- United States

- /

- Biotech

- /

- NasdaqCM:CDTX

Cidara Therapeutics (CDTX) Is Up After CD388 Wins FDA Breakthrough Status on Strong Influenza Data – What’s Next?

Reviewed by Sasha Jovanovic

- Cidara Therapeutics announced that its influenza candidate, CD388, received FDA Breakthrough Therapy designation following positive Phase 2b NAVIGATE study results demonstrating significant prevention efficacy in healthy unvaccinated adults.

- This milestone highlights CD388's progress as a potential new preventative option for those at heightened risk of severe influenza, reflecting both regulatory support and clinical promise.

- We’ll explore how the Breakthrough Therapy designation and Phase 2b results could reshape Cidara's investment narrative, especially for high-risk groups.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Cidara Therapeutics' Investment Narrative?

To be a Cidara Therapeutics shareholder right now, you’d need conviction in the potential for CD388 to become a new standard for influenza prevention among high-risk groups. The recent FDA Breakthrough Therapy designation confirmed CD388’s promise and immediately raised the importance of the ongoing Phase 3 ANCHOR trial as the company’s defining short-term catalyst. This news also shifts the risk profile: positive Phase 2b results may provide the confidence needed for further funding or partnerships, but Cidara’s lack of revenue, ongoing losses, and dependence on timely trial success remain central concerns. Although the share price has already surged this year, the new regulatory milestone raises investor expectations even further in the near term. Still, if Phase 3 data disappoints or trial hurdles slow approval, it could dampen momentum just as hopes are peaking.

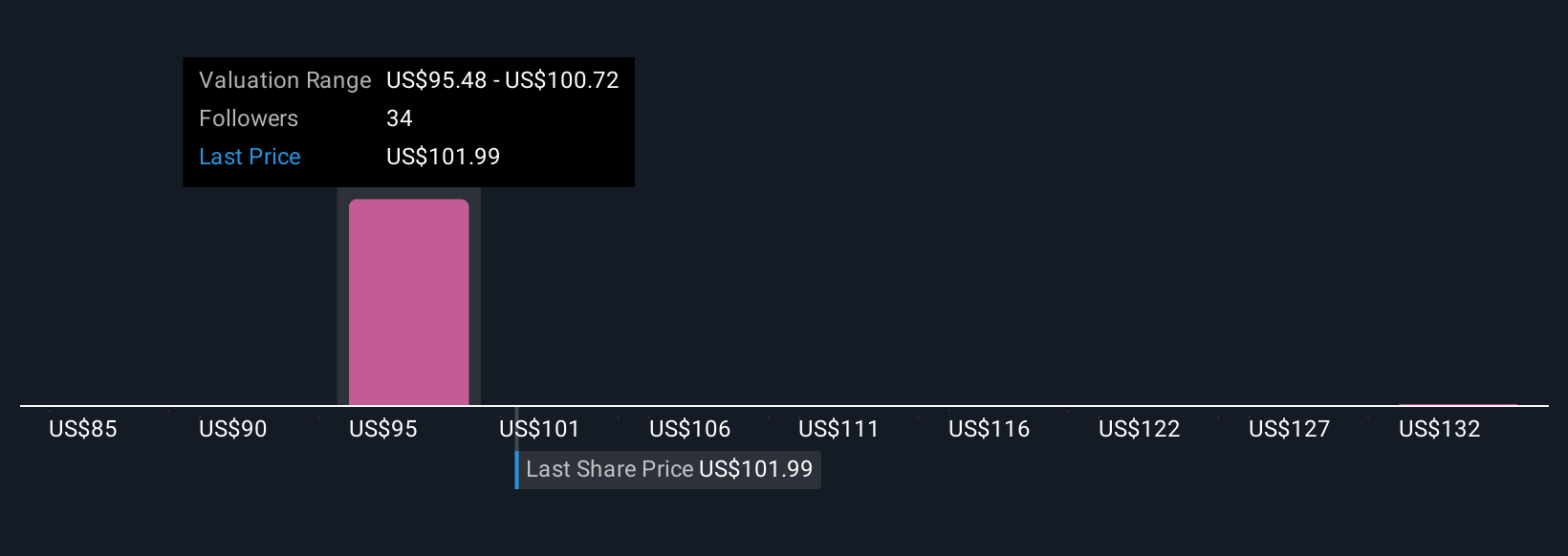

But if cash burn continues while CD388 faces delays, that’s something investors must be ready for. The analysis detailed in our Cidara Therapeutics valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 4 other fair value estimates on Cidara Therapeutics - why the stock might be worth as much as 55% more than the current price!

Build Your Own Cidara Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cidara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cidara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cidara Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDTX

Cidara Therapeutics

Operates as a biotechnology company that focuses on developing targeted therapies for patients facing cancers and other serious diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives