- United States

- /

- Life Sciences

- /

- NasdaqGS:CDXS

Codexis, Inc.'s (NASDAQ:CDXS) Shares Leap 56% Yet They're Still Not Telling The Full Story

Codexis, Inc. (NASDAQ:CDXS) shares have continued their recent momentum with a 56% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

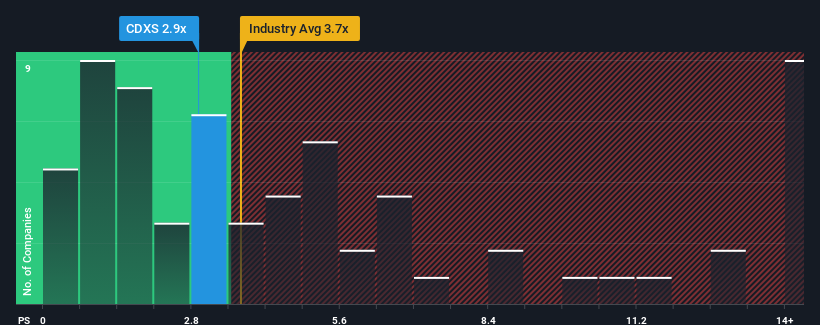

In spite of the firm bounce in price, Codexis may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.9x, considering almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Codexis

What Does Codexis' Recent Performance Look Like?

Recent times haven't been great for Codexis as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Codexis.Is There Any Revenue Growth Forecasted For Codexis?

The only time you'd be truly comfortable seeing a P/S as low as Codexis' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 44%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.0% per year during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 4.7% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that Codexis is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Codexis' P/S Mean For Investors?

Despite Codexis' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Codexis' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Codexis (of which 1 can't be ignored!) you should know about.

If you're unsure about the strength of Codexis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CDXS

Codexis

Provides enzymatic solutions for therapeutics manufacturing, leveraging its proprietary CodeEvolver technology platform to discover, develop, and enhance novel enzymes in the United States, Canada, Latin America, Europe, the Middle East, Africa, Australia, New Zealand, Southeast Asia, and China.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives