- United States

- /

- Biotech

- /

- NasdaqCM:CDTX

Cidara Therapeutics (CDTX) Is Up 16.2% After $339 Million BARDA Award for Influenza Drug Acceleration

Reviewed by Sasha Jovanovic

- Cidara Therapeutics, Inc. recently announced it has received a multi-year award valued at up to US$339 million from the Biomedical Advanced Research and Development Authority (BARDA) to support the accelerated and expanded development of its CD388 antiviral for influenza.

- This non-dilutive funding boosts Cidara's ability to advance CD388 through a broader and faster Phase 3 trial, potentially increasing its future market reach.

- We'll examine how the BARDA award and expanded Phase 3 trial shape Cidara's investment narrative and future commercial potential.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cidara Therapeutics' Investment Narrative?

For investors in Cidara Therapeutics, the investment narrative increasingly depends on the successful progression and commercialization of CD388, especially after the latest BARDA funding award of up to US$339 million. This capital injection, which is non-dilutive, meaning it doesn't further erode shareholder stakes, provides a cushion for the upcoming expanded Phase 3 trial, sharply accelerating its timeline and vastly broadening the addressable market to over 100 million people in the US. The biggest short-term catalyst now clearly becomes the interim and final results from this pivotal trial, as feedback from regulators suggests a single successful study could be enough for FDA approval. However, the rapid scale-up also sharpens the risk profile: with no commercial revenue and significant past dilution, any clinical or operational setback could have an outsized impact. The BARDA deal materially strengthens the near-term story, but results from the ongoing Phase 3 trial are now even more central to the Cidara thesis.

On the flip side, the company’s recent history of share dilution is something investors should not ignore.

Exploring Other Perspectives

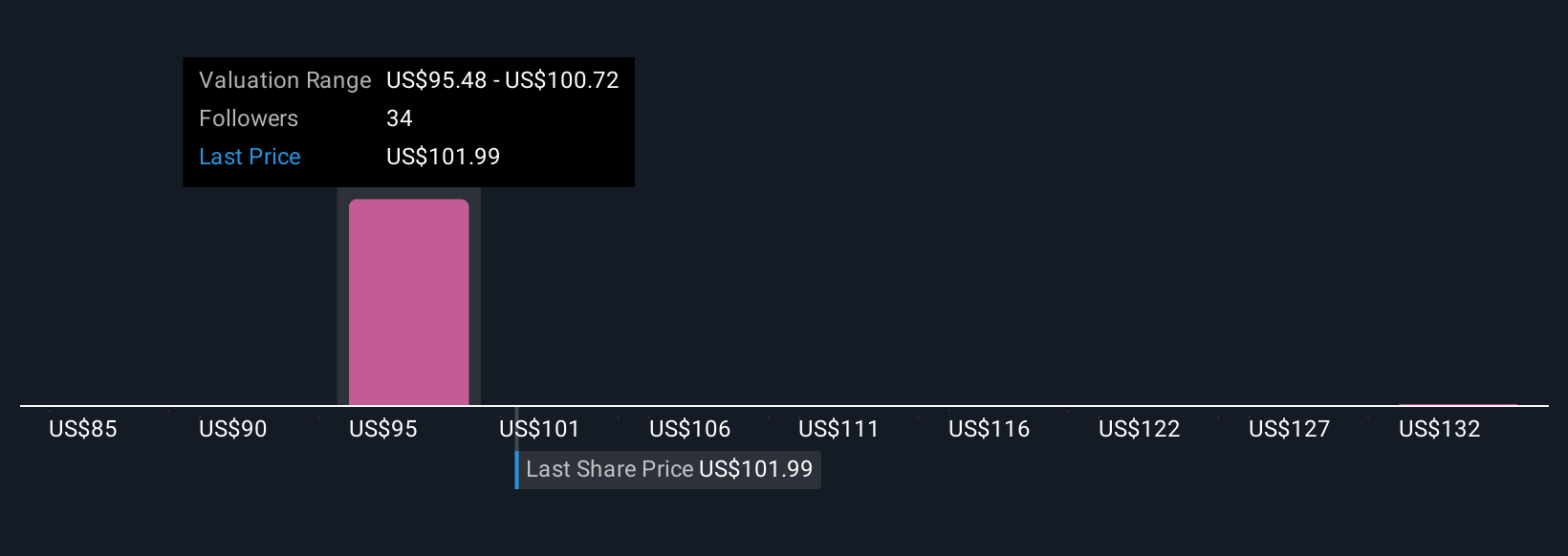

Explore 4 other fair value estimates on Cidara Therapeutics - why the stock might be worth as much as 35% more than the current price!

Build Your Own Cidara Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cidara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cidara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cidara Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDTX

Cidara Therapeutics

Operates as a biotechnology company that focuses on developing targeted therapies for patients facing cancers and other serious diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives