- United States

- /

- Pharma

- /

- NasdaqGM:CRMD

CorMedix (CRMD) Is Down 6.3% After Strong Q3 Results and $87.6M Shelf Registration Filed

Reviewed by Sasha Jovanovic

- CorMedix Inc. recently reported a very large increase in third-quarter revenue and net income, issued positive guidance for the fourth quarter, and filed an US$87.61 million shelf registration covering 7,672,000 common shares linked to an ESOP-related offering.

- Strong third-quarter results and ambitious fourth-quarter projections underscore CorMedix’s ongoing expansion, with its shelf registration suggesting plans to leverage positive momentum to fund growth initiatives or broaden employee participation.

- We'll explore how CorMedix’s remarkable third-quarter financial growth shapes the company’s future investment narrative and earnings profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CorMedix Investment Narrative Recap

To be a CorMedix shareholder, you need confidence in its ability to leverage recent acquisitions, ramp up new product offerings, and realize projected revenue growth, even while managing integration and market competition risks. The latest shelf registration filing may broaden capital access or employee ownership, but it does not appear to materially affect the most immediate catalyst, successful execution on ambitious Q4 revenue targets, or change the primary risk: integrating Melinta profitably without margin or operational setbacks.

The updated fourth-quarter guidance, forecasting net revenue between US$115 million and US$135 million, is highly relevant as it underscores management’s optimism following several periods of strong growth. This sets investor expectations around the company’s ability to deliver on integration synergies while expanding its footprint in the competitive anti-infectives market.

In contrast, investors should be aware of potential challenges if the Melinta integration were to bring unexpected costs or margin pressure, particularly if...

Read the full narrative on CorMedix (it's free!)

CorMedix's outlook projects $433.6 million in revenue and $244.7 million in earnings by 2028. This assumes annual revenue growth of 52.8% and an earnings increase of $193.5 million from current earnings of $51.2 million.

Uncover how CorMedix's forecasts yield a $19.00 fair value, a 102% upside to its current price.

Exploring Other Perspectives

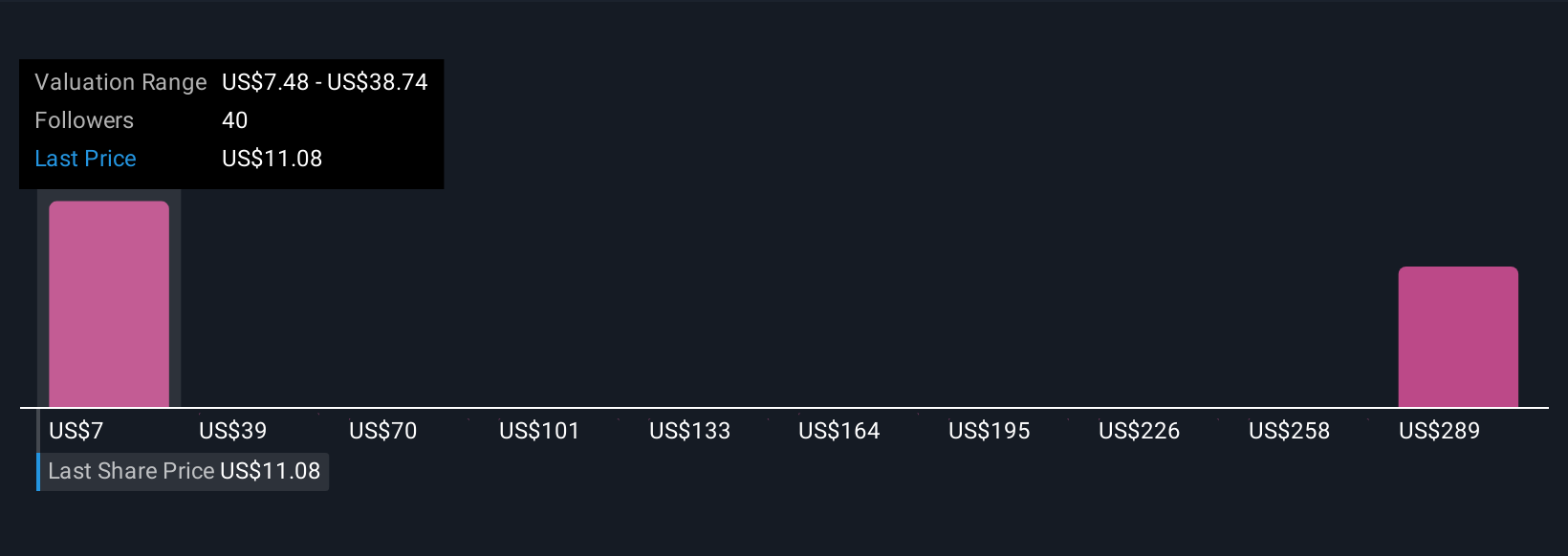

Eight private investors in the Simply Wall St Community have set fair value estimates for CorMedix ranging from US$7.48 to US$63.07. As you compare these widely diverse valuations, consider how the company’s recent growth outlook rests on ambitious revenue execution and successful acquisition integration, factors that can lead to sharply different expectations for future performance.

Explore 8 other fair value estimates on CorMedix - why the stock might be worth 20% less than the current price!

Build Your Own CorMedix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CorMedix research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CorMedix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CorMedix's overall financial health at a glance.

No Opportunity In CorMedix?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRMD

CorMedix

A biopharmaceutical company, focuses on developing and commercializing therapeutic products for life-threatening diseases and conditions in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.