- United States

- /

- Biotech

- /

- NasdaqCM:CDMO

The five-year returns have been strong for Avid Bioservices (NASDAQ:CDMO) shareholders despite underlying losses increasing

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Avid Bioservices, Inc. (NASDAQ:CDMO) stock is up an impressive 104% over the last five years. And in the last week the share price has popped 8.2%.

The past week has proven to be lucrative for Avid Bioservices investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Avid Bioservices

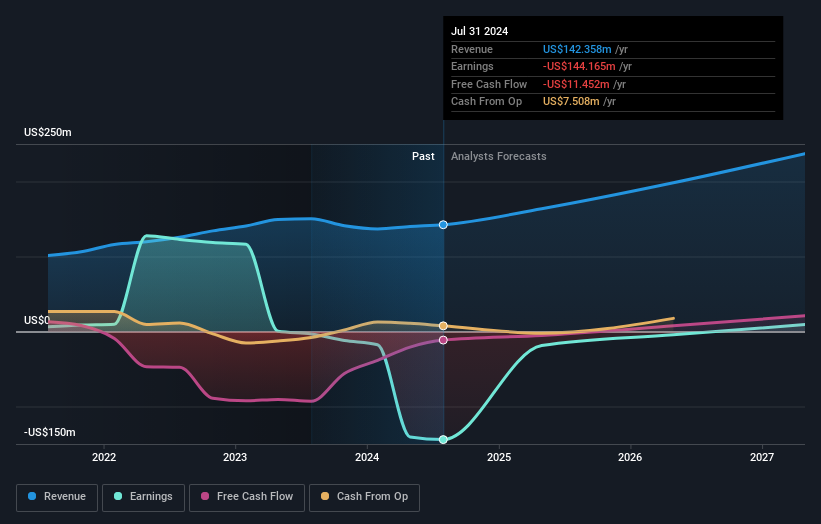

Avid Bioservices isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Avid Bioservices can boast revenue growth at a rate of 19% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 15% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes Avid Bioservices worth investigating - it may have its best days ahead.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Avid Bioservices has rewarded shareholders with a total shareholder return of 100% in the last twelve months. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Avid Bioservices better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Avid Bioservices you should know about.

Avid Bioservices is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CDMO

Avid Bioservices

Operates as a contract development and manufacturing organization for the biotechnology and biopharmaceutical industries in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives