- United States

- /

- Biotech

- /

- NasdaqGS:CCCC

C4 Therapeutics, Inc.'s (NASDAQ:CCCC) 41% Share Price Surge Not Quite Adding Up

Those holding C4 Therapeutics, Inc. (NASDAQ:CCCC) shares would be relieved that the share price has rebounded 41% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 74%.

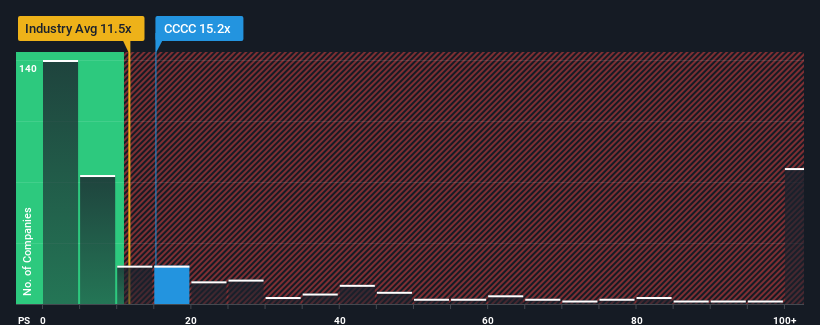

Following the firm bounce in price, C4 Therapeutics may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 15.2x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 11.5x and even P/S lower than 4x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for C4 Therapeutics

What Does C4 Therapeutics' P/S Mean For Shareholders?

C4 Therapeutics could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think C4 Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For C4 Therapeutics?

In order to justify its P/S ratio, C4 Therapeutics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 83%. Still, revenue has fallen 13% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 178% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 183% each year, which is not materially different.

In light of this, it's curious that C4 Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does C4 Therapeutics' P/S Mean For Investors?

C4 Therapeutics' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given C4 Therapeutics' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It is also worth noting that we have found 2 warning signs for C4 Therapeutics that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCC

C4 Therapeutics

A clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives