends with these 33 healthcare AI stocks to see which healthcare innovators are bringing artificial intelligence to life in medicine.

- Ride the wave of digital innovation by following these 79 cryptocurrency and blockchain stocks, featuring stocks making real progress in cryptocurrency and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives