- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (NasdaqCM:CORT) Reports US$21M Q1 Net Income Lowers EPS

Reviewed by Simply Wall St

Corcept Therapeutics (NasdaqCM:CORT) reported a decline in net income and earnings per share for Q1 2025, but maintained confidence by confirming its annual revenue guidance. This stable outlook occurred amid a market environment where major indices experienced some volatility, largely due to uncertainties surrounding tariffs and Federal Reserve decisions. Despite the market complexities, the company's 10.51% price increase over the last quarter aligns with the broader market movements. Amidst these market fluctuations, Corcept's continued advancement in clinical trials and reaffirmed guidance would have likely had a stabilizing effect, providing confidence to investors during a period marked by economic uncertainty.

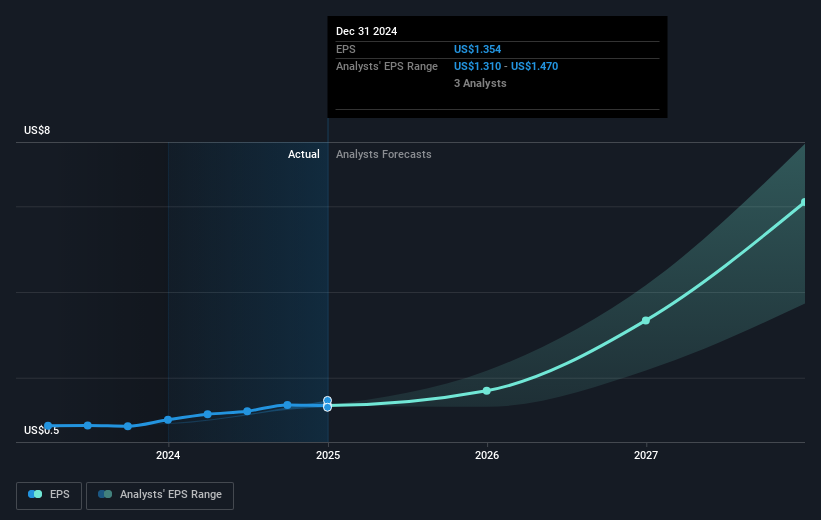

Despite challenges such as declining net income and earnings per share in Q1 2025, Corcept Therapeutics' commitment to maintaining its annual revenue guidance amidst a volatile market environment underscores its strategic positioning. The potential FDA approval for relacorilant could further bolster spirits, particularly as the company has indicated plans for expansion across multiple therapeutic areas, which could significantly impact future revenue streams and profitability. Analysts' projections suggest an optimistic trajectory for earnings and revenue in upcoming years, especially if ongoing clinical trials yield favorable results.

Over the past five years, Corcept's shareholders have enjoyed an impressive total return of 438.53%, marking a significant long-term growth phase for the company. When compared to the past year, Corcept’s performance exceeded the broader US Pharmaceuticals industry's annual return of a 3.4% decline. This divergence highlights Corcept's resilience and growth relative to industry peers.

The price movement in the last quarter, with shares increasing by 10.51%, remains aligned with current market trends. However, given the fair value assessment from consensus analyst price targets at US$143.25, the present share price of US$73.23 suggests notable upside potential. This context encourages investors to consider the company's consistent progress and the promising outlook portrayed through its ongoing developments, despite short-term setbacks in financial results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Corcept Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives