- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

Assessing BioLife Solutions (BLFS) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

BioLife Solutions (BLFS) shares have climbed over 4% in the past month, reflecting growing investor interest. Recent performance has put the stock up 17% over the past year. This has fueled a steady conversation around its valuation.

See our latest analysis for BioLife Solutions.

Recent momentum in BioLife Solutions' share price has caught attention, with a 20.3% 90-day price return suggesting renewed optimism for the stock. Although the three-year total shareholder return stands at 32.5%, some investors are watching closely to see if this upward trend can be sustained in the long term.

If recent gains have you thinking bigger, now is the perfect moment to see what else is performing. Discover See the full list for free.

With shares trading higher and recent gains outpacing the broader market, the key question now is whether BioLife Solutions remains undervalued or if investors have already priced in all of its future growth prospects.

Most Popular Narrative: 12.7% Undervalued

BioLife Solutions closed at $27.34, while the most widely followed narrative sets a fair value at $31.30, leaving a clear gap for investors to consider. The narrative highlights growth, innovation, and sector tailwinds as value catalysts. So, what is driving this bullish view?

Ongoing customer adoption of multiple integrated products (cross-selling), with evidence of key accounts trialing and potentially implementing new technologies (e.g., CT-5 automated fill, CryoCase), is expected to significantly boost average revenue per dose and improve customer stickiness, supporting both top-line growth and higher net margins over time.

Want to know the secrets behind this value gap? One reason could be high future profit margins and earnings targets that rival some of the fastest-growing sectors. Discover which bold assumptions about revenue growth and business transformation drive these projections. Take a closer look at what the narrative is really betting on for BioLife Solutions.

Result: Fair Value of $31.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few large customers and falling gross margins could quickly change the outlook if these issues continue.

Find out about the key risks to this BioLife Solutions narrative.

Another View: Trading Multiples Paint a Cautious Picture

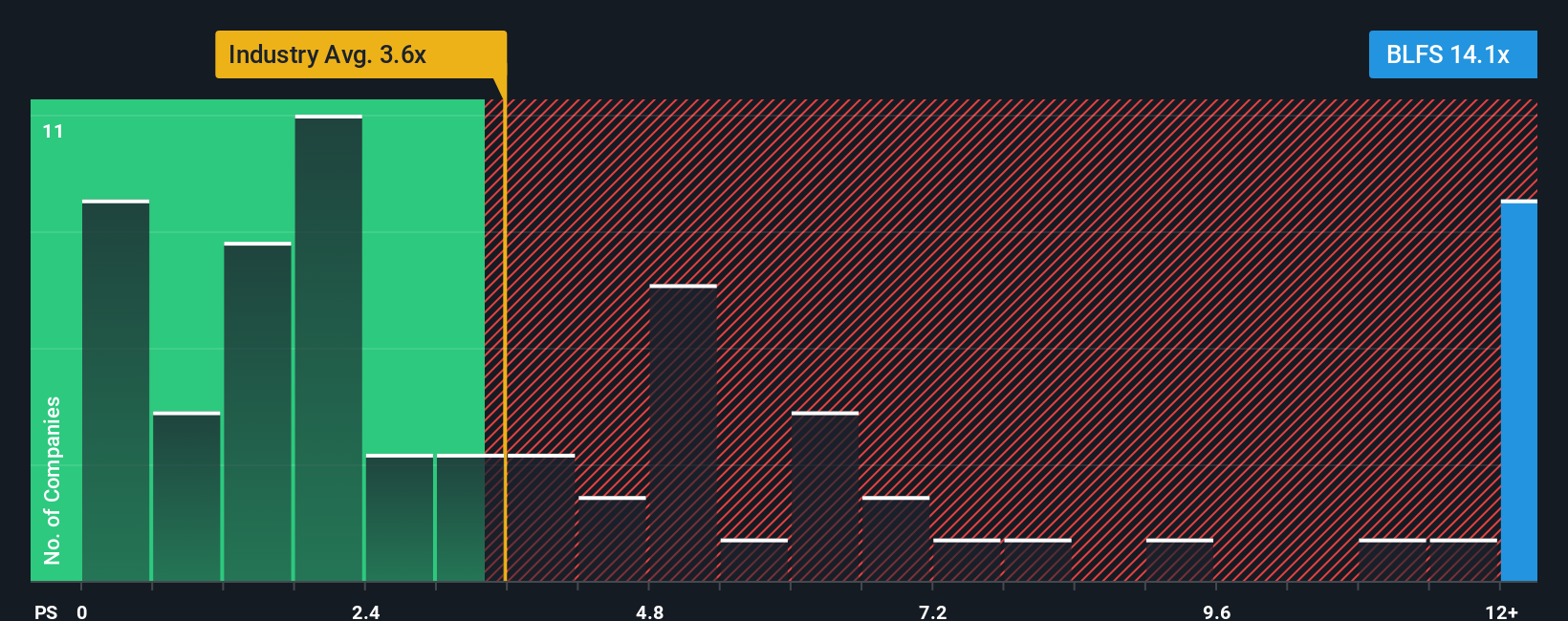

While valuation narratives point to BioLife Solutions being undervalued, its price-to-sales ratio stands at 14x. This is far above industry peers, who average just 3.5x. It is even higher than the fair ratio of 4.8x, suggesting the stock could be expensive relative to its fundamentals. Does this premium signal exclusive opportunity, or increased risk around high expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioLife Solutions Narrative

If you want to dig deeper, you can review the details and reach your own conclusions in just a few minutes. Do it your way

A great starting point for your BioLife Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Plenty of smart investors seek their edge by branching out beyond the obvious. Get ahead of the pack and uncover stocks most people are missing out on right now.

- Unlock value by targeting strong cash flow opportunities that you can spot instantly with these 887 undervalued stocks based on cash flows.

- Tap into reliable portfolio income by tracking high-yield companies showcased through these 19 dividend stocks with yields > 3%.

- Position yourself for breakthroughs in artificial intelligence with early movers found using these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioLife Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLFS

BioLife Solutions

Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026