- United States

- /

- Pharma

- /

- NasdaqCM:BLTE

Is Belite Bio’s Surge Justified by DCF Upside and Price to Book Signals?

Reviewed by Bailey Pemberton

- If you are wondering whether Belite Bio's rapid rise is backed by real value or driven by hype, this article will walk you through what the numbers are really saying about the stock.

- After a sharp move higher, with the share price up 16.4% over the last week, 34.2% over the last month, and an eye catching 132.9% year to date, the market is clearly re rating the story and its risk profile.

- Much of the excitement has centered around Belite Bio's late stage ophthalmology pipeline, particularly its candidate for treating Stargardt disease and dry age related macular degeneration. This has been drawing attention from both specialists and generalist investors. Alongside positive sentiment around its clinical progress and regulatory milestones, this has helped fuel a narrative that Belite could address a meaningful part of a large unmet medical need.

- Even with that backdrop, Belite Bio currently scores a 3 out of 6 on our valuation checks. This suggests pockets of potential undervaluation, but also areas where the price already reflects a lot of optimism. Next, we break down what traditional valuation methods indicate, and then look at a more nuanced way to judge whether the stock is truly offering what could be considered good value.

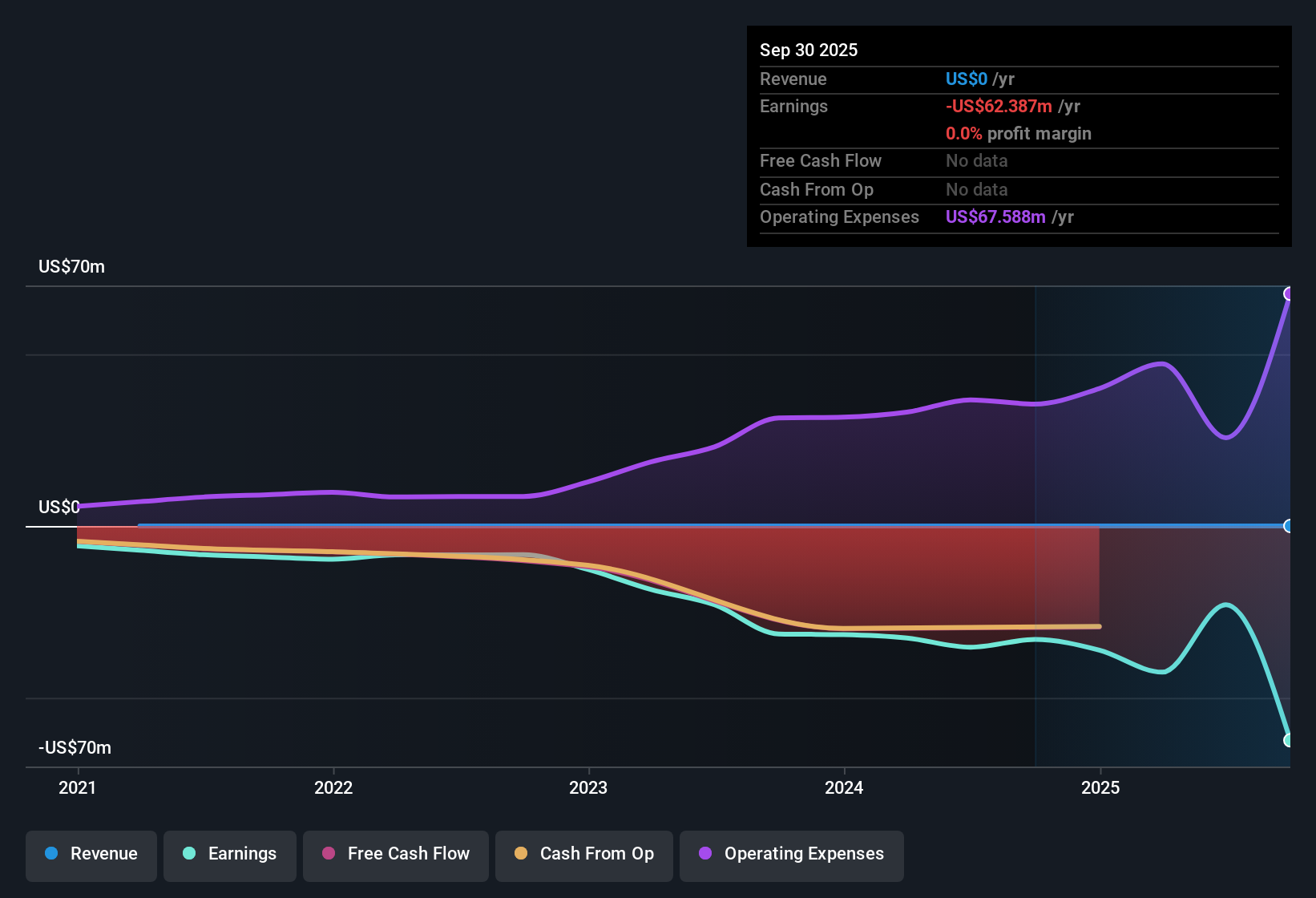

Approach 1: Belite Bio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those projections back to a present value.

For Belite Bio, the latest twelve month Free Cash Flow (FCF) is negative at around $29.35 Million, reflecting ongoing investment rather than mature profitability. Analysts provide detailed forecasts out to 2029, with FCF expected to swing into positive territory and reach about $538.95 Million. Beyond that, Simply Wall St extends the projections using a 2 Stage Free Cash Flow to Equity model, with FCF rising into the low billions of dollars over the following decade as the ophthalmology pipeline potentially scales.

When those projected cash flows are discounted back, the model suggests an intrinsic value of roughly $820.18 per share. Compared with the current share price, this implies Belite Bio is trading at an 81.6% discount to its estimated fair value, which indicates the market may still be heavily underpricing its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Belite Bio is undervalued by 81.6%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

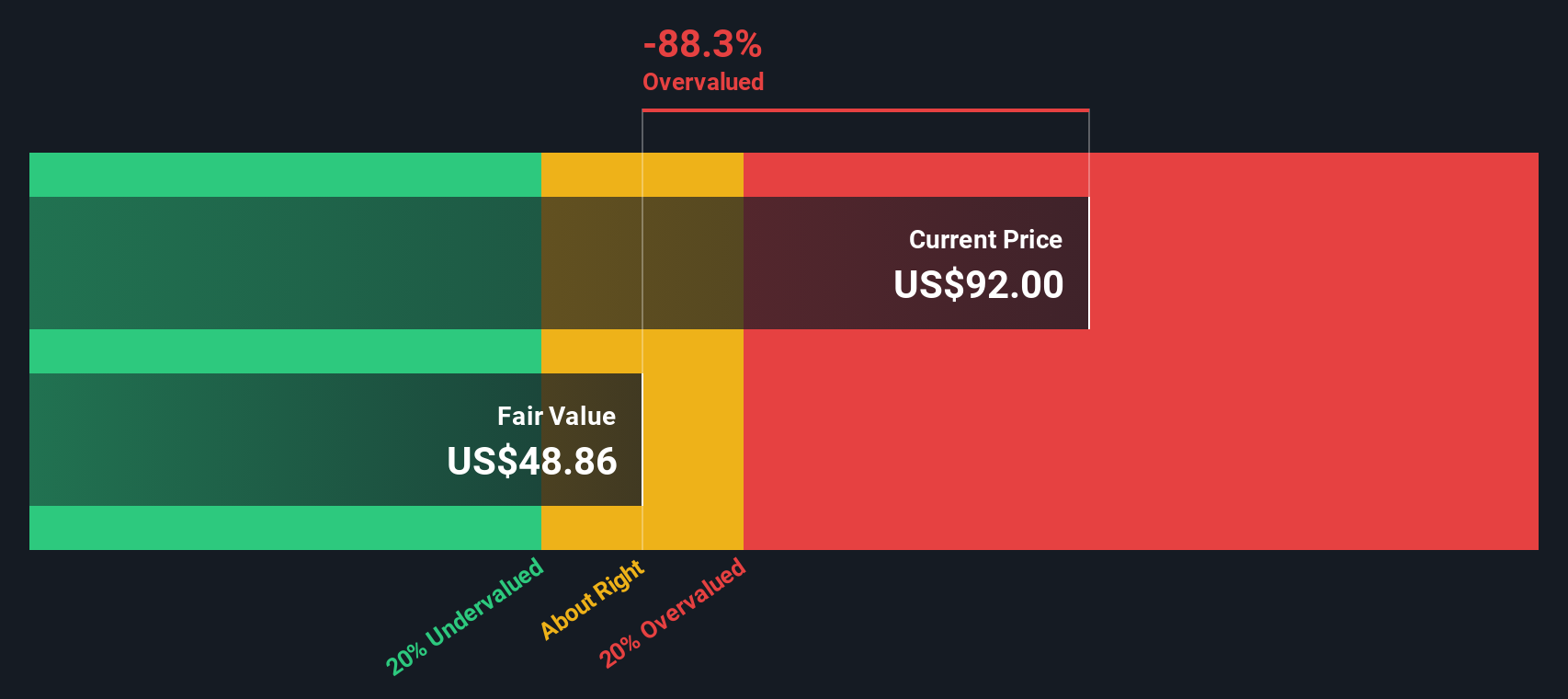

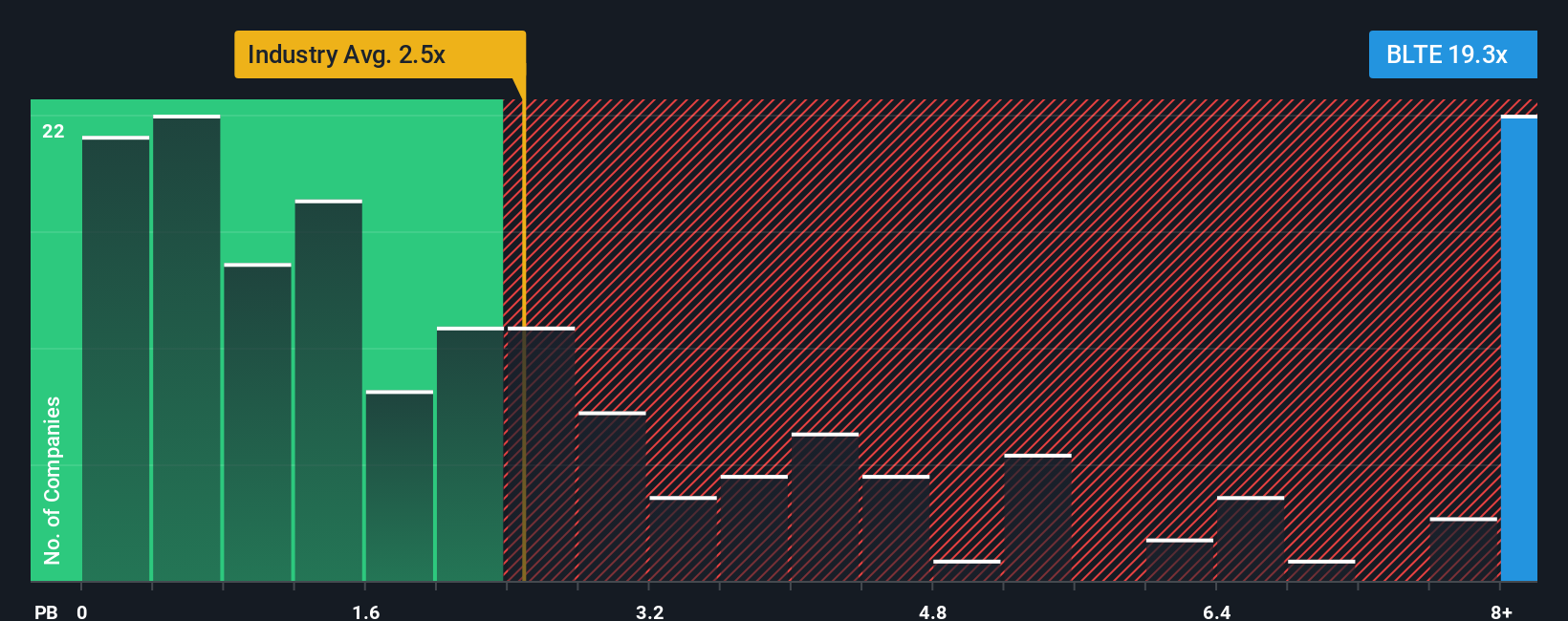

Approach 2: Belite Bio Price vs Book

For companies that are still loss making but asset intensive, the price to book ratio can be a useful way to gauge how much investors are paying relative to the net assets on the balance sheet. In general, faster growth and lower perceived risk can justify a higher multiple, while slower growth and higher uncertainty usually warrant a multiple closer to, or even below, the sector norm.

Belite Bio currently trades on a price to book ratio of about 19.2x, which is far above the Pharmaceuticals industry average of roughly 2.5x and well below the peer group average of around 318.4x. To move beyond these broad comparisons, Simply Wall St uses a proprietary Fair Ratio. This estimates the price to book multiple a stock should trade on after adjusting for its growth outlook, profitability, risk profile, size, and industry characteristics. Because this framework systematically accounts for those drivers, it is a more tailored benchmark than simply lining the stock up against peers or the sector.

On this basis, Belite Bio screens as overvalued relative to its Fair Ratio, suggesting the current market price already reflects a lot of optimism about future execution.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Belite Bio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind it. A Narrative is your own investment story for Belite Bio, where you define assumptions for future revenue, earnings and margins, and then translate those into a fair value that makes sense to you. By linking the company’s clinical milestones, competitive position and risks directly to a financial forecast and then to a fair value, Narratives turn abstract spreadsheets into an intuitive, story driven framework. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that help you compare your view of Belite Bio’s fair value with its current market price. They update dynamically as new information, such as trial results, news or earnings, is released, so your story and numbers stay aligned. For example, one investor’s Narrative may see limited adoption and a conservative fair value for Belite Bio, while another assumes rapid uptake and assigns a far higher fair value.

Do you think there's more to the story for Belite Bio? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belite Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLTE

Belite Bio

A clinical stage biopharmaceutical drug development company, engages in the research and development of novel therapeutics targeting retinal degenerative eye diseases with unmet medical needs in the United States.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026