- United States

- /

- Biotech

- /

- NasdaqCM:CMPX

Companies Like Compass Therapeutics (NASDAQ:CMPX) Are In A Position To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Compass Therapeutics (NASDAQ:CMPX) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Compass Therapeutics

When Might Compass Therapeutics Run Out Of Money?

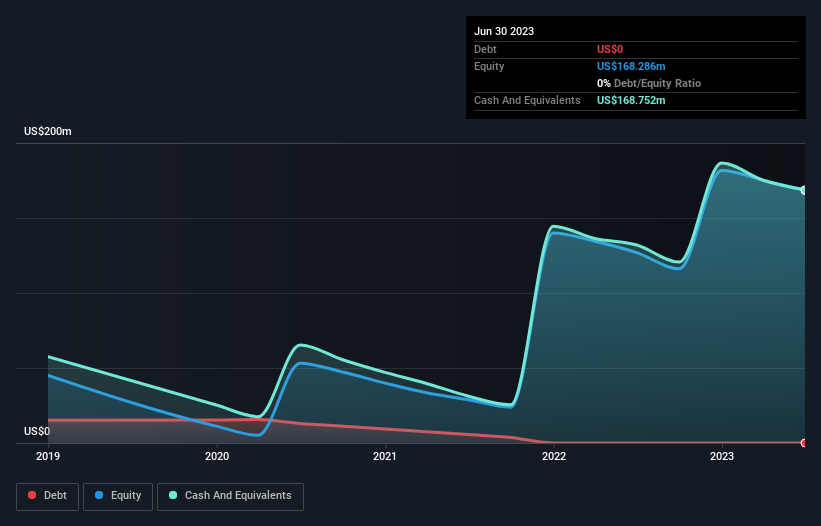

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Compass Therapeutics last reported its balance sheet in June 2023, it had zero debt and cash worth US$169m. Importantly, its cash burn was US$44m over the trailing twelve months. So it had a cash runway of about 3.8 years from June 2023. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Is Compass Therapeutics' Cash Burn Changing Over Time?

Because Compass Therapeutics isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. The skyrocketing cash burn up 101% year on year certainly tests our nerves. That sort of spending growth rate can't continue for very long before it causes balance sheet weakness, generally speaking. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Compass Therapeutics To Raise More Cash For Growth?

While Compass Therapeutics does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$256m, Compass Therapeutics' US$44m in cash burn equates to about 17% of its market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Compass Therapeutics' Cash Burn A Worry?

On this analysis of Compass Therapeutics' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Compass Therapeutics (1 is concerning!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you're looking to trade Compass Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CMPX

Compass Therapeutics

A clinical-stage oncology-focused biopharmaceutical company, engages in the development of antibody-based therapeutics for the treatment of various human diseases in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives