- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics, Inc. (NASDAQ:CAPR) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

Unfortunately for some shareholders, the Capricor Therapeutics, Inc. (NASDAQ:CAPR) share price has dived 26% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 32% in the last year.

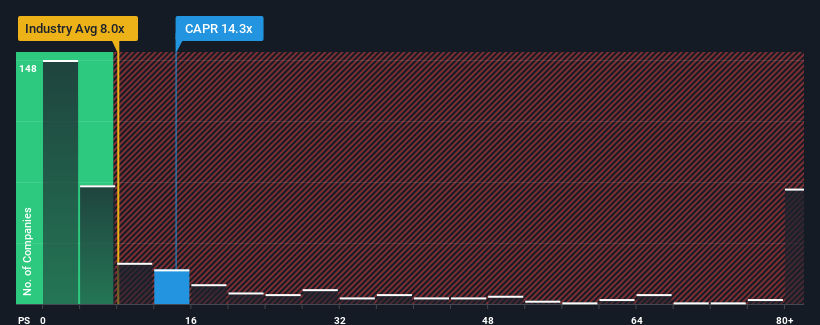

Even after such a large drop in price, Capricor Therapeutics' price-to-sales (or "P/S") ratio of 14.3x might still make it look like a strong sell right now compared to other companies in the Biotechs industry in the United States, where around half of the companies have P/S ratios below 8x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Our free stock report includes 2 warning signs investors should be aware of before investing in Capricor Therapeutics. Read for free now.Check out our latest analysis for Capricor Therapeutics

How Capricor Therapeutics Has Been Performing

While the industry has experienced revenue growth lately, Capricor Therapeutics' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Capricor Therapeutics.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Capricor Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 103% each year over the next three years. With the industry predicted to deliver 157% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Capricor Therapeutics' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Capricor Therapeutics' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Capricor Therapeutics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - Capricor Therapeutics has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Capricor Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives