- United States

- /

- Biotech

- /

- NasdaqGS:CRBU

Little Excitement Around Caribou Biosciences, Inc.'s (NASDAQ:CRBU) Revenues As Shares Take 43% Pounding

To the annoyance of some shareholders, Caribou Biosciences, Inc. (NASDAQ:CRBU) shares are down a considerable 43% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

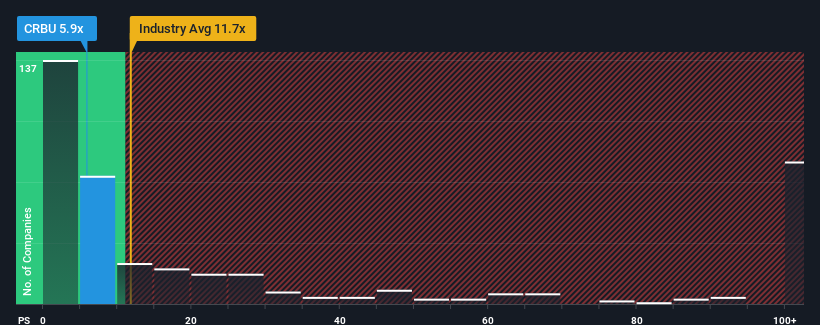

After such a large drop in price, Caribou Biosciences may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 5.9x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.7x and even P/S higher than 67x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Caribou Biosciences

What Does Caribou Biosciences' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Caribou Biosciences has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Caribou Biosciences will help you uncover what's on the horizon.How Is Caribou Biosciences' Revenue Growth Trending?

Caribou Biosciences' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 127% last year. The strong recent performance means it was also able to grow revenue by 173% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 30% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 209% per year, which is noticeably more attractive.

With this information, we can see why Caribou Biosciences is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The southerly movements of Caribou Biosciences' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Caribou Biosciences' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Caribou Biosciences is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Caribou Biosciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRBU

Caribou Biosciences

A clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies in the United States and internationally.

Flawless balance sheet slight.