- United States

- /

- Biotech

- /

- NasdaqGM:CHRS

Coherus BioSciences, Inc.'s (NASDAQ:CHRS) 32% Dip In Price Shows Sentiment Is Matching Revenues

The Coherus BioSciences, Inc. (NASDAQ:CHRS) share price has fared very poorly over the last month, falling by a substantial 32%. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

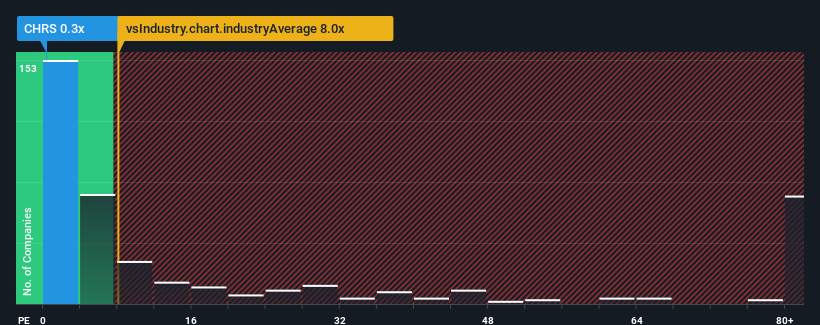

Since its price has dipped substantially, Coherus BioSciences may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8x and even P/S higher than 45x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Our free stock report includes 6 warning signs investors should be aware of before investing in Coherus BioSciences. Read for free now.View our latest analysis for Coherus BioSciences

What Does Coherus BioSciences' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Coherus BioSciences has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coherus BioSciences.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Coherus BioSciences' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 10% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 24% per year over the next three years. With the industry predicted to deliver 163% growth per year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Coherus BioSciences' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Coherus BioSciences' P/S?

Coherus BioSciences' P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Coherus BioSciences' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Don't forget that there may be other risks. For instance, we've identified 6 warning signs for Coherus BioSciences (4 are a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CHRS

Coherus Oncology

A biopharmaceutical company, researches, develops, and commercializes immunotherapies to treat cancer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives