- United States

- /

- Biotech

- /

- NasdaqCM:CGEN

Compugen Ltd.'s (NASDAQ:CGEN) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Despite an already strong run, Compugen Ltd. (NASDAQ:CGEN) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 258% following the latest surge, making investors sit up and take notice.

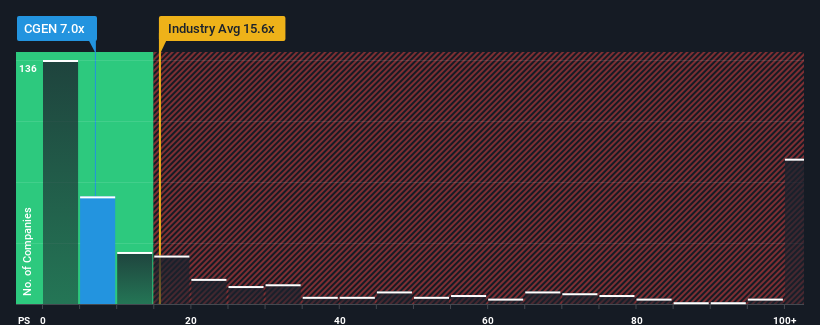

Although its price has surged higher, Compugen may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 7x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15.6x and even P/S higher than 75x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Compugen

How Compugen Has Been Performing

Recent times have been advantageous for Compugen as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Compugen's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Compugen?

The only time you'd be truly comfortable seeing a P/S as depressed as Compugen's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 12% per year during the coming three years according to the two analysts following the company. That's not great when the rest of the industry is expected to grow by 272% per annum.

With this in consideration, we find it intriguing that Compugen's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Compugen's P/S Mean For Investors?

Shares in Compugen have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Compugen's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Compugen (1 doesn't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Compugen, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CGEN

Compugen

A clinical-stage therapeutic discovery and development company, engages in the research, development, and commercialization of therapeutics and product candidates in Israel, the United States, and Europe.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives