- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

Analysts Just Slashed Their BioNTech SE (NASDAQ:BNTX) EPS Numbers

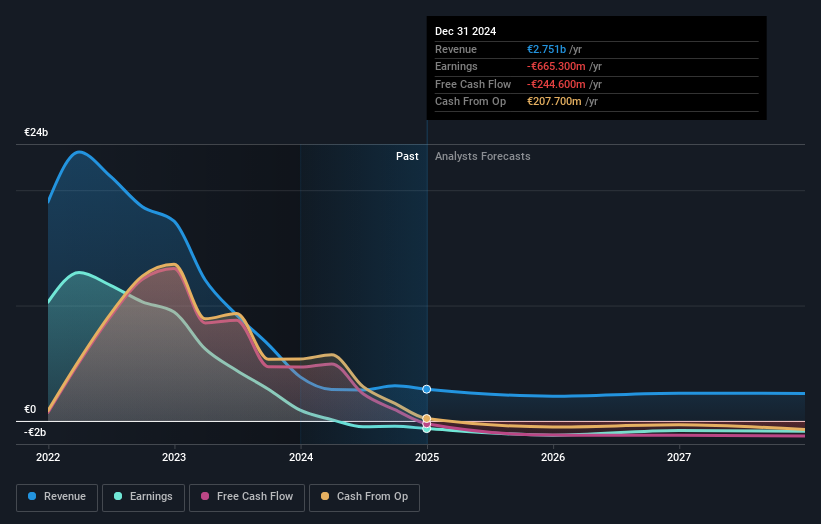

One thing we could say about the analysts on BioNTech SE (NASDAQ:BNTX) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

After the downgrade, the consensus from BioNTech's 19 analysts is for revenues of €2.1b in 2025, which would reflect a disturbing 22% decline in sales compared to the last year of performance. Per-share losses are expected to explode, reaching €5.04 per share. However, before this estimates update, the consensus had been expecting revenues of €2.5b and €3.40 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for BioNTech

The consensus price target was broadly unchanged at €129, perhaps implicitly signalling that the weaker earnings outlook is not expected to have a long-term impact on the valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values BioNTech at €158 per share, while the most bearish prices it at €101. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 22% by the end of 2025. This indicates a significant reduction from annual growth of 8.1% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 20% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - BioNTech is expected to lag the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at BioNTech. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of BioNTech.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for BioNTech going out to 2027, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Increasing revenue at high costs relies on membership to convert to spend

Google - The world's first "Full Stack AI Sovereign"

Substantial founder ownership speaks to the strength of its business

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks