Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqCM:CLDX

Here's What We Learned About The CEO Pay At Celldex Therapeutics, Inc. (NASDAQ:CLDX)

This article will reflect on the compensation paid to Anthony Marucci who has served as CEO of Celldex Therapeutics, Inc. (NASDAQ:CLDX) since 2008. This analysis will also assess whether Celldex Therapeutics pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Celldex Therapeutics

How Does Total Compensation For Anthony Marucci Compare With Other Companies In The Industry?

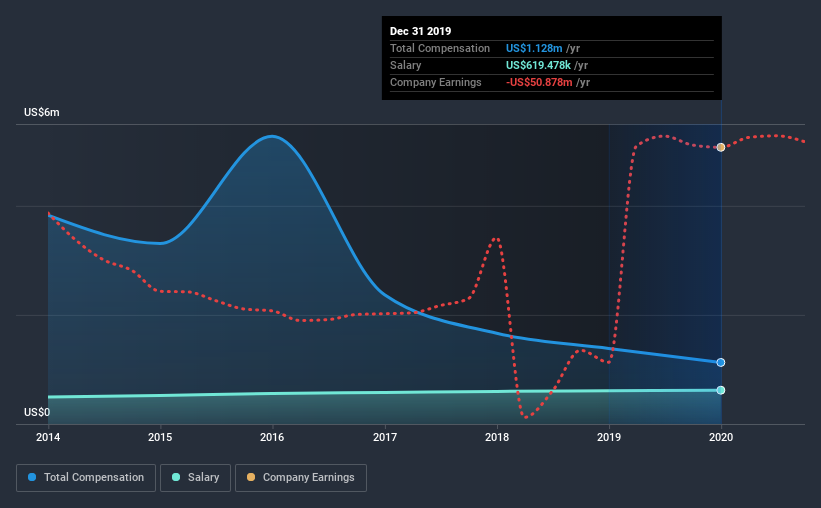

According to our data, Celldex Therapeutics, Inc. has a market capitalization of US$861m, and paid its CEO total annual compensation worth US$1.1m over the year to December 2019. Notably, that's a decrease of 19% over the year before. Notably, the salary which is US$619.5k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$2.5m. This suggests that Anthony Marucci is paid below the industry median. Furthermore, Anthony Marucci directly owns US$423k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$619k | US$608k | 55% |

| Other | US$509k | US$777k | 45% |

| Total Compensation | US$1.1m | US$1.4m | 100% |

On an industry level, around 25% of total compensation represents salary and 75% is other remuneration. Celldex Therapeutics is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Celldex Therapeutics, Inc.'s Growth Numbers

Over the past three years, Celldex Therapeutics, Inc. has seen its earnings per share (EPS) grow by 65% per year. In the last year, its revenue is up 1.8%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Celldex Therapeutics, Inc. Been A Good Investment?

Since shareholders would have lost about 52% over three years, some Celldex Therapeutics, Inc. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Celldex Therapeutics, Inc. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, the company has impressed with its EPS growth over three years. It's tough to criticize CEO compensation when the per-share EPS movement is positive. But shareholders will likely want to hold off on any raise for Anthony until investor returns are positive.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 2 which are significant) in Celldex Therapeutics we think you should know about.

Important note: Celldex Therapeutics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Celldex Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Celldex Therapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:CLDX

Celldex Therapeutics

A biopharmaceutical company, engages in developing therapeutic monoclonal and bispecific antibodies for the treatment of various diseases.

Flawless balance sheet with limited growth.