- United States

- /

- Pharma

- /

- NasdaqCM:CORT

How Could Corcept (CORT) Specialty Pharmacy Partnership Reflect Its Approach to Diversifying Beyond Korlym?

Reviewed by Sasha Jovanovic

- Curant Health recently announced that its Curant Rare division was selected by Corcept Therapeutics to provide specialty pharmacy services, focusing on enhancing patient care and coordinated therapy access.

- This collaboration comes as Corcept advances relacorilant, its key pipeline drug, into late-stage development and pursues regulatory approval for broader indications, signaling an effort to reduce reliance on Korlym and diversify its product portfolio.

- We’ll explore how Corcept’s specialty pharmacy partnership may accelerate its strategy to expand clinical reach and decrease single-product risks.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Corcept Therapeutics Investment Narrative Recap

To be a Corcept Therapeutics shareholder today, you need confidence in the company’s ability to expand beyond Korlym by securing approval for relacorilant and broadening its drug pipeline. The new Curant Health partnership may streamline patient access and support fulfillment, but it does not materially alter the most important near-term catalyst, FDA approval of relacorilant, or reduce the primary risk posed by Korlym’s revenue dependence and ongoing generic erosion.

The most relevant recent announcement is the FDA’s acceptance of Corcept’s New Drug Application for relacorilant in platinum-resistant ovarian cancer, with a key decision date set for July 2026. This regulatory milestone remains the core focus for investors watching for future revenue diversification and margin potential as the company transitions away from Korlym.

By contrast, one issue investors should be especially mindful of is how delays or setbacks in regulatory approvals could…

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' outlook forecasts $2.0 billion in revenue and $743.0 million in earnings by 2028. This projection relies on 40.7% annual revenue growth and a $611.0 million increase in earnings from the current $132.0 million.

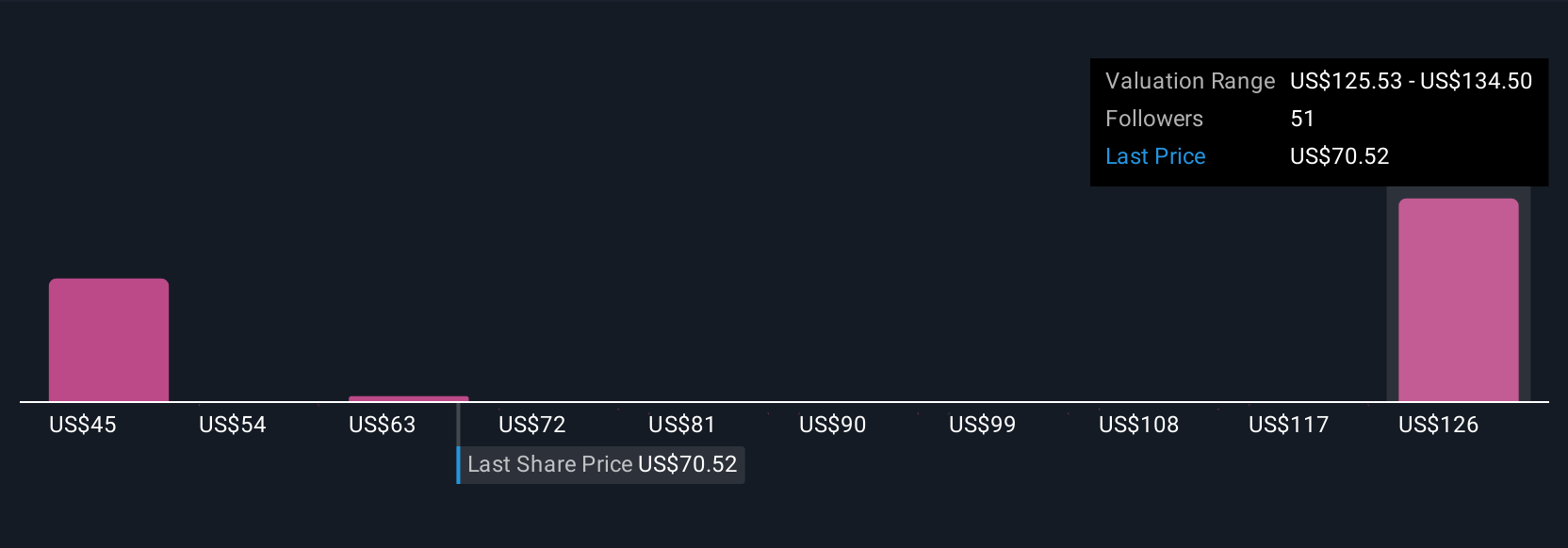

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 57% upside to its current price.

Exploring Other Perspectives

Twelve private investors in the Simply Wall St Community estimate Corcept’s fair value anywhere from US$44.83 to US$193.61 per share. While views differ sharply, many are watching the critical FDA decisions ahead, which could shape future growth and risks for the business.

Explore 12 other fair value estimates on Corcept Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

No Opportunity In Corcept Therapeutics?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives