- United States

- /

- Biotech

- /

- NasdaqGS:CAI

Caris Life Sciences (CAI): Revenue Forecast to Rise 21% Annually Heading Into Earnings Season

Reviewed by Simply Wall St

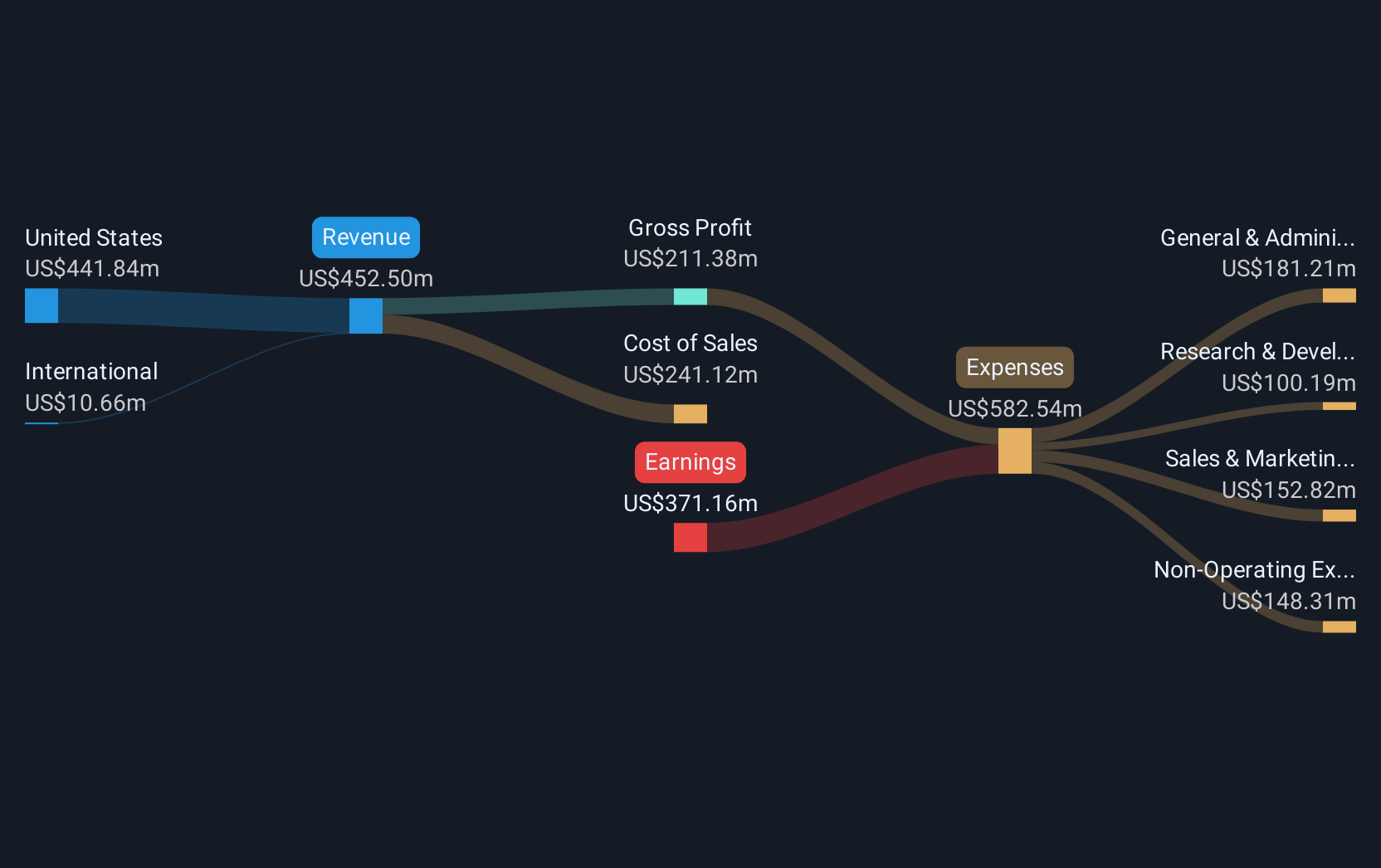

Caris Life Sciences (CAI) is currently unprofitable, with no clear trend in net profit margin or earnings reported for the past year or five years. Analysts forecast revenue growth at an impressive 21% per year and earnings growth of 129.25% per year, predicting the company will reach profitability within three years. Shares currently trade at $24.61, notably below the estimated fair value of $48.22. While its Price-To-Sales Ratio of 10.7x is higher than the US biotech industry average, it remains lower than its peer group. This dynamic fuels a mix of value and growth sentiment among investors.

See our full analysis for Caris Life Sciences.Next, we will see how the latest numbers measure up against the most widely discussed narratives. This is where the data either confirms or questions the market’s expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Outlook Stays Well Ahead of Market

- Caris Life Sciences is forecast to grow revenue by 21% per year, which is more than double the broader US market average of 10.4% per year. This signals the company is expected to outpace its sector when it comes to top-line expansion.

- Market analysis sees this strong projected growth heavily supporting the optimistic case for the company’s future:

- Consensus commentary highlights how the above-average revenue trajectory, paired with an anticipated 129.25% earnings growth rate, points to a high-potential turnaround story even as the company remains unprofitable today.

- Notably, analysts still anticipate a transition to profitability within three years, anchoring bullish hopes in both the speed and scale of projected business growth compared to peers.

Peer Multiple Gap Narrows Despite Premium to Industry

- The Price-To-Sales Ratio stands at 10.7x, exceeding the US biotech industry average (10.3x) but appearing much cheaper than its peer group, which trades at 15.6x. This creates a mixed but intriguing valuation spread across comparables.

- Analysis draws attention to the valuation tension this creates for investors:

- Bulls highlight that trading below peer multiples, despite being more expensive than the average industry name, implies the market recognizes Caris Life Sciences' growth upside while still leaving some room for rerating if execution remains strong.

- Critics might point to the premium over the broader industry as justification for patience, but the gap to faster-growing biotech peers is more material. This makes the valuation position less aggressive than it might seem at first glance.

DCF Fair Value Points to Undervaluation

- With shares at $24.61 and DCF fair value estimated at $48.22, Caris Life Sciences is currently trading at a substantial discount relative to projected intrinsic value. This represents a gap of nearly 50% that stands out even in a growth-centric context.

- The data-driven case finds that such a significant fair value gap:

- Strongly supports arguments for value-oriented investors who believe the market is underestimating future earnings inflection, especially given expectations for a pivot to profitability within three years.

- However, as the company remains unprofitable and faces a valuation premium to the broader biotech industry, the narrative remains sensitive to execution risk and ongoing growth delivery relative to forecasts.

See our latest analysis for Caris Life Sciences.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Caris Life Sciences's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Caris Life Sciences is projected to grow rapidly, its ongoing lack of profitability and fluctuating margins create questions about the reliability of its financial progress.

If you’re searching for steadier performers, use our stable growth stocks screener (2077 results) to find companies with a proven record of consistent revenue and earnings growth in any environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAI

Caris Life Sciences

An artificial intelligence TechBio company, provides molecular profiling services in the United States and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives