We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Benitec Biopharma (NASDAQ:BNTC) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Benitec Biopharma

Does Benitec Biopharma Have A Long Cash Runway?

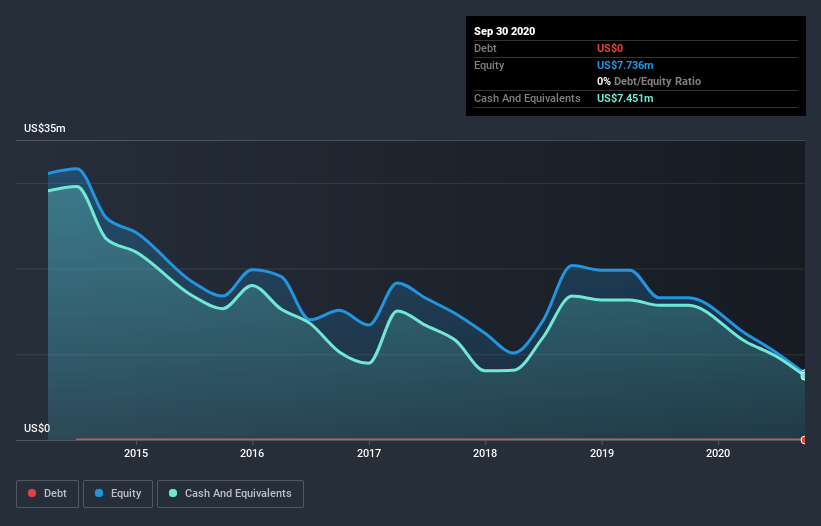

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2020, Benitec Biopharma had cash of US$7.5m and no debt. In the last year, its cash burn was US$9.6m. So it had a cash runway of approximately 9 months from September 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

Can Benitec Biopharma Raise More Cash Easily?

Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$21m, Benitec Biopharma's US$9.6m in cash burn equates to about 47% of its market value. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

Is Benitec Biopharma's Cash Burn A Worry?

Given it's an early stage company, we don't have a lot of data with which to judge Benitec Biopharma's cash burn. But generally speaking, we can say that early stage companies like Benitec Biopharma are generally higher risk than well established businesses. Therefore, in our view, the company has somewhat problematic cash burn rates, and it may face the need for more funding in the future. Separately, we looked at different risks affecting the company and spotted 5 warning signs for Benitec Biopharma (of which 3 make us uncomfortable!) you should know about.

Of course Benitec Biopharma may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Benitec Biopharma, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Benitec Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BNTC

Benitec Biopharma

A clinical-stage biotechnology company, focuses on the development of novel genetic medicines.

Excellent balance sheet and fair value.

Market Insights

Community Narratives