- United States

- /

- Pharma

- /

- NasdaqCM:CORT

How Investors May Respond To Corcept Therapeutics (CORT) Raising 2025 Revenue Guidance Amid Pharmacy Constraints

Reviewed by Sasha Jovanovic

- Earlier this week, Corcept Therapeutics revised its 2025 revenue guidance to US$800–US$850 million, reflecting capacity constraints with its former specialty pharmacy vendor and a surge in new prescriptions for Korlym®.

- This update arrives amid heightened analyst focus on the company’s pipeline, particularly the upcoming PDUFA decision for relacorilant in hypercortisolism slated for December 2025.

- We'll assess how Corcept's updated revenue guidance and operational constraints may impact its investment narrative and business outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Corcept Therapeutics Investment Narrative Recap

To own Corcept Therapeutics, investors need confidence that growth in hypercortisolism prescriptions and successful pipeline execution, especially with relacorilant, can ultimately offset the risks of heavy reliance on Korlym and pressure from generic competition. The latest revenue guidance revision, while reflective of recent fulfillment capacity issues, does not appear to materially change the primary catalyst, the upcoming FDA decision for relacorilant in hypercortisolism slated for December 2025, or the core risk tied to Korlym’s patent and competitive pressures.

Among recent company updates, the modification of 2025 revenue guidance to US$800–US$850 million is most relevant, as it directly links operational bottlenecks to financial outlook adjustments during a period of record Korlym prescriptions. This operational constraint underscores the ongoing execution risk, especially as the approval and launch of relacorilant could further test the company’s ability to meet demand without delaying revenue recognition tied to new product launches.

In contrast, near-term performance hinges not only on pipeline progress, but on whether Corcept can sustain fulfillment capacity as competitive threats intensify, investors should be aware of...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' narrative projects $2.0 billion in revenue and $743.0 million in earnings by 2028. This requires 40.7% yearly revenue growth and a $611.0 million increase in earnings from the current $132.0 million.

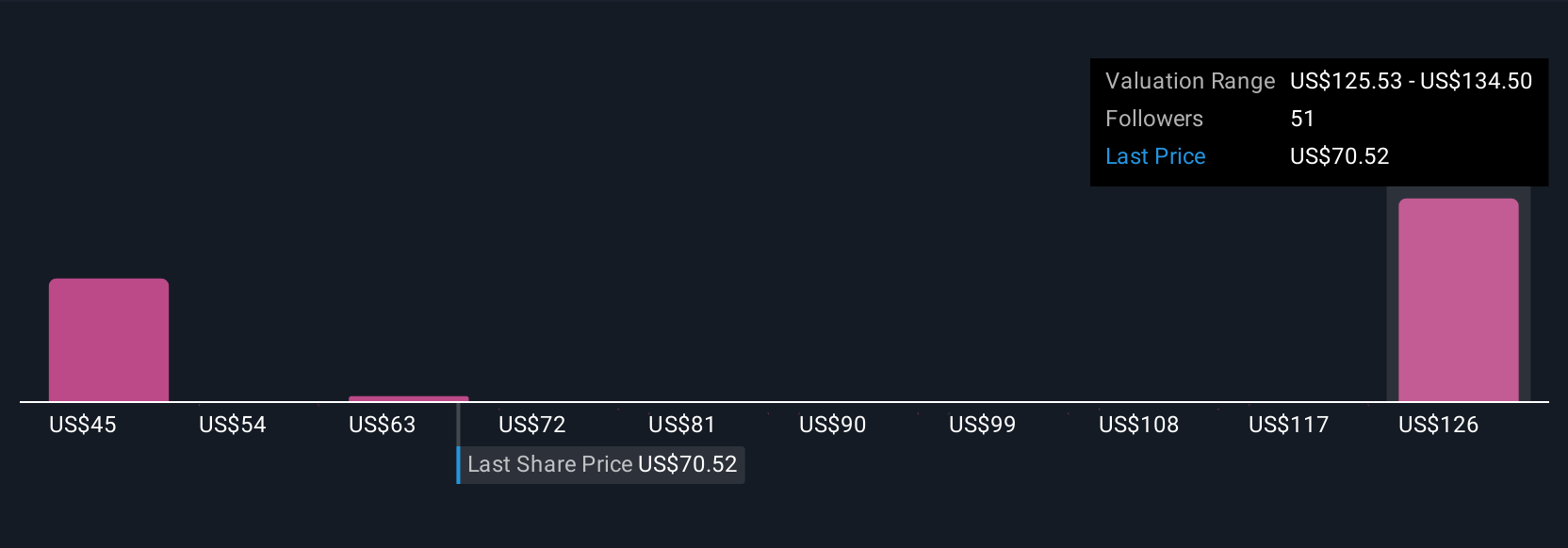

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 69% upside to its current price.

Exploring Other Perspectives

Ten estimates from the Simply Wall St Community place fair value for Corcept shares between US$74.33 and US$259.75. With execution risk around scaling pharmacy operations driving recent guidance changes, the range of views highlights the importance of looking at multiple perspectives before making decisions.

Explore 10 other fair value estimates on Corcept Therapeutics - why the stock might be worth 6% less than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.