- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Celcuity (CELC): Valuing the Stock After FDA Acceptance of Gedatolisib and Major Pipeline Progress

Reviewed by Kshitija Bhandaru

The FDA’s acceptance of Celcuity (CELC) New Drug Application for gedatolisib under the Real-Time Oncology Review program marks a major regulatory step that could speed up market access for its breast cancer therapy.

See our latest analysis for Celcuity.

Celcuity’s share price momentum has been gradually building in 2025, with the latest FDA breakthrough and strengthened credit facility supporting optimism around its pipeline. While short-term share price returns have been modest, Celcuity’s one-year total shareholder return of 2.3% hints at steadily improving long-term sentiment as commercialization efforts advance.

If Celcuity’s progress in oncology therapeutics has you watching the sector, it’s worth exploring other innovative healthcare stocks. See the full list for free at See the full list for free..

With shares still trading well below analyst price targets even after a run of pivotal milestones, investors are left to consider if Celcuity remains undervalued or if the market is already pricing in the next wave of growth.

Price-to-Book Ratio of 47.3x: Is it justified?

Celcuity’s current price-to-book ratio stands at 47.3 times, a figure significantly elevated compared to industry norms and its closest peers. At a last close price of $49.42, investors are paying a notable premium on the company’s net asset value, rather than a discount or an in-line valuation.

The price-to-book ratio compares the company’s market value to its book value and provides a snapshot of how much investors are willing to pay for each dollar of assets. With biotech firms, high multiples often reflect speculation around future innovation and anticipated commercialization rather than present financials.

In Celcuity’s case, the 47.3x multiple is far above the US Biotechs industry average of 2.4x and its peer group, which comes in at 19.4x. This underscores just how much the market is pricing in future upside. It signals very strong optimism about the company’s pipeline and regulatory catalysts, but also means the shares are priced well above asset value benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 47.3x (OVERVALUED)

However, investors should note that regulatory hurdles and potential delays in commercialization could challenge market optimism and impact Celcuity’s future performance.

Find out about the key risks to this Celcuity narrative.

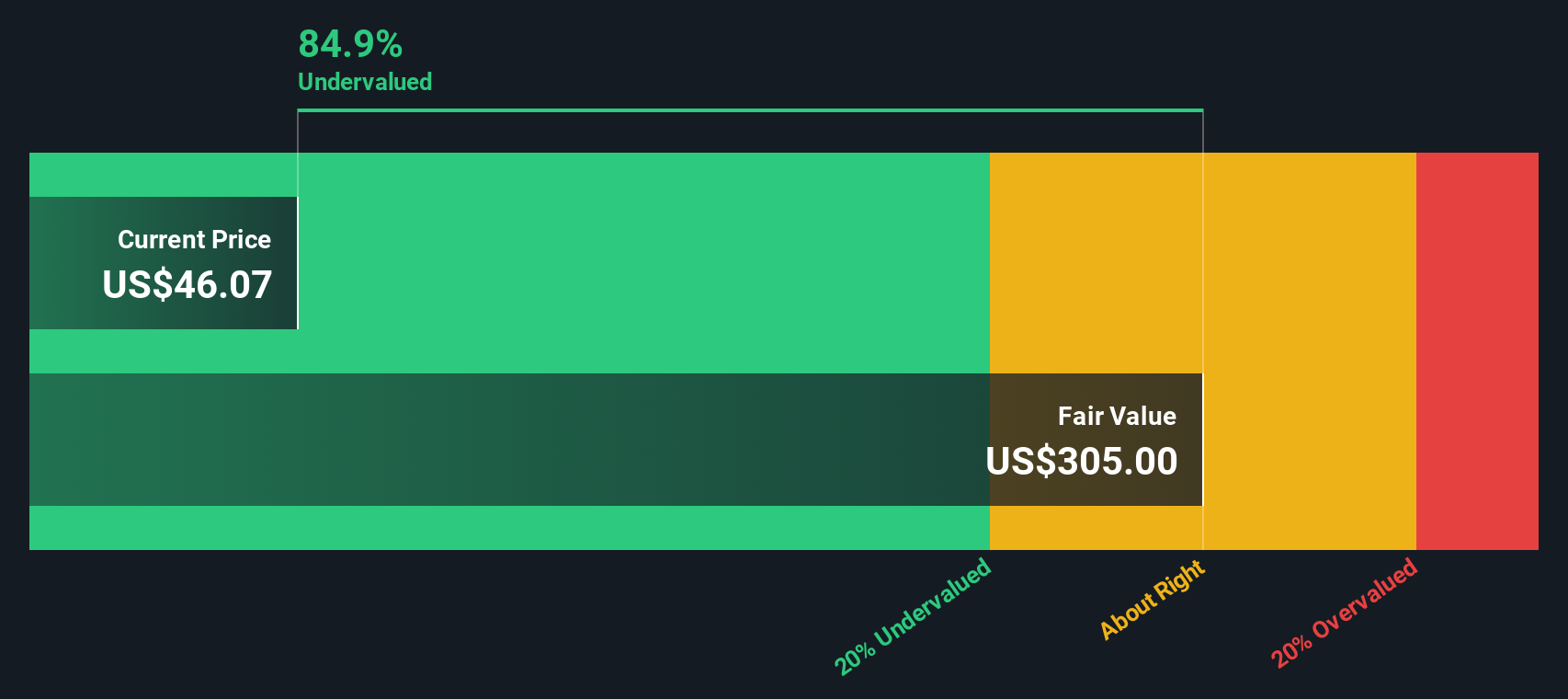

Another Perspective: DCF Suggests Deep Undervaluation

While Celcuity’s elevated price-to-book ratio points to concerns about overvaluation, a different approach tells another story. The SWS DCF model estimates Celcuity’s fair value at $308.13 per share, which is 84% above the current price. This stark contrast with the market’s view raises an intriguing question: is Celcuity overlooked, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you have a different perspective or want to dig deeper into the numbers, you can quickly build your own view and narrative in just a few minutes. Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest investors broaden their horizons to find the next big winner. If you only focus on one company, you could miss out on other standout opportunities. Use these tools to guide your next smart move:

- Capture growth potential as AI transforms industries by jumping into the fast lane with these 23 AI penny stocks.

- Pursue long-term wealth by seeking out income opportunities with these 19 dividend stocks with yields > 3%, which stand out for their reliable yields above 3%.

- Stay ahead of the curve in digital innovation by riding the wave with these 78 cryptocurrency and blockchain stocks, where blockchain and crypto pioneers are reshaping global finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives