- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (CORT) Is Up 9.9% After Relacorilant–Nab-Paclitaxel Phase 3 Success in Ovarian Cancer

Reviewed by Sasha Jovanovic

- Corcept Therapeutics recently presented new, positive Phase 3 ROSELLA trial data at the ESMO 2025 Annual Meeting, showing that relacorilant plus nab-paclitaxel improved progression-free survival for patients with platinum-resistant ovarian cancer, including those previously treated with PARP inhibitors.

- The findings suggest relacorilant may offer a clinically meaningful benefit for a particularly high-risk patient group where chemotherapy resistance is a significant challenge.

- We'll examine how the compelling Phase 3 oncology results could influence Corcept Therapeutics' prospects for pipeline diversification and revenue expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Corcept Therapeutics Investment Narrative Recap

For investors considering Corcept Therapeutics, the key belief centers on successful diversification beyond Korlym by achieving regulatory approval and commercial success for relacorilant in new indications. The recent Phase 3 ROSELLA results further strengthen the short-term catalyst of FDA and EMA approval for relacorilant in platinum-resistant ovarian cancer, but they do not materially change the ongoing risk tied to Korlym's dependence and potential generic pressures. The story remains focused on execution around both regulatory milestones and revenue mix transition.

Among recent announcements, Corcept’s submission of a Marketing Authorization Application to the EMA directly aligns with the relacorilant catalyst, emphasizing the company’s momentum in pursuing international regulatory approvals. This coincides with upcoming U.S. regulatory decisions, positioning the company for possible global expansion if approvals are secured.

In contrast, what investors should be aware of is the extent to which generic competition could impact Korlym revenue before relacorilant’s full launch and...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' narrative projects $2.0 billion revenue and $743.0 million earnings by 2028. This requires 40.7% yearly revenue growth and a $611.0 million earnings increase from $132.0 million today.

Uncover how Corcept Therapeutics' forecasts yield a $134.50 fair value, a 71% upside to its current price.

Exploring Other Perspectives

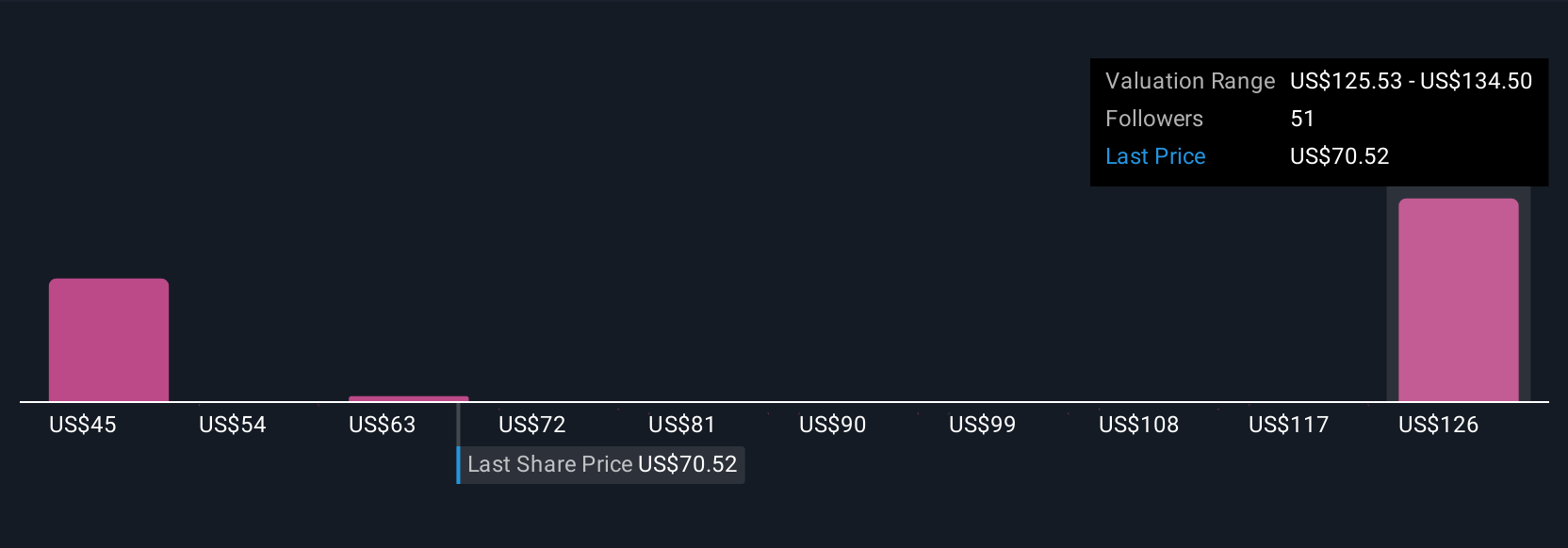

Eleven members of the Simply Wall St Community estimate Corcept's fair value between US$44.83 and US$193.61 per share. While upcoming relacorilant approval drives much of the optimism, the heavy reliance on Korlym revenues remains a central concern for many.

Explore 11 other fair value estimates on Corcept Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives