- United States

- /

- Biotech

- /

- NasdaqGS:CGON

CG Oncology (CGON): Assessing Valuation Following Phase 3 Trial Progress and Upbeat Analyst Outlook

Reviewed by Simply Wall St

CG Oncology (CGON) has been drawing attention as it advances its Phase 3 clinical trial for BOND-003, which targets high-risk bladder cancer. Progress in this trial is shaping expectations for the company's future direction.

See our latest analysis for CG Oncology.

Behind the scenes, CG Oncology’s share price return has surged 60% over the past 90 days and climbed 44.7% year-to-date. Optimism around its clinical trial progress and sustained buy ratings are driving momentum. Both short- and longer-term performance reflect building investor confidence in the company’s prospects.

If clinical trial breakthroughs in biotech catch your interest, take the next step and uncover other innovators using our See the full list for free..

With analysts projecting significant upside for CG Oncology and its stock well above its recent lows, investors now face a crucial question: is there untapped value left in CGON, or has the anticipated growth already been factored in?

Price-to-Book of 4.8x: Is it justified?

CG Oncology’s latest close of $41.91 puts its valuation above other biotechs in the US, trading at a 4.8 times price-to-book ratio while the industry average stands at 2.6x. For investors, that raises a pivotal question: does strong revenue growth potential warrant the premium?

The price-to-book (P/B) ratio shows what investors are willing to pay relative to a company’s net assets. In biotech, high P/B ratios can signal high expectations for future innovation or breakthrough products, but also come with greater risk if profitability remains out of reach.

Despite its premium, CG Oncology’s P/B of 4.8x is considerably cheaper than the peer group average of 8.8x. This positions it as better value compared to closer competitors, even though it remains expensive versus the broader industry. The fair value ratio isn’t available, so it is unclear whether this multiple could normalize further if market sentiment shifts around clinical progress or earnings outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4.8x (OVERVALUED)

However, potential delays in clinical milestones or unforeseen regulatory challenges could quickly alter the growth trajectory of CG Oncology and investor sentiment.

Find out about the key risks to this CG Oncology narrative.

Another View: What Does Our DCF Model Say?

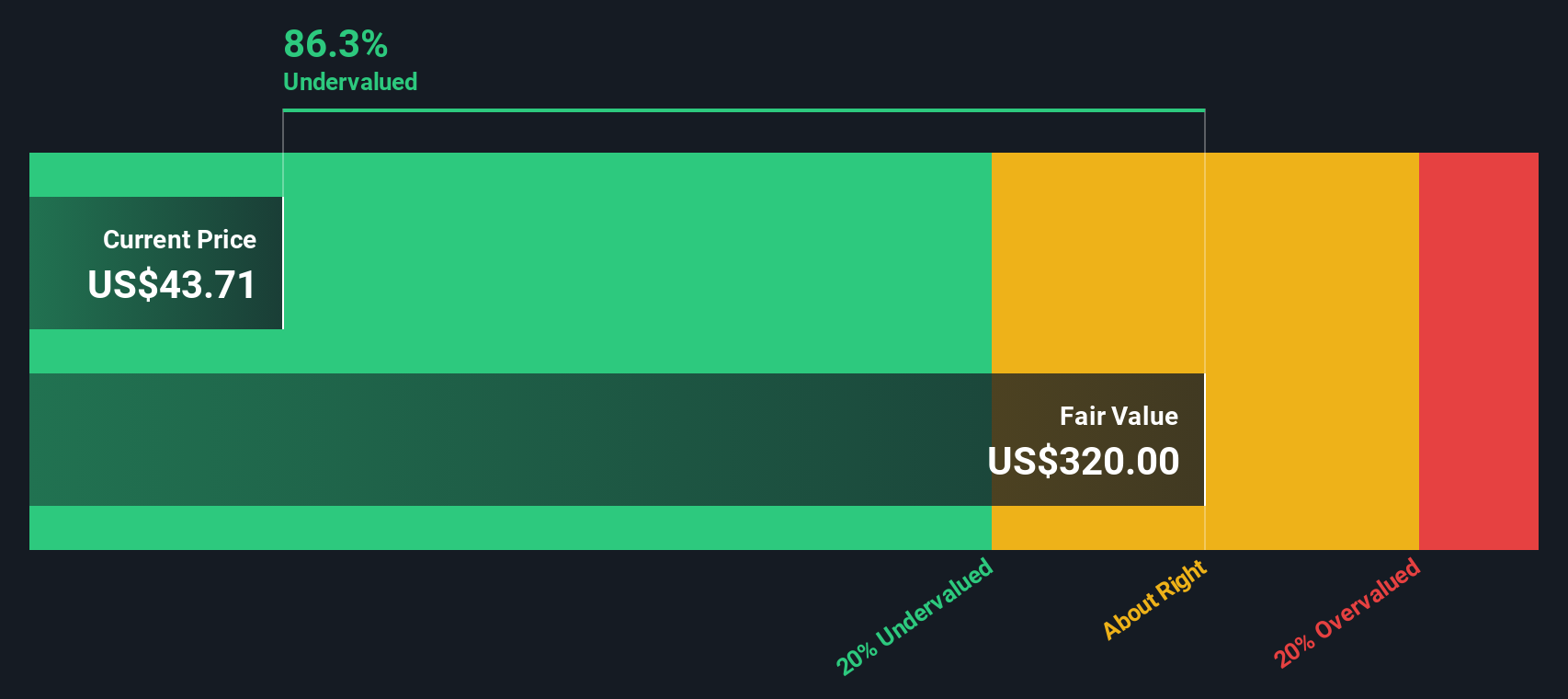

While the price-to-book ratio signals CG Oncology is trading at a premium to the biotech industry, our SWS DCF model offers a different outlook. According to this approach, CGON’s shares are trading well below our estimated fair value. Could the market be overlooking true upside potential, or is the high growth forecast already factored into the share price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CG Oncology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CG Oncology Narrative

If you want to investigate the numbers for yourself or shape your own story around CG Oncology, you can dive in and create your own narrative in just a few minutes. Do it your way.

A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio strategy by searching beyond the obvious. Don’t let opportunity pass you by when unique sectors and future trends are just a click away.

- Capitalize on financial momentum by reviewing these 878 undervalued stocks based on cash flows that are positioned for strong growth based on robust cash flow forecasts.

- Catch the AI transformation wave and see which innovators are gaining traction with these 26 AI penny stocks in high-demand fields.

- Benefit from potential income and stability by checking out these 17 dividend stocks with yields > 3% offering healthy yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGON

CG Oncology

A late-stage clinical biopharmaceutical company, develops and commercializes backbone bladder-sparing therapeutics for patients with bladder cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives