- United States

- /

- Biotech

- /

- NasdaqGS:BMRN

BioMarin Pharmaceutical Inc.'s (NASDAQ:BMRN) Shares Lagging The Industry But So Is The Business

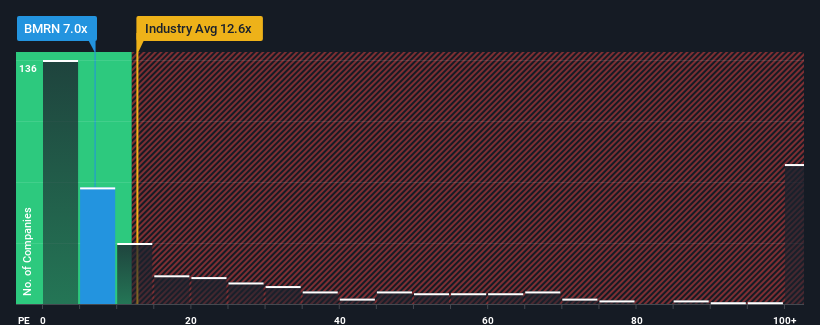

You may think that with a price-to-sales (or "P/S") ratio of 7x BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) is a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 12.6x and even P/S higher than 63x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for BioMarin Pharmaceutical

What Does BioMarin Pharmaceutical's Recent Performance Look Like?

Recent times haven't been great for BioMarin Pharmaceutical as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BioMarin Pharmaceutical.Do Revenue Forecasts Match The Low P/S Ratio?

BioMarin Pharmaceutical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry predicted to deliver 162% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's understandable that BioMarin Pharmaceutical's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does BioMarin Pharmaceutical's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that BioMarin Pharmaceutical maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for BioMarin Pharmaceutical that you need to take into consideration.

If these risks are making you reconsider your opinion on BioMarin Pharmaceutical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if BioMarin Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BMRN

BioMarin Pharmaceutical

Engages in the development and commercialization of therapies for people with serious and life-threatening rare diseases and medical conditions.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives