- United States

- /

- Biotech

- /

- NasdaqGS:CCXI

Did The Underlying Business Drive ChemoCentryx's (NASDAQ:CCXI) Lovely 934% Share Price Gain?

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. But when you hold the right stock for the right time period, the rewards can be truly huge. One bright shining star stock has been ChemoCentryx, Inc. (NASDAQ:CCXI), which is 934% higher than three years ago. On top of that, the share price is up 26% in about a quarter. But this could be related to the strong market, which is up 13% in the last three months.

It really delights us to see such great share price performance for investors.

Check out our latest analysis for ChemoCentryx

ChemoCentryx wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years ChemoCentryx saw its revenue shrink by 10% per year. So it's pretty amazing to see the stock price has zoomed up 118% per year in that time. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

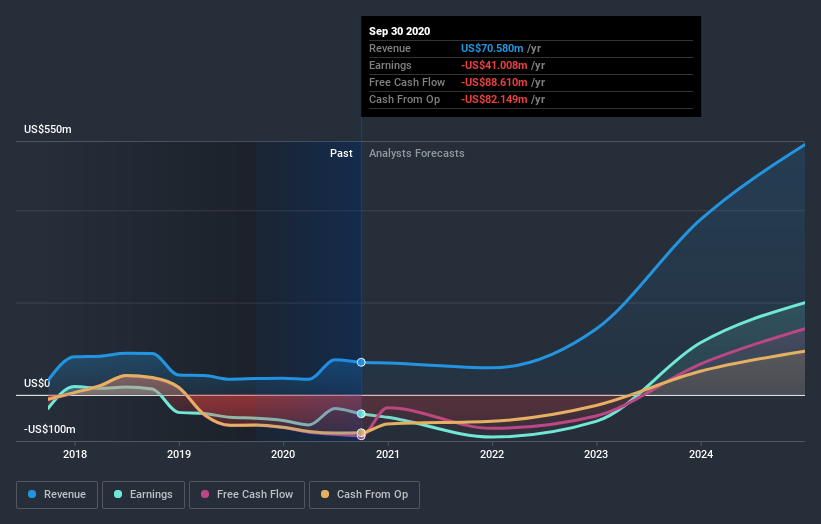

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that ChemoCentryx shareholders have received a total shareholder return of 93% over the last year. That gain is better than the annual TSR over five years, which is 51%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - ChemoCentryx has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade ChemoCentryx, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade ChemoCentryx, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:CCXI

ChemoCentryx

ChemoCentryx, Inc., a biopharmaceutical company, focuses on the development and commercialization of new medications for inflammatory disorders, autoimmune diseases, and cancer in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives