- United States

- /

- Biotech

- /

- NasdaqGM:CARM

Investors Don't See Light At End Of Carisma Therapeutics, Inc.'s (NASDAQ:CARM) Tunnel And Push Stock Down 26%

The Carisma Therapeutics, Inc. (NASDAQ:CARM) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

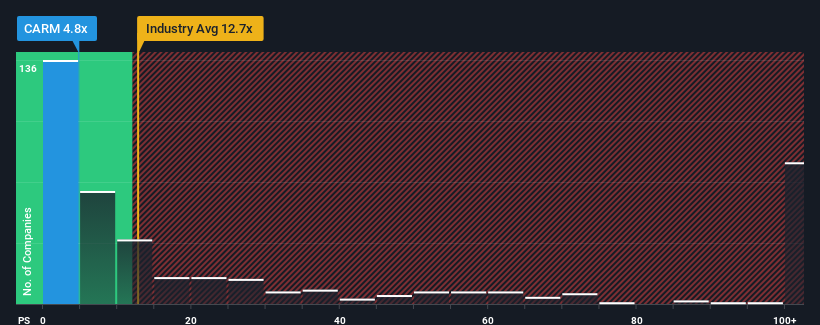

After such a large drop in price, Carisma Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.7x and even P/S higher than 64x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Carisma Therapeutics

How Has Carisma Therapeutics Performed Recently?

With revenue growth that's inferior to most other companies of late, Carisma Therapeutics has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Carisma Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

Carisma Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 52% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 15% per year over the next three years. With the industry predicted to deliver 164% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Carisma Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Carisma Therapeutics' P/S Mean For Investors?

Shares in Carisma Therapeutics have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Carisma Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Carisma Therapeutics, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Carisma Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CARM

Carisma Therapeutics

A clinical-stage cell therapy company, focuses on discovering and developing immunotherapies to treat cancer and other serious diseases in the United States.

Moderate and good value.

Market Insights

Community Narratives