- United States

- /

- Pharma

- /

- NasdaqCM:CORT

Corcept Therapeutics (CORT): Assessing Valuation After European Ovarian Cancer Therapy Regulatory Milestone

Reviewed by Kshitija Bhandaru

Corcept Therapeutics (CORT) has drawn renewed attention from investors after submitting an application to the European Medicines Agency for its ovarian cancer therapy, relacorilant. This step is based on strong late-stage clinical trial results.

See our latest analysis for Corcept Therapeutics.

Corcept’s bold regulatory push has sparked momentum in its share price, with traders responding to relacorilant’s European filing and a recent run of positive clinical news. After a solid multi-month rally, the year-to-date share price return sits at 57.5%, while total shareholder return over the past three years has soared to nearly 175%. The latest gain follows a stream of regulatory updates and a shift in distribution agreements, indicating the market sees fresh growth potential on the horizon.

If these recent biotech milestones have you scanning for more promising healthcare names, our Healthcare Leaders Screener is a great next step: See the full list for free.

But with shares rallying and analyst price targets well above the current price, investors must ask whether Corcept is trading at a discount to its growth prospects or if the market has already anticipated the upside.

Most Popular Narrative: 41.5% Undervalued

Corcept Therapeutics is currently trading well below the narrative's fair value target, indicating a potentially significant upside from its last close. The stage is set for major catalysts tied to product approvals and commercial expansion, which could reshape the company's trajectory.

The company is rapidly scaling commercial infrastructure (for example, onboarding additional pharmacy vendors and expanding clinical specialist headcount) to meet surging demand and reduce fulfillment bottlenecks. This is positioning Corcept to capture greater revenue as operational barriers are removed.

Curious what’s fueling such a high fair value? The narrative hinges on breakthrough growth projections, bold margin improvements, and a game-changing leap in future earnings. Ready to see the full picture behind these sky-high expectations? The numbers might surprise you.

Result: Fair Value of $134.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing patent litigation and delays in scaling pharmacy operations could have a significant impact on Corcept’s growth trajectory if not successfully managed.

Find out about the key risks to this Corcept Therapeutics narrative.

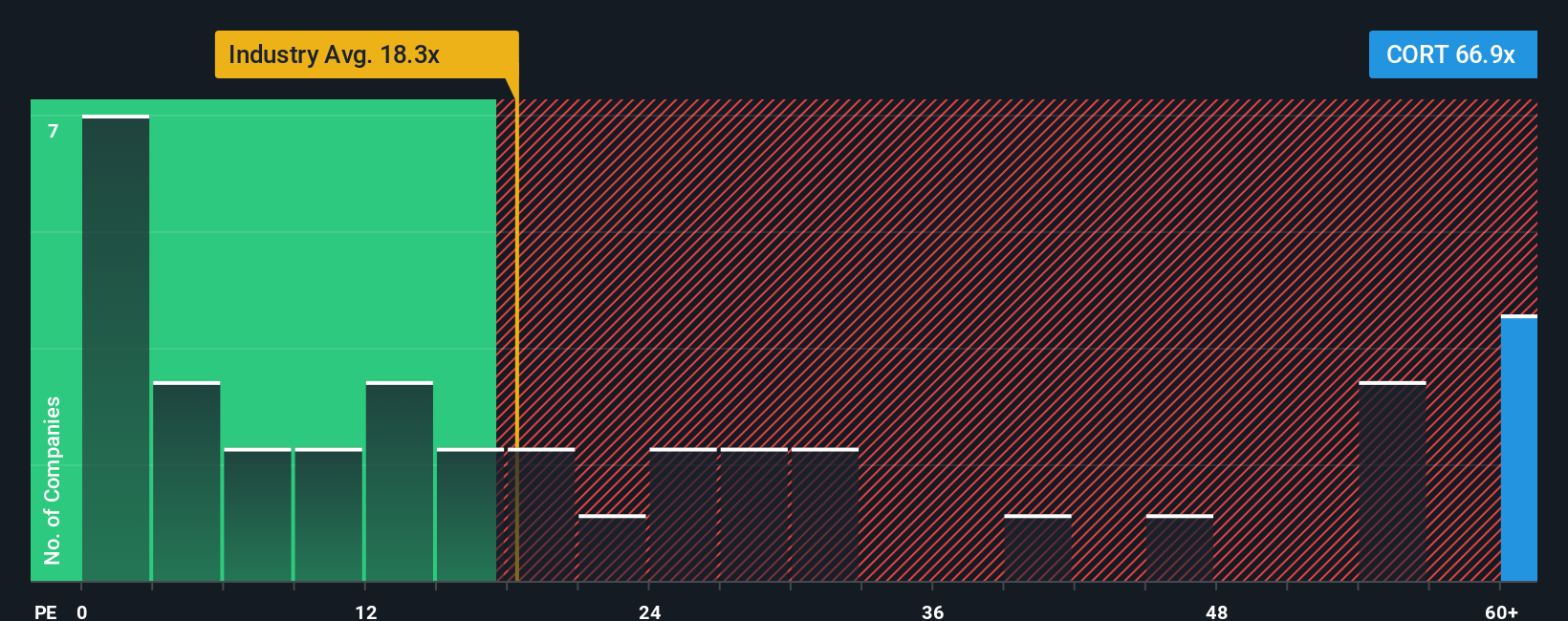

Another View: Multiples Tell a Different Story

Looking beyond the narrative's target price, the market is pricing Corcept at a price-to-earnings ratio of 62.8x, which is dramatically higher than both industry peers (28x) and the sector average (17.6x). Even against its fair ratio of 59x, shares seem expensive. This raises questions about the level of optimism being priced in. Does this setup signal added risk for buyers, or could ongoing growth still justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you see the numbers differently or want to dig in for yourself, you can shape your own outlook on Corcept in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corcept Therapeutics.

Looking for More Investment Ideas?

Don’t settle for what you already know. Give yourself an edge by checking out stocks in powerful trends that others are missing. Opportunity can move fast, so make your next move count.

- Catch the momentum and tap into wealth-building potential by scanning these 878 undervalued stocks based on cash flows that show strong fundamentals but are flying under the radar.

- Unlock future growth by tracking these 33 healthcare AI stocks that are reshaping medicine with AI-powered breakthroughs and innovations.

- Boost your income streams with dependable returns from these 18 dividend stocks with yields > 3% offering attractive yields above 3% for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CORT

Corcept Therapeutics

Engages in discovery and development of medication for the treatment of severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives