- United States

- /

- Biotech

- /

- NasdaqCM:CDMO

Avid Bioservices (NASDAQ:CDMO) adds US$57m to market cap in the past 7 days, though investors from three years ago are still down 67%

Avid Bioservices, Inc. (NASDAQ:CDMO) shareholders should be happy to see the share price up 23% in the last quarter. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 67% in that time. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

While the last three years has been tough for Avid Bioservices shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Avid Bioservices

Because Avid Bioservices made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Avid Bioservices grew revenue at 13% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 19% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

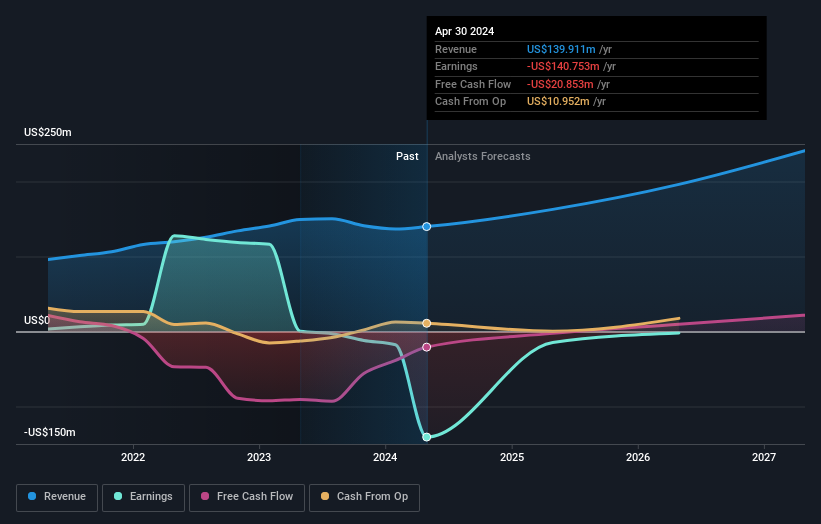

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Avid Bioservices will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 24% in the last year, Avid Bioservices shareholders lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Avid Bioservices better, we need to consider many other factors. Take risks, for example - Avid Bioservices has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDMO

Avid Bioservices

Operates as a contract development and manufacturing organization for the biotechnology and biopharmaceutical industries in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives