- United States

- /

- Biotech

- /

- NasdaqGS:CNTA

Centessa Pharmaceuticals (CNTA) Raises $250 Million for Pipeline Expansion Is This a Turning Point?

Reviewed by Sasha Jovanovic

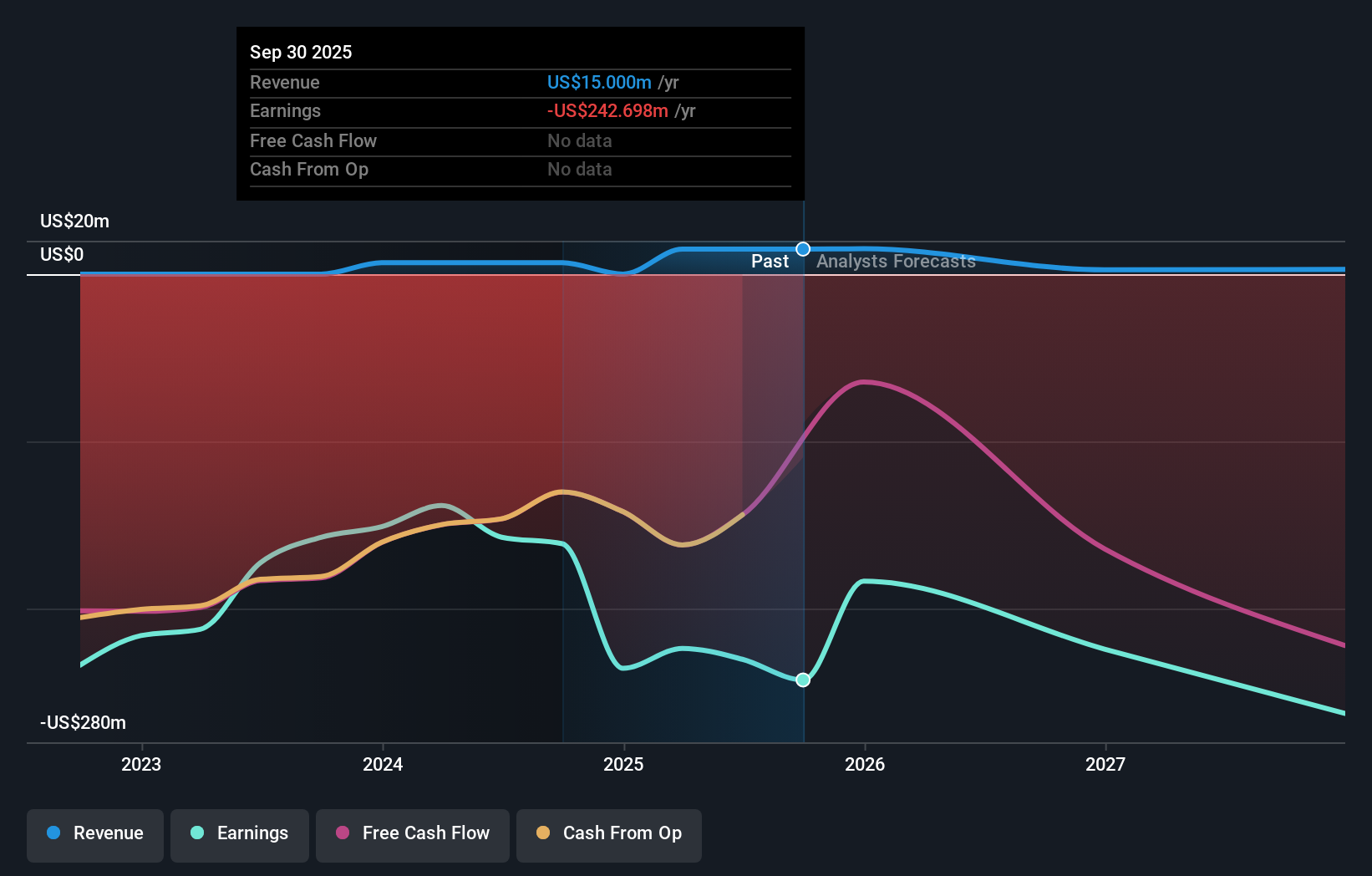

- Centessa Pharmaceuticals recently completed a significant follow-on equity offering, raising approximately US$250 million through the sale of more than 11.6 million American Depositary Shares at US$21.50 each, with additional purchase options granted to underwriters.

- This capital raise follows a period of increased research and development spending, with proceeds aimed at supporting the advancement of Centessa’s diverse pipeline targeting neurological and neuropsychiatric disorders.

- We'll explore how this follow-on offering and its funding implications could reshape Centessa’s investment narrative moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Centessa Pharmaceuticals' Investment Narrative?

To own shares in Centessa Pharmaceuticals, you need to believe the company’s focus on neurological and neuropsychiatric therapies can yield meaningful clinical and commercial breakthroughs, while managing the financial risks of an unprofitable biotech model. The recent US$250 million follow-on offering stands out as a material event, giving Centessa a sizable cash buffer after a stretch of rising research and development spending and ongoing quarterly losses. This fundraising could help fund upcoming clinical catalysts, especially for programs like ORX142 and ORX750, and may reduce short-term balance sheet risk that previously overshadowed the story. However, it also dilutes current shareholders and puts renewed attention on the complex path to regulatory approvals and eventual revenue. Volatility may persist, especially as the lock-up expiration nears and the market digests both the capital raise and Centessa’s ability to advance its pipeline fast enough to justify its premium valuation.

But with new cash in play, the uncertainty around dilution and lock-up expiry becomes crucial for investors. Our valuation report unveils the possibility Centessa Pharmaceuticals' shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Centessa Pharmaceuticals - why the stock might be worth as much as 6% more than the current price!

Build Your Own Centessa Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centessa Pharmaceuticals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Centessa Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centessa Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNTA

Centessa Pharmaceuticals

A clinical-stage pharmaceutical company, discovers, develops, and delivers medicines.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives