- United States

- /

- Biotech

- /

- NasdaqGM:CMRX

Those Who Purchased Chimerix (NASDAQ:CMRX) Shares Five Years Ago Have A 85% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is a pleasure to report that the Chimerix, Inc. (NASDAQ:CMRX) is up 66% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Five years have seen the share price descend precipitously, down a full 85%. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The important question is if the business itself justifies a higher share price in the long term.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Chimerix

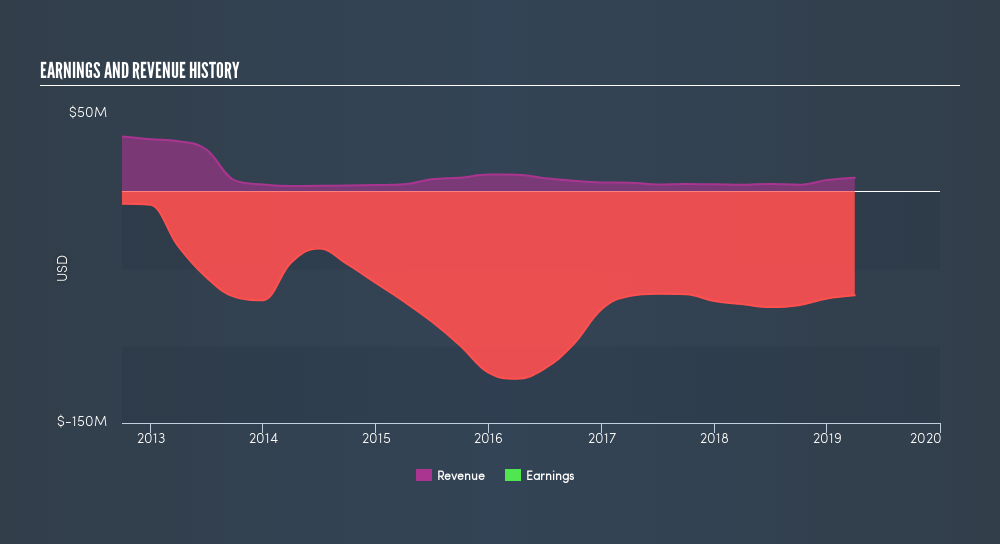

Chimerix isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Chimerix grew its revenue at 2.5% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 31%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Chimerix

A Different Perspective

While the broader market gained around 6.9% in the last year, Chimerix shareholders lost 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 31% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Chimerix is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:CMRX

Chimerix

A biopharmaceutical company, develops medicines to improve and extend the lives of patients facing deadly diseases in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives