- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (CORT): Valuation Spotlight After FDA Accepts Relacorilant Application for Ovarian Cancer

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 40% Undervalued

According to the most widely followed narrative among analysts, Corcept Therapeutics is trading at a substantial discount to its estimated fair value. The consensus is that the stock remains attractively priced relative to the growth and market opportunities analysts see ahead.

Anticipated regulatory approvals for relacorilant in both hypercortisolism at the end of this year, and platinum-resistant ovarian cancer next year, supported by clinically differentiated safety and efficacy data, create major new revenue and margin expansion opportunities as the company moves past single-product dependence.

What is the engine under Corcept’s dramatic price target? This narrative is built on projections of rapid sales growth, expanding margins, and ambitious profit assumptions that most investors are not factoring in today. Hungry for the specific financial leaps and market catalysts driving this bold outlook? Discover the numbers that could reshape the valuation landscape for Corcept Therapeutics.

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing patent litigation and heavy reliance on a single product could quickly challenge the bullish outlook if outcomes turn unfavorable.

Find out about the key risks to this Corcept Therapeutics narrative.Another View: What Do Earnings Ratios Say?

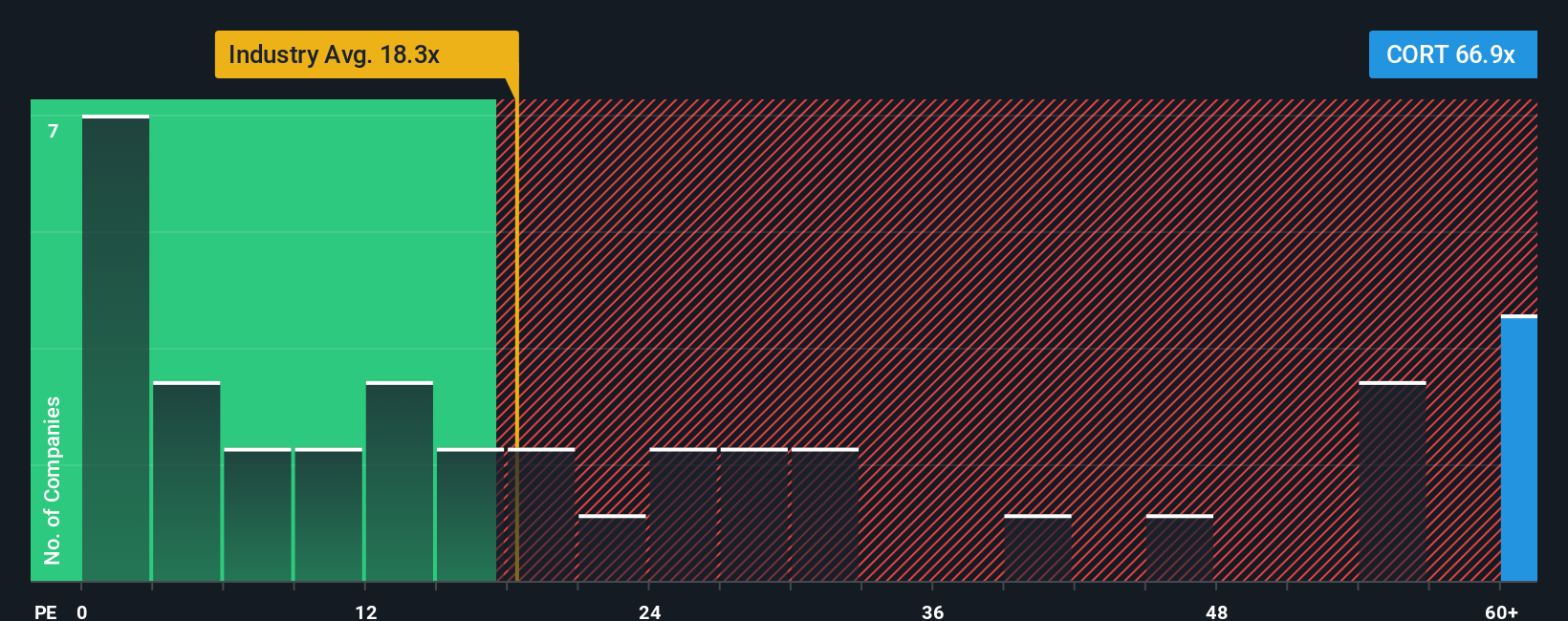

Looking through a different lens, evaluating Corcept's valuation against the industry using one popular earnings ratio shows the stock trades at a steep premium. This challenges the narrative of a wide margin of undervaluation. Could current optimism be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Corcept Therapeutics to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Corcept Therapeutics Narrative

If you want to dig deeper or reach your own conclusions, you can easily craft a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corcept Therapeutics.

Looking for More Smart Investment Moves?

Why limit your gains to one company? Get ahead of the crowd and uncover investment ideas that could change your financial future by using these curated lists to spot tomorrow’s winners today.

- Spot opportunities in tech’s next frontier by unleashing the potential of quantum computing advancements with the quantum computing stocks resource.

- Catch companies reimagining medicine and healthcare by tapping into breakthroughs in artificial intelligence with our insider look at healthcare AI stocks.

- Jump on undervalued stocks poised for growth and find unique values hiding in plain sight using our original undervalued stocks based on cash flows shortlists.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives