- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

Market Cool On ChromaDex Corporation's (NASDAQ:CDXC) Revenues

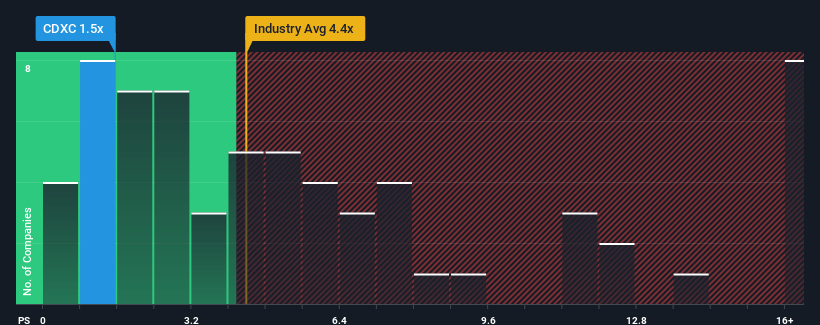

ChromaDex Corporation's (NASDAQ:CDXC) price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the Life Sciences industry in the United States, where around half of the companies have P/S ratios above 4.4x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for ChromaDex

What Does ChromaDex's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, ChromaDex has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ChromaDex will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For ChromaDex?

The only time you'd be truly comfortable seeing a P/S as depressed as ChromaDex's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. This was backed up an excellent period prior to see revenue up by 53% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.1%, which is noticeably less attractive.

In light of this, it's peculiar that ChromaDex's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From ChromaDex's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems ChromaDex currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware ChromaDex is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives