- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Is Capricor Therapeutics Still Attractive After Its 375% Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Capricor Therapeutics is still a smart buy after its huge run, or if you are late to the party? This breakdown will help you decide whether the current price actually makes sense.

- The stock has exploded recently, jumping about 375% over the last week and 308.4% over the past month, and is now sitting around $25.40 after years of strong gains.

- That kind of move has come alongside renewed investor focus on Capricor’s cell and exosome based therapies, including its work in rare diseases and regenerative medicine, which has put the stock firmly back on radar screens. Media coverage has highlighted growing interest in its pipeline and partnerships, which helps explain why sentiment has shifted so sharply.

- On our checklist of 6 valuation tests, Capricor scores a 3/6 for being undervalued. This suggests the market may not be fully pricing in its potential, but also that the stock is not a screaming bargain on every metric. Next, we will walk through the key valuation approaches behind that score, and then finish with a more powerful way to make sense of Capricor’s true worth that goes beyond the usual numbers.

Approach 1: Capricor Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today in $ terms. For Capricor Therapeutics, the model uses a 2 stage Free Cash Flow to Equity approach, starting from last twelve month free cash flow of about $63.7 Million outflow and then building up as the business is expected to scale.

Analysts provide explicit forecasts for the next few years, with free cash flow projected to swing into positive territory and reach about $133 Million by 2029. Beyond those analyst estimates, Simply Wall St extrapolates cash flows out to 2035, with discounted projections rising into the low hundreds of Millions as the pipeline is assumed to mature and generate higher returns.

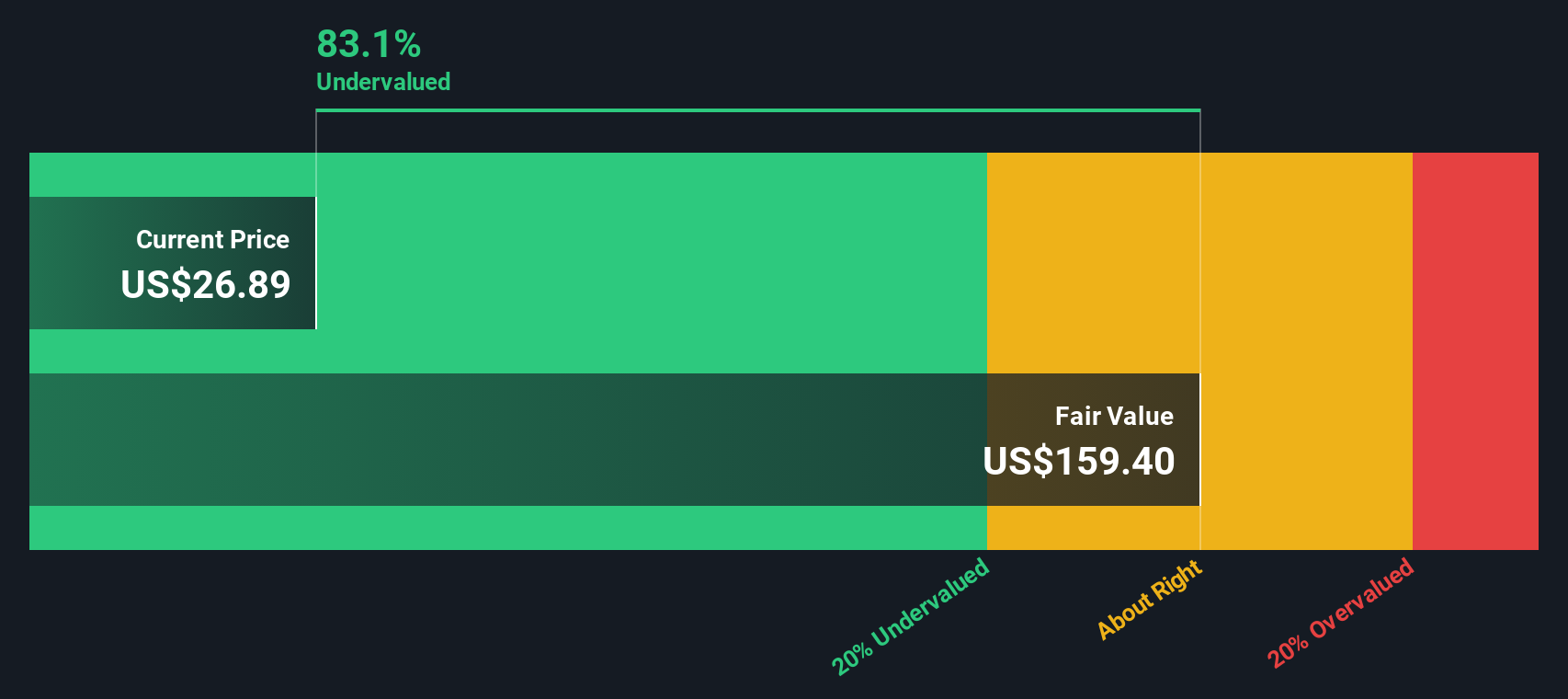

When all those projected cash flows are discounted back to today, the model arrives at an estimated intrinsic value of roughly $159.39 per share. Compared with the current share price around $25.40, the DCF implies the stock is about 84.1% undervalued, suggesting the market is heavily discounting Capricor’s long term potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Capricor Therapeutics is undervalued by 84.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Capricor Therapeutics Price vs Book

For many profitable companies, price to book is a useful yardstick because it compares what investors are paying for each dollar of net assets to what those assets might reasonably be worth over time. In general, faster growth and lower risk can justify a higher multiple, while slower growth or higher uncertainty usually call for a discount.

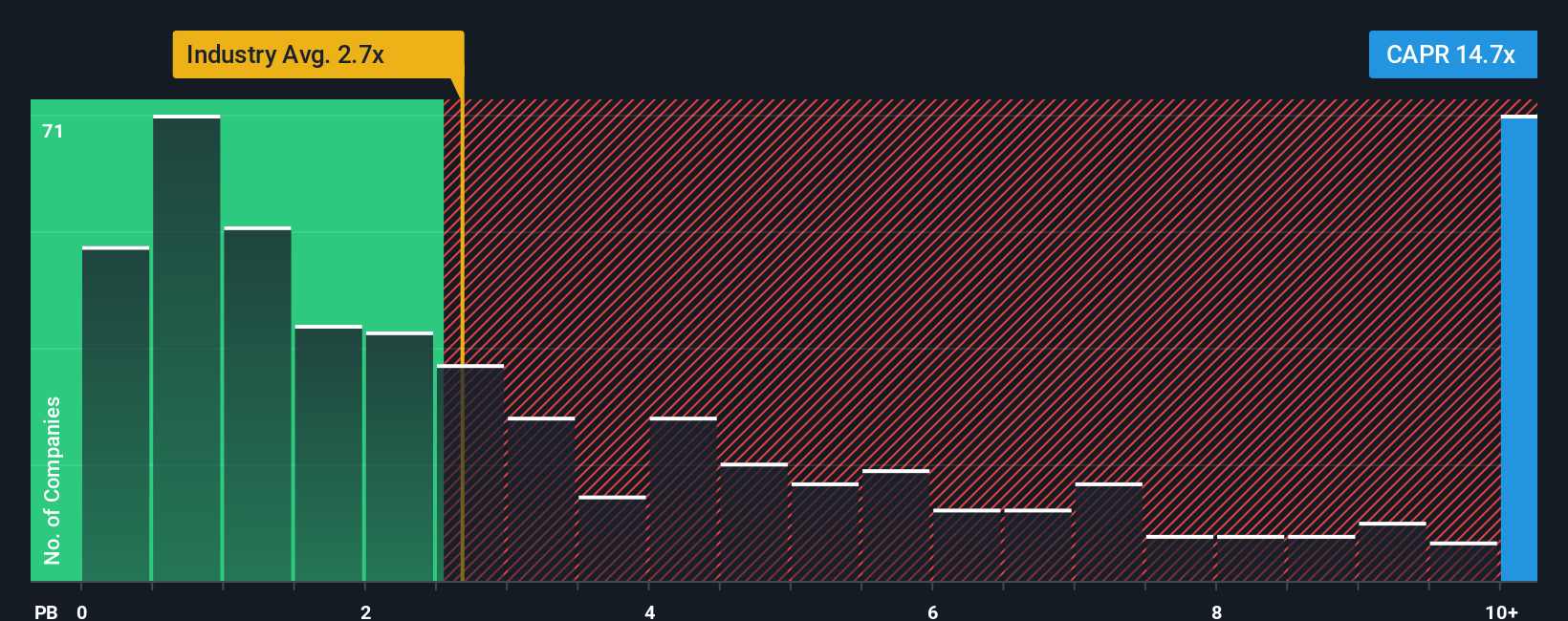

Capricor currently trades on a price to book ratio of about 13.85x. This is far richer than the Biotechs industry average of around 2.72x and also below the peer group average of roughly 32.66x. To refine this view, Simply Wall St uses a proprietary Fair Ratio for price to book. This estimates the multiple that would make sense given Capricor’s specific mix of growth prospects, profitability profile, size and risk factors, rather than relying on blunt peer or industry comparisons.

Because the Fair Ratio directly incorporates those company specific drivers, it is a more tailored benchmark than simple averages. On this basis, Capricor’s current 13.85x multiple sits meaningfully above its modelled Fair Ratio. This points to a stock price that is ahead of what these fundamentals alone would justify.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capricor Therapeutics Narrative

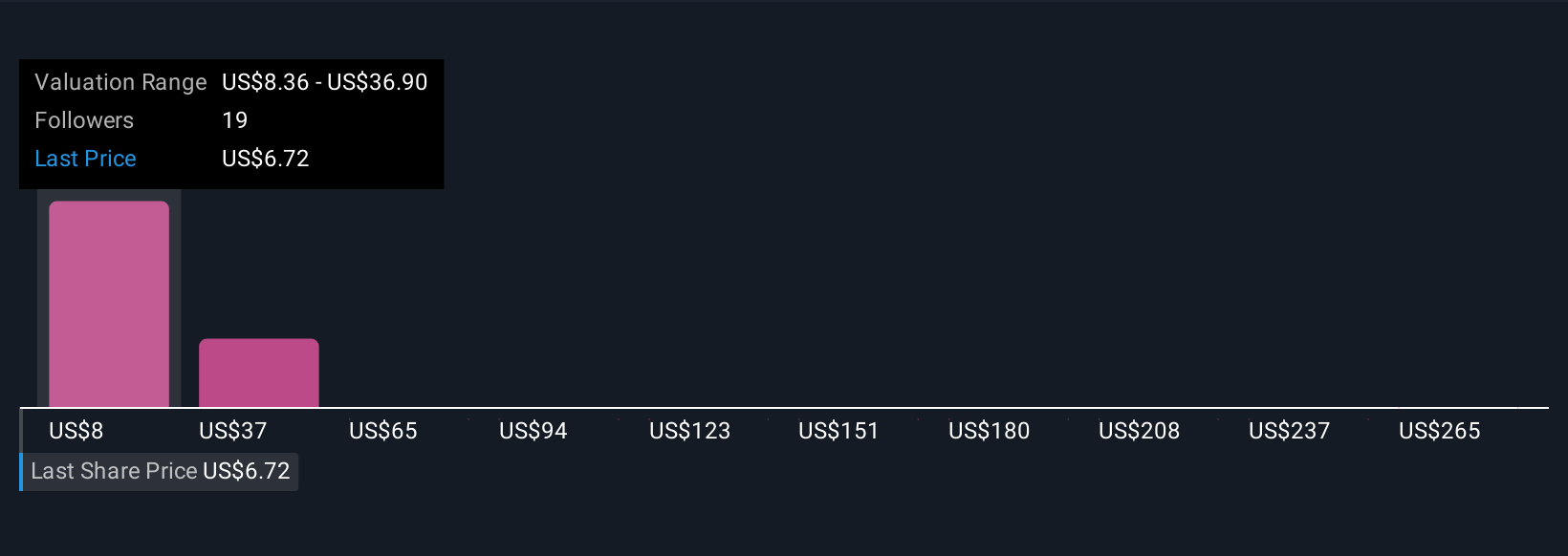

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers. You can spell out how you think Capricor’s revenue, earnings and margins will evolve, link that story to a financial forecast and a fair value, then compare that fair value to today’s share price to consider whether to buy, hold or sell. The platform dynamically updates your Narrative as fresh news or earnings arrive. This means you can see, for example, how one investor might build a bullish Capricor Narrative around rapid rare disease revenue growth, 40 percent plus profit margins and a fair value near $45 per share. Another, more cautious investor might assume slower adoption, lower profitability and a fair value closer to $12, yet both can use the same intuitive framework to turn their view of the company into a live, decision ready valuation.

Do you think there's more to the story for Capricor Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026