- United States

- /

- Pharma

- /

- NasdaqGS:CGC

Canopy Growth (Nasdaq:CGC): Further Dilution Seems Inevitable

Reviewed by Michael Paige

Key Takeaways from This Analysis:

- President Biden made a first step toward the decriminalization or legalization of marijuana at the federal level.

- Canopy Growth's Canadian business is still not profitable and its US ambitions will require significant capital.

- Shareholders face further dilution or lackluster growth prospects.

Shares of Canopy Growth ( Nasdaq: CGC ) and other cannabis stocks predictably rallied after President Biden began the process of softening US federal regulations around cannabis. But the share prices of Canadian producers like Canopy Growth quickly reversed on Friday, ending below where they started on Thursday.

For many investors, Canopy Growth has been the go-to cannabis stock since the sector gained mainstream attention in 2017. But Canopy’s capacity to build a presence in the US is not what it was back then.

See our latest analysis for Canopy Growth

The Path to Legalization at the Federal Level

Biden announced a pardon for all prior Federal offenses of simple possession of marijuana and urged state governors to do the same . He also began the process of rescheduling cannabis.

The steps taken don’t actually do anything to make cannabis sales legal at the federal level - but they may be a step in the right direction. There are however some doubts about his commitment to going all the way.

Canopy Growth's Canadian Business

Regardless of what happens with US legislation, Canopy Growth’s current business is focused on Canada where recreational cannabis has been legal since 2018. At that point, the company invested heavily in production facilities and distribution channels.

Since then the market has suffered from oversupply and falling margins. The company has been forced to close production facilities and recently exited its retail distribution businesses .

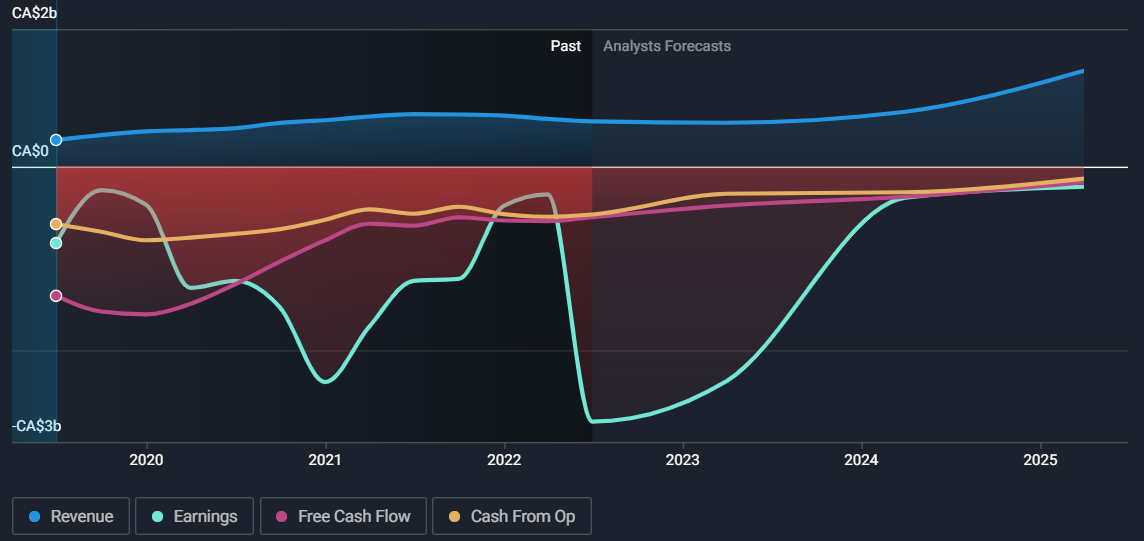

The restructuring has reduced Canopy’s overheads, but free cash flow is still negative. And the following chart shows that positive cash flows are still some way off.

Canopy only has around$1.2 billion in cash, which should keep it going for a few years. But that will just allow the company to survive and hopefully break even at some point. It’s worth pointing out that since 2017 earnings estimates have only trended one way - down - and the expected date for reaching profitability has been pushed out year after year.

US Ambitions

While Canopy is primarily a Canadian business, the US has always been the growth opportunity investors have been waiting for. In 2018, Constellation Brands ( NYSE: STZ ) invested $4 billion in the company, which gave Canopy a war chest to build a US business.

In 2019 Canopy entered into an agreement where it would buy US producer Acreage Holdings ( CNSX:ACRG.A.U ) if and when cannabis was federally legalized in the US. If the deal had been concluded at the time, Canopy would have effectively bought Acreage for $3.4 billion. Today Acreage is worth less than 5% of that, earns annual revenue of ~$220 million, and has negative cash flow.

While this deal, if concluded, could give Canopy an entry into the US market, it will take a lot of capital to build it into anything substantial.

What this means for Investors

In the short term, Cannabis stocks are very sensitive to news flow around the industry. But, as long-term investments, cannabis companies need a path to long-term profitability. If Canopy stays in Canada, the outlook doesn’t look very exciting. If it pursues a US strategy, a capital injection will be required - which means shareholders will be diluted yet again.

Canopy’s greatest asset to date has been its brand recognition amongst investors. But last week’s price action suggests investors are losing interest in the stock, which will make a capital raise even more difficult.

If you would like to know more about the company’s financials, have a look at our full analysis for Canopy Growth .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:CGC

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success